Investing remains, till date, by far the most effective way to create wealth, to grow wealth for your future, your retirement, your family, and the next generation.

Investing remains, till date, by far the most effective way to create wealth, to grow wealth for your future, your retirement, your family, and the next generation.

Investing in stock market remains one of the most easily accessible (and with some effort & learning) and efficient ways to create wealth for retail investors.

I love investing and trading in individual stocks that are growing tremendously with great sales, revenues and earnings; and particularly the ones with tailwind of global trends behind them - for e.g, 'work from home' culture - does that sound familiar?

With Coronavirus (Covid-19) pandemic and global lockdown led to massive overnight shift in how people work, study and connect with loved ones. Never in my medical career I thought that I will be treating my patients over a video call when the doctor-patient relationship is so personal and significant in the treatment process. But with the forced national lockdowns and risk of contracting the virus, pushed all of us to innovate different ways to reach out to people and yet to continue our work and education only remotely.

The companies that enable the work from home are super winners, from their sales, earnings and stock returns view point, in the year 2020. It was widely estimated that technological adoption has been advanced by at least 5 years because of this. Starting from e-commerce, and distant education to telemedicine, it was ALL CHANGE in 2020.

This massive opportunity gave me a windfall of return to my portfolio which handily beat one of the best performing US market indexes (NASDAQ 100) which had an historic great performance itself that year. So I remain a staunch believer of investing in individual growth companies to grow my wealth.

However, I know very well that not everyone share my passion and the risk appetite to invest in individual companies. Many, if not most, still believes that stock market investing is highly risky, so they keep the money in bank (which perpetually gets devalued) or give their hard earned money to someone else to invest who is only interested in receiving commissions and doesn't have your best interest of wealth creation in his mind. Giving your money to someone else who doesn't have your best interest in mind! - Now, I call this 'high risk'.

Remember:

No one but you will have the best interest on your money.

So, having understood that you don't want to give your money to some money managers, to invest in some (usually) underperforming funds with extortionate maintenance, annual and performance fee, and don't want to invest in individual stocks either, how do you go about growing your wealth in stock market?

The answer is: Passive (+/- Index) Funds, ETF and Investment Trusts.

Not all funds are created equal. Not all passive funds are bad. For that matter, not all active funds are bad.

I live in UK. This means I am unable to invest in certain high flyer ETFs and some other good passive funds available for my US counterparts. But, there is no shortage of opportunities to have exposure to such passive way to invest in stock market.

The big benefit of passive funds is its low annual fee (OCF = Ongoing Charges Figure), usually less than 0.4%, some even as low as 0.1%. Index Funds track the performance of the underlying index it tries to follow / mimic. For eg., S&P 500 index funds would follow USA's S&P500 market index and invest in the same companies at similar proportion to that of the index. As there is no active role for the fund manager, other than to make changes to replicate the index composition, it incurs very little fee.

