Hey everyone,

Trade Ideas strategies and stock selections have had a great beginning to this year.

GrowWealth portfolio started just after the peak of the US stock market in 2021 and at the beginning of this bear market. The subsequent 21 months has been gruelling and a test for our investing strategy. The use of risk management with appropriate stop loss and technical analysis based stocks & crypto trades meant that we were able to protect the capital despite the losses to continue to be in this game.

Followers and members came and went with the rising tide of stock market optimism and pessimism. We are not in this for the feel good effect or for fun. This is a serious wealth creation approach and we take this seriously as we trade our hard earned money in many of the watchlist stocks.

This disciplined and methodical approach has allowed us to stay in this game to reap the benefit of the stock market when it recovers. It always recovers and it has been doing so for the last few months. The "Trade Ideas" watchlist and the portfolio stocks has taken off nicely so far in 2023.

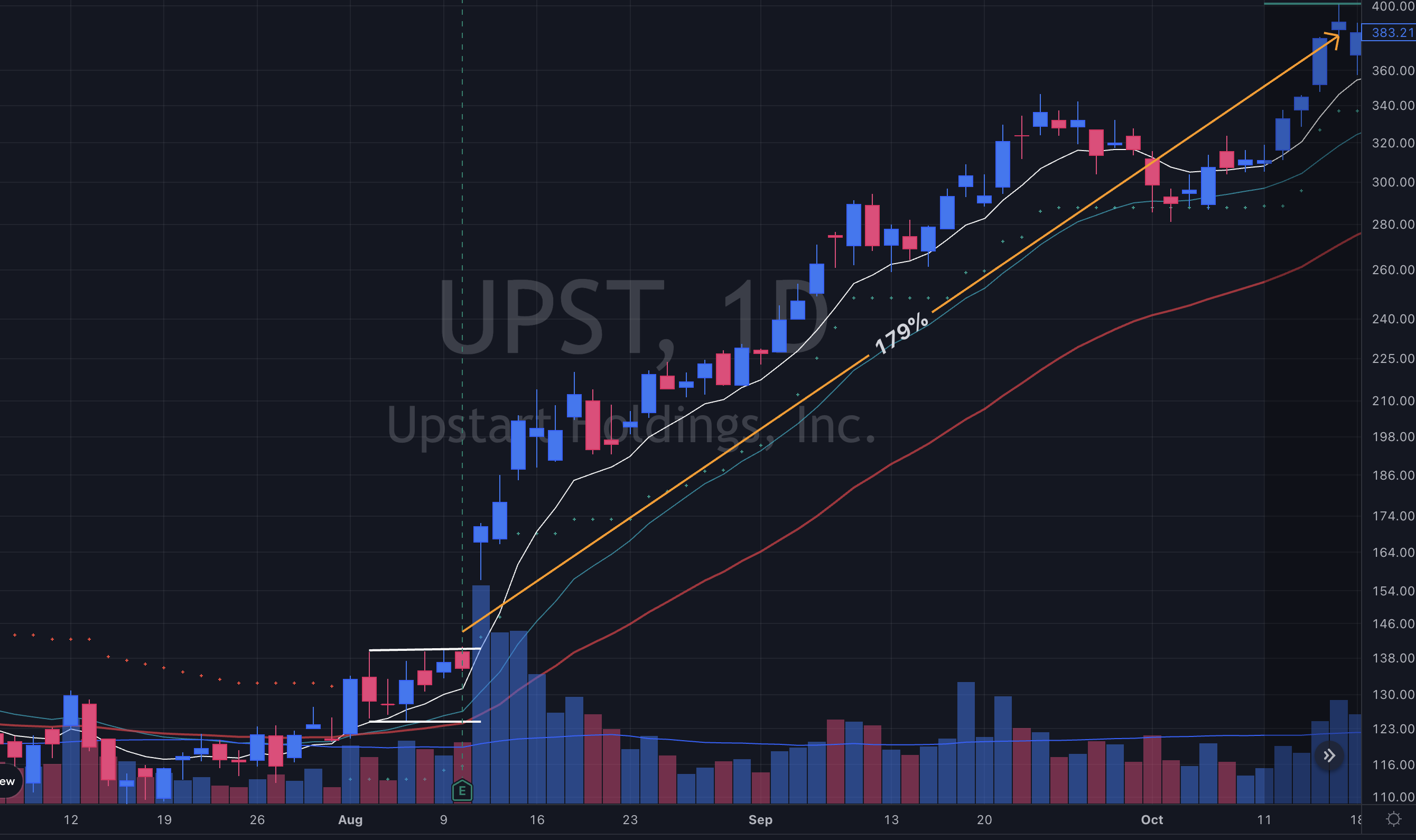

One of the previous members, missed the trade from my watchlist which gave well over 100% gains in $UPST, in 2021.

He asked if there will be other stock selections that will give similar returns to trade. Needless to say that we didn't have many stocks that performed well in the bear market in the last 18months.

