I've been running myself 2 instances of Symrank on my windows pc which is on 24/7 anyway. This can be shown on my Paper Trade v5 for the live data. Also Neos Paper Trade Spreadsheet has a few Symrank Tests.

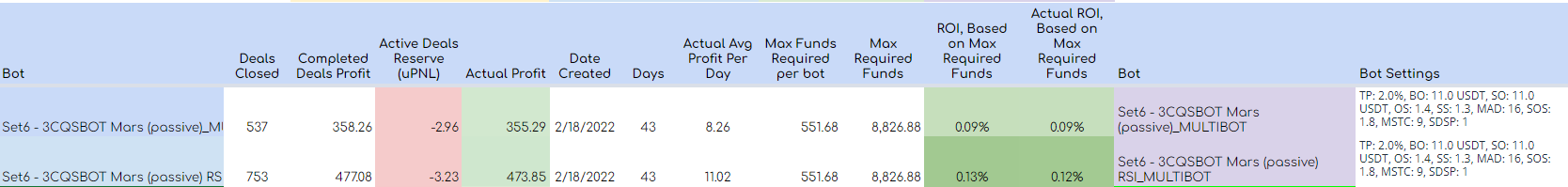

As of 31st of March 2022, the ones I run have the following results.

These have been running since 18th Feb 2022. And we haven't really had any crazy corrections during that period to test how well it removes and avoid the terrible coins, but the results so far show such a low ADR. This means deals are closing fine which means so far, the coin selection hasn't been too bad. ROI wise on my tests, its nothing special, but tbh I didn't really start a normal asap bot at same time with same settings to compare. The closest thing to compare to is the Set 5 but they have been running 2 weeks extra , so its not good for comparison. I'll try my best to show what I see from the data I have.

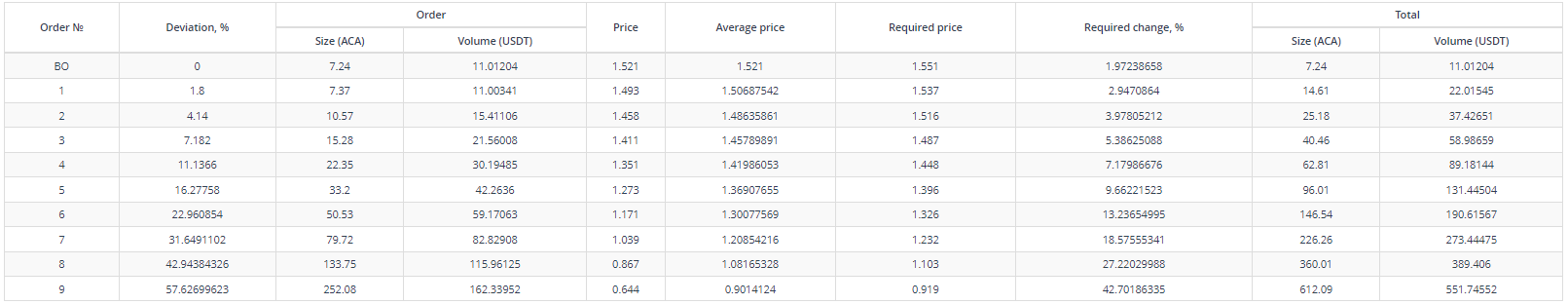

First the two different type of bots. The Mars (passive) is the settings for the standard Mars but with the 9th Safety Order added. I opted for a safer option so adding that 9th Safety order just incase we got any major crashes, I wanted to be covered for the downside, but this does reduce the ROI potential a lot.

Both tests were run with the same settings

Mars (Passive)

TP: 2.0%, BO: 11.0 USDT, SO: 11.0 USDT, OS: 1.4, SS: 1.3, MAD: 16, SOS: 1.8, MSTC: 9, SDSP: 1

Lets Look at both Tests

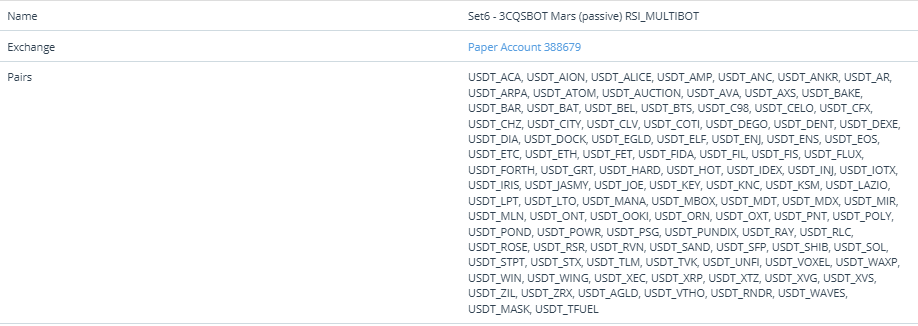

Signals Based - (Set6 - 3CQSBOT Mars (passive)_MULTIBOT)

This runs purely via the signals that SYMRANK gives. The advantage of this is its a bit more selective on when to start deals for certain coins, and it should be more safer and leave you with less red bags and hopefully a nice lower ADR. The disadvantages for this is your ROI will be lower for the safety it provides as its opening less deals. We can see the ROI is only 0.09% Compared to 0.13% running it just asap. Sadly because most of the deals have closed perfected and we hadn't really tested any major dips, its hard to show you that its safer. But worth keeping an eye on the live data to see if the theory was right.