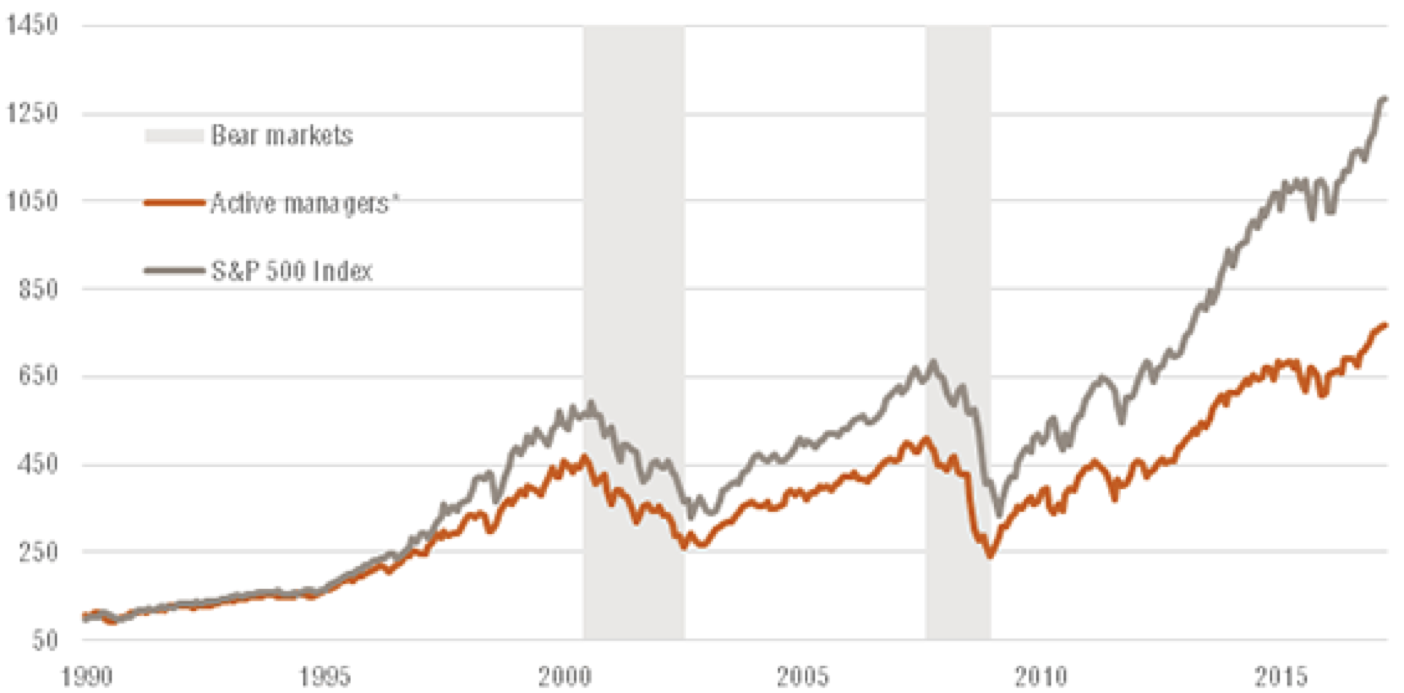

Most active funds, as history suggest, underperforms the broader market. You might as well invest in an index fund to match your performance closely to that of the broader market index with little fee. You will be well off with this strategy in long run.

Similarly there are many such low cost passive funds, tracking different indexes or sectors. Assess the previous performance, compare the annual charges, look for any hidden charges and finalise on low cost but at least market matching if not beating performance.

Some active funds with great track record and again with lower fee is worth considering. If a fund has more than 1% fee, you need to really think hard if you must need that in your portfolio at all. If the fee is 1.5% or more - my personal view is to stay away from that fund. I am confident that I can find another equally or better performing funds with lower charges.

The last decade of fantastic growth in stock market has given the data that we need to separate the wheat from the chaff. Although, past performance is not a guarantee to future performance, it certainly can give you valuable information to help us decide.

Winners Win.

If they performed consistently better over multiple years and had stable managers or ownership, it is an evidence that their investing style works. You could look into that further.

There are certain ETFs, and Investment trusts in UK has done consistently well. Many of them has ranked top favourites and top ETFs and Investment Trusts bought by retail investors.

Every portfolio should consider having a portion of their allocation to such passive approach - Index funds, ETFs and Investment Trusts.

I certainly have done so in my family's portfolio. I consider myself a fairly aggressive investor. I have allocated about 15-20% of my family's portfolio for this.

I have listed a few examples of top ranked, top performing and/or highly regarded funds & other passive investing vehicles below to give you an idea. These are not recommendations to buy. But certainly consider such approach to diversify your portfolio.

Examples (not recommendations) of:

S&P500 index fund: UBS S&P 500 Index C Acc (OCF = 0.09%)

ETF tracking S&P 500 index: –Vanguard S&P 500 UCITS ETF GBP (LSE: VUSA) or iShares Core S&P 500 ETF USD Acc GBP (LSE:CSP1)

Good mutual funds (based on recent performance & reputation)

1) Baillie Gifford American B Acc

2) T. Rowe Price US Large Cap Growth Equity Q GBP (OCF= 0.74%)

3) Fundsmith Equity I Acc

S&P total market index funds - Vanguard US Equity Index fund GBP ACC (OCF = 0.1%)

Fund of Funds (one of my favourites to instantly have diversification in my portfolio): Vanguard LifeStrategy (%) equity A Acc funds. They have 20%, 40%, 60%, 80% and 100% equity options with corresponding performances. (OCF = 0.22%). You can choose any of them depending on how much exposure to stocks and bonds you want. Correspondingly the return will vary. My philosophy is, if you have an investment horizon of over 20yr, you return will be much better from higher % exposure to stock market exposure.

Investment Trusts: Scottish Mortgage Trust, Allianz Technology Trust, etc.

You don't have to buy all of them. You could buy other funds, ETF, and Investment trusts that aren't shown above in the examples. The above list isn't exhaustive and certainly not a recommendation to buy those exact funds. It is aimed at giving you an idea of what is available in various investment vehicles or products.

You could decide to divide your total portfolio with such passive investing style. Or, if you are like me, you could allocate a certain portion to this and learn from GrowWealth page, training webinars, and membership to identify and invest in great individual companies/stocks. You can do any combinations of the above. But keep investing for long term and you will be in a better financial position in future.

CAUTION: Do not go for leveraged ETFs. They are complex investments not suited for most retail investors or beginners.

Happy Learning and Successful Investing.

Request: If you like what you read, please share, like and comment. You can also 'buymeacoffee' at the bottom of this page or home page. These contributions keep GrowWealth page going. Thank you for your support.

Disclaimer: This material is intended for educational purposes only, and is not recommendations to buy or sell any financial instruments or products. Do your own due diligence and make your own decision. The value of your investments can rise as well as fall. Capital is at risk when investing in any financial products. You could get back less than you invested.