As many of us have seen its been a very difficult environment for using DCA bots, there's only a very few coins actually showing good recovery bounces, so most are holding red bags. Every single paper trade setting has been struggling since November 2021 to present. The drops are too big and to counter it, you would need extreme DCA covering 60-80% drops and also really keep the Required change % as low as possible. This means very expensive settings by increasing the OS (Volume Scale) really ramps up the costs. This also really lowers the ROI and profit potential as you need spare funds set aside to cover the bot costs. So when a bot costs like 2-5k per setting and you are generally only using 20% of the funds, you will see the big drop in profit.

The Test 9 settings in Paper Trade v5, is one of the safer settings in that the "Actual ROI is still best from all the settings, but even that is in the negative" and you've seen all the backtesting spreadsheets. To be honest, I wouldn't even run test 9 or any other setting in this bear market where you get big drops but no big recovery bounces. As you would need to keep RC% as low as under 8%. It really comes down to good coin selection which seems more like "luck" these days as even strong projects or top 100 coins can struggle. We've seen what happened to LUNA.

I'm going to do some more testing to see if there's anything that would run well, but for now the only setting I'm running is a BTC/BUSD bot with the following settings as a test, but with real money. You can just run it with BTC/USD or BTC/USDT. I'm collecting in base, but it may be better just to accumulate USD until we've hit a bottom and started trending up again.

This is thanks to Heopas who did a 2017 to May 2022 test and that was one of the better performing settings that also had lowest max deal time from the tests.

The settings I run are

Ribsy BTC Bot

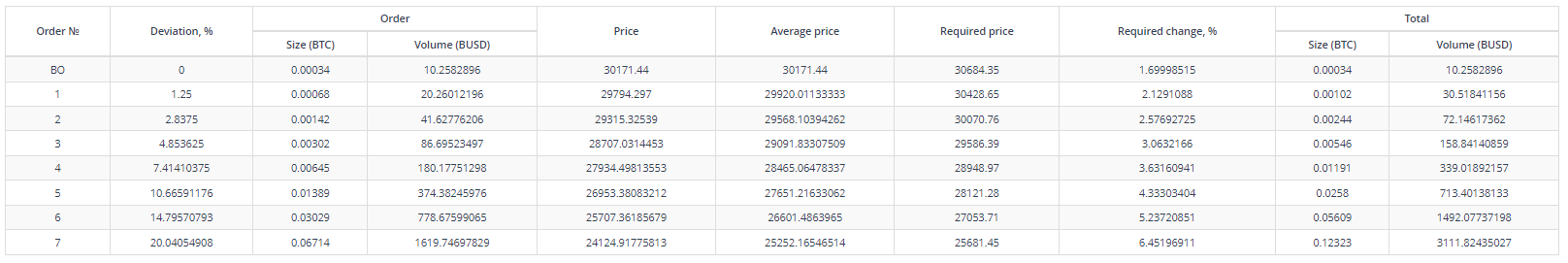

TP: 1.7%, BO: 10.0 BUSD, SO: 20.0 BUSD, OS: 2.08, SS: 1.27, SOS: 1.25, MSTC: 7,

https://3commas.io/bots/8960987/shared_show?secret=43839e5d94

This bot is really expensive as it costs 3.1k but if you look its only cover 20% drop, but the RC% is really kept as low as possible. So far its been closing deals ok, its only been running since 05/10/2022, so not much data on it, but THIS SETTING is ONLY for BTC atm, and currently what I'm only running myself with real money along with my stuck red bags from NOVEMBER 2011. I've also reserved more funds just incase I do need to add more funds, so its just a test for now but using real money.

The volume is heavily skewed to the bottom side, so unless it fills safety orders, you won't be making much.

A safer option would be to cover even more deviation, but the costs are way too much and this setting is already very expensive to run.

This is just a temporary setting I'm running until things pick up and I am avoiding alt coins that can easily drop much deeper and go to zero.

So far the ROI for running for about 12 Days is 0.20% which is ok as I was expecting lower. Its in the Live Portfolio spreadsheet. Hopefully this won't get stuck, but I do not recommend running this on alts or ETH. Its really just BTC specific, and may eventually get stuck too, even though its worked since 2017, with a ROI of around 200%.

Most of my spare funds are really going to be allocated to buying alts if the market drops even more to pick up some value prices, but they have to be very cheap for me to risk it.

I have been using my stuck red bags to run short bots but they are turned off and on and managed actively so it requires a lot of work. Understanding when you are coming into major resistance or knowing when to turn off the bots really is the key. Also you need to constantly tweak the settings or you will run out of funds, by selling too much coins at an unfavorable amount as the price just keeps tumbling. Long term, if the coin really does drop, you are still going to be in big negative and waiting months for that recovery bounce.

Out of the options of dealing with long term red bags by using Short bot, Grid recovery bot, Flexible Staking, Smart Cover, I think the short bots is slightly better (but I still don't like using them), but they all have their pros and cons. I've tested short bots and grid recovery bots, but they all have their pros and cons, and tbh I don't think any of they provide a great solution, as its really just a short term fix. Staking the coins is ok, but won't generate much, and Smart Cover is like a simpler Short bot where you just sell now, and buy the same coins back at a lower price. If you was able to time the market, you may as well be a trader and not be running DCA long bots or know to stop your bots and close them at market price to avoid big potential losses.

My focus is to continue to learn to trade and "value buy", and wait for the longer time frame indicators to show a change in trend before restarting any DCA bots with bigger risks. Keeping risks low and not chasing profits or not running and DCA bots would be the sensible decision. Please be careful in this market environment, and even adding signals/QFL is worth looking into if you still want to run bots and ok with much lower profits.