Well, GrowWealth certainly has identified another such stock! I have added this stock to the portfolio in October 2022 and updated our members. We booked partial profits in this stock at 44% and the remainder is >107% profit now! The company is AEHR test system, stock ticker: $AEHR.

GrowWealth's "Trade Ideas" is aimed at identifying great companies and stocks that are gaining momentum which has great potentials.

The options trade in Russell 2000 has given us 100% win rate with 6 out of 6 profitable monthly trades closing positively. Crypto strategy is also come to fruition now with risk on trades and crypto price recovering. Our recent Bitcoin trade is sitting at 40% gains now.

This is the benefit of great trade selection that follows the disciplined monitoring of the stock market conditions with a regular weekly routine. With the broader market showing some strenght and Nasdaq having a cluster of FTDs (Follow Through Days) in the last 25 trading days with price eventually climbing above the significant KMAs (Key Moving Averages), the intermediate trend is looking positive.

Anything can happen in the market.

The next week has a lot of high impact economic events scheduled: CPI data, FOMC meeting where it is anticipated that FED will raise 25 basis points and not 50basis points of interest rate, NFP data, UK interest rate, and ongoing earning season etc. All of this will have an impact on market sentiment and we in GrowWealth will continue our weekly routine in a disciplined manner to stay tuned and aligned with the market. Change our views, when necessary, if the market sentiment changes. This is how you stay in the game for longer.

Market Update:

