The Tax Foundation: Governments with higher taxes generally tout that they provide more services as an explanation, and while that is often true, the cost of these services can be more than half of an average worker’s salary, and for most, at least a third of their salary.

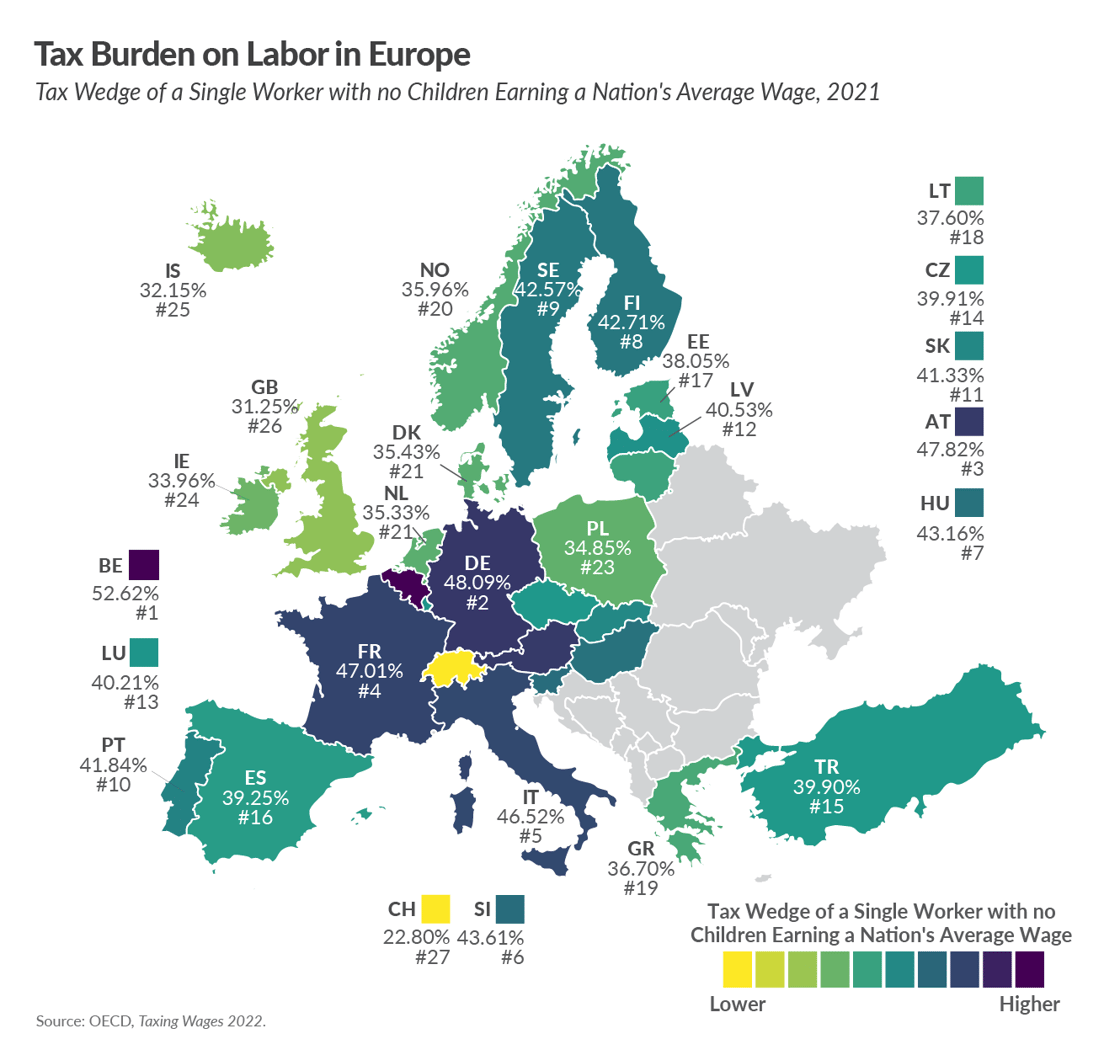

This week's map illustrates how European countries differ in their tax burden on labor. Belgium has the highest tax burden on labor, at 52.6 percent, followed by Germany and Austria, at 48.1 percent and 47.8, respectively. Meanwhile, Switzerland had the lowest tax burden, at 22.8 percent.

Individual income taxes, payroll taxes, and consumption taxes like value-added taxes (VAT) make up a large portion of many countries’ tax revenue. These taxes combined make up the tax burden on labor both by taxing wages directly and through the tax burden on wages used for consumption.

Changes to income tax systems directly impact the tax burden on labor: Some individual countries have made substantial changes to their income and payroll taxes in the last two decades.

Hungary, the OECD country with the highest tax burden on labor in 2000, has had the most notable decrease in its tax wedge, from 54.7 percent to 43.2 percent in 2021. This is partially due to the introduction of a flat tax on income, which lowered the income tax burden relative to total labor costs.

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services. This will be particularly important as policymakers explore way to encourage a robust economic recovery.