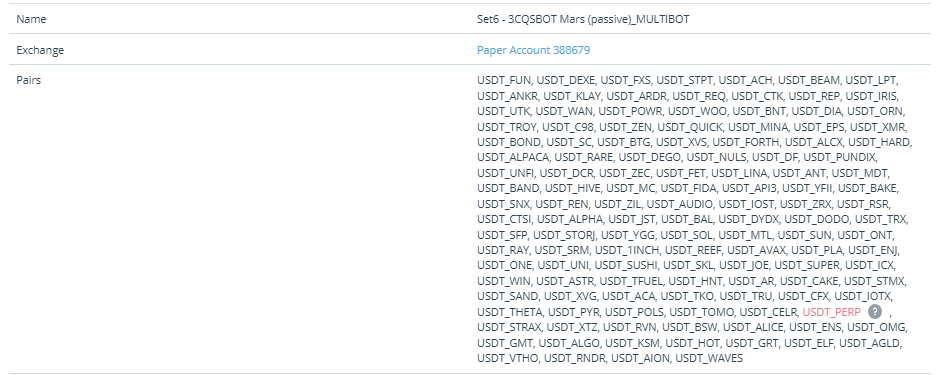

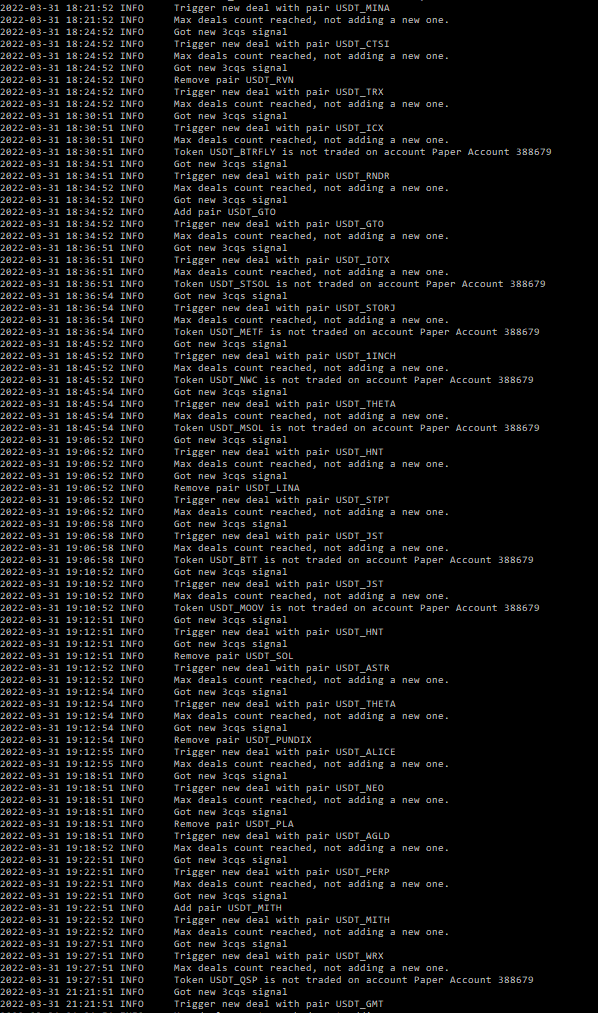

Lets have a look at time of the coins it picked during the time

It managed to pick Perp which is a coin I have blacklisted, there's nothing wrong with the coin, just preference that I don't have it. Looking at the list, there's quite a few I've run in the past for my bots, but some that I would not be running long term as some got stuck in the past for many weeks. But if its able to remove and add coins efficiently, then Symrank has done a great job for being fully automated. Some still rather use Symrank manually as they have more control on what coins they really want to be running their bots with.

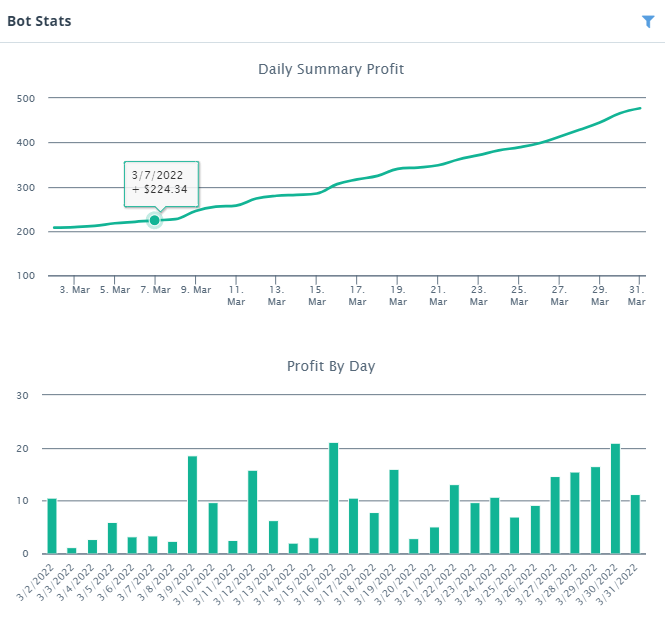

Profits

It's been looking nicely up, the bot bankroll costs $8826.88, and each bot costs $551.68. Ithttps://3commas.io/bots/8192123/shared_show?secret=ae15e424a8s made $358.26 in the 42 Days running. Market wasn't bullish either so ROI would have been low for everyone. Also the bots were started during a ranging period and we took a dip on BTC on the day it started.

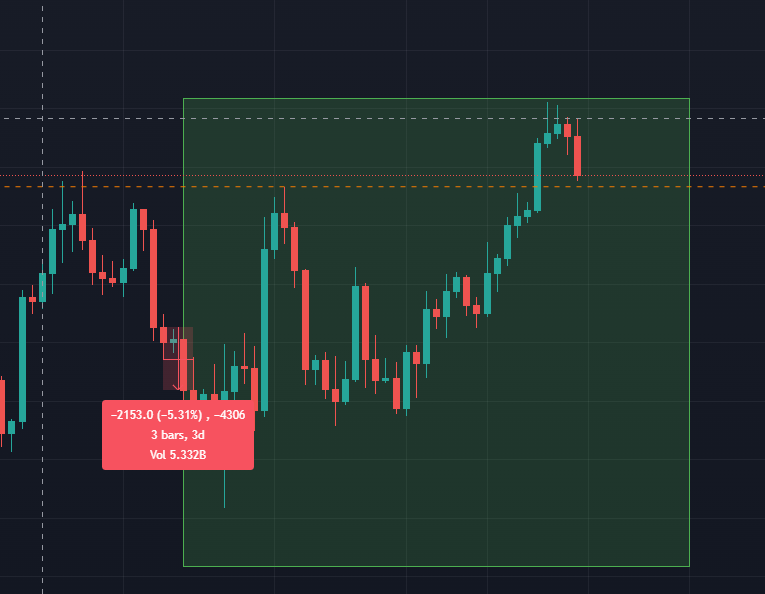

BTC

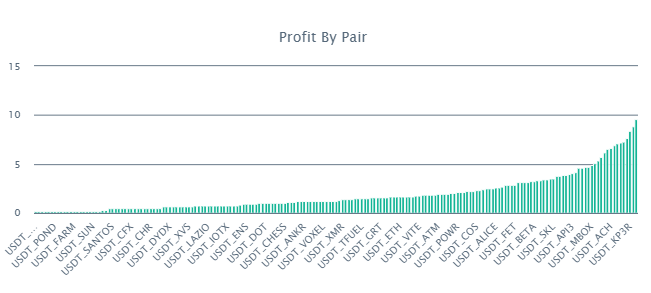

Now lets look at most profitable pairs during this period Top 10 coins Profit

Top 10 coins Profit

FXS 9.57

RAD 8.79

KP3R 8.42

RARE 7.66

QTUM 7.25

DUSK 7.19

LRC 7.07

YGG 6.93

ACH 6.59

JST 6.53

These are some of the things I had to consider when testing these bots that you would need to decide yourself if auto coin selection is for you.

Most important factor for running Symrank, does it help you enough to pick the coins for you and remove them efficiently?

Are these coins you would be happy to run and hold red bags with worst case?

Do you need to set a blacklist?

Do you need to set a min BTC volume to prevent it running very low cap coins? Or is your risk tolerance good enough to let SYMRANK do everything.

When a coin is removed, how long are the wait times for the current deal to close and free up space for a new coin deal? Is this going to affect overall ROI?

Are the signals being triggered as you wanted and are you getting enough to run all "Max Active Deals?"

ASAP Based Set6 - 3CQSBOT Mars (passive) RSI_MULTIBOT

The test adds the coins that SYMRANK picks, but runs it as ASAP until told to remove the coin.

(For ASAP mode with multi-bots, there is no ASAP so