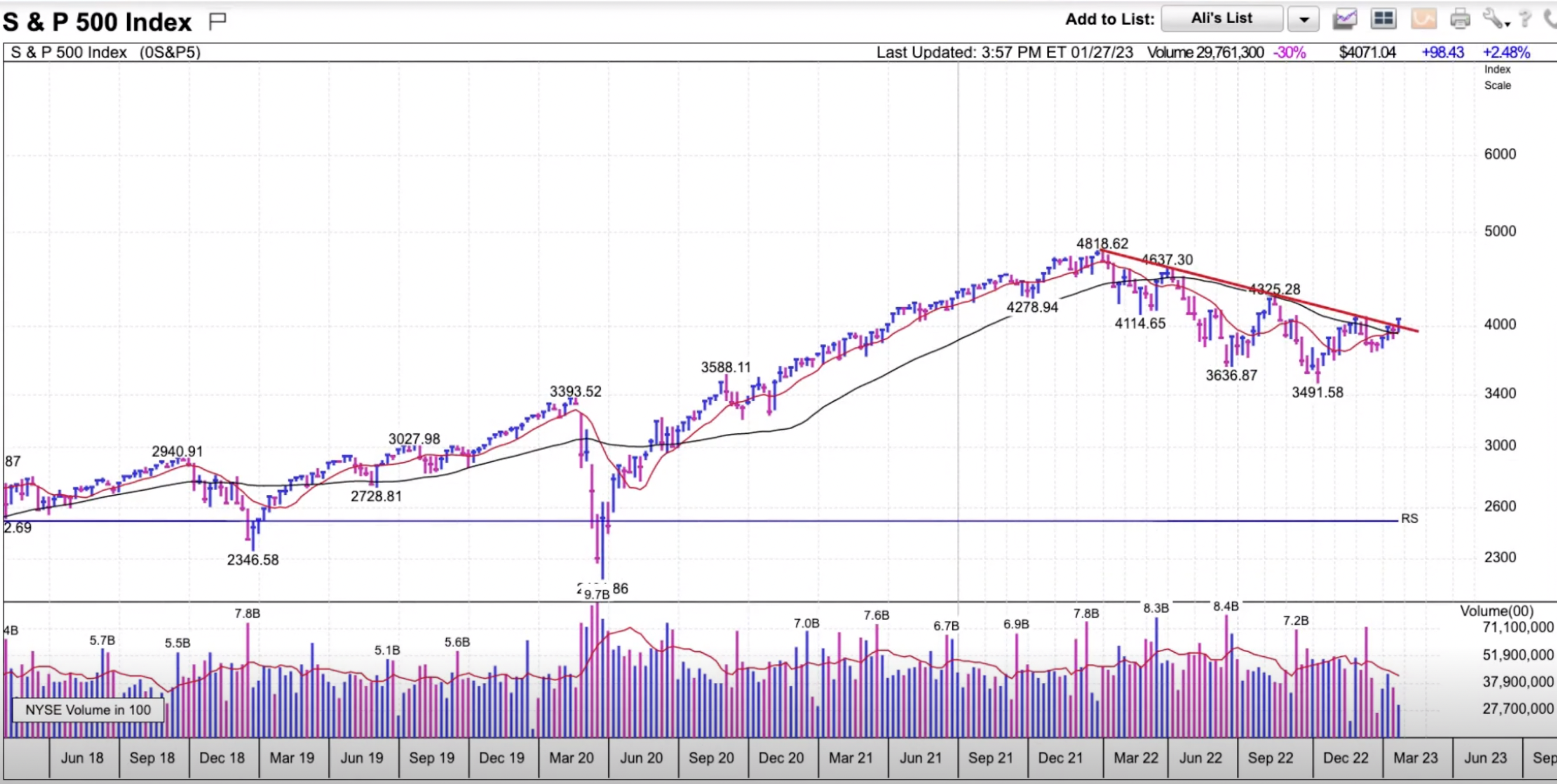

Nasdaq Composite: Moved above the 200day MA for the first time since the beginning of the bear market. You could see on the chart how they acted as a resistance before. We need to see if this now holds as a support. But it is sitting just below the 50wk EMA which needs to be cleared decisively to further strengthen its position.

S&P 500:

Well above 200d MA, and just crossed above the long term downtrending line last week.

Russell 2000 is also above its KMAs.

There is a sense of 'raising tides lifting all boats' and a beginning of change in market sentiment as some of the companies with mediocre earnings have had their stocks pop up!

We are still in the midst of an earnings season with the heavy weight $AMZN and others are yet to report their quarterly earnings. If those results disappoint the market we are likely to see a pullback to the market, but otherwise the current market sentiment is looking up.

'Trade Ideas' watchlist has some interesting list of stocks that are at all time high price (ATH) and/or breaking out of a proper base. A good trade strategy needs a few significant criteria. Good fundamentals with growing earnings and sales, stock chart breaking out of a consolidation / base pattern or recovering from a pull back to natural support level and a suitable risk management strategy in the form of a stop loss. The

Couple of names from the 'Trade Ideas' watchlist for this week include:

$VC - Visteon Corp

Look at their EPS and sales figures at the bottom left of this screen shot. It also has a IBD's bluedot Relative Strength on the weekly chart. Next earnings is due in 20days.

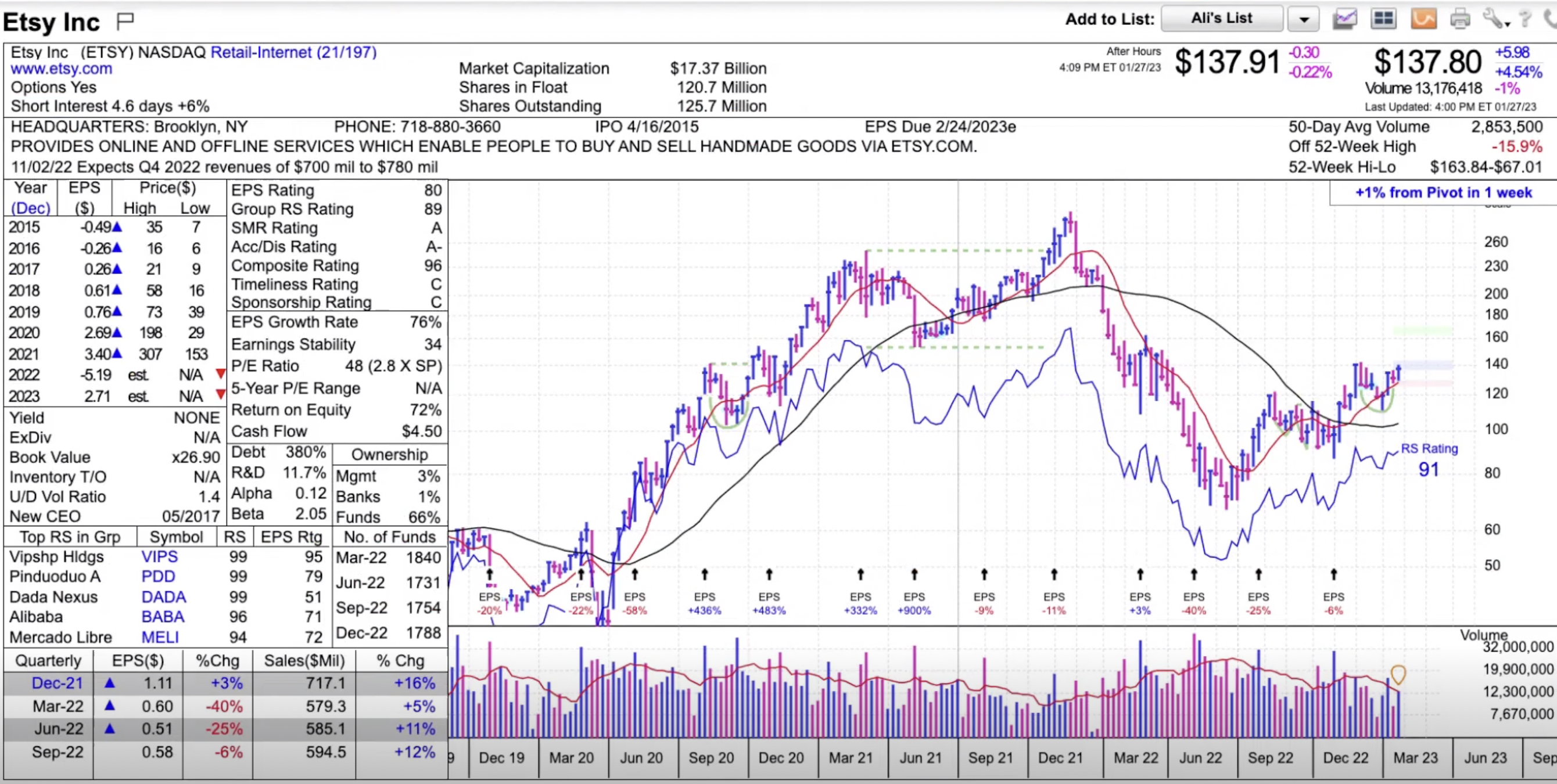

$ETSY:

IBD's MarketSmith highlights a cup & handle breakout on weekly chart in ETSY. Although $AMZN's earnings may have an impact on this stock's performance, more recently the e-commerce names has been showing great strengths. You just have to look at the likes of $SHOP (23% in a week), $PDD (12.75% in a week), and $MELI (11.2% in a week) and breaking out of their longterm resistances.

There are a few more interesting stock setups in the "Trade Ideas" watchlist and a couple of them just had power earnings gap up with huge volume. I am quite excited by those setups.

Let's see what the market has in its store for us next week. One thing is certain - Exciting times ahead!

Happy learning and successful investing.

Disclaimer: This material is intended for educational purposes only, and is not recommendations to buy or sell any financial instruments or products. Do your own due diligence and make your own decision. The value of your investments can rise as well as fall. Capital is at risk when investing in any financial products. You could get back less than you invested. Past performance may not be indicative of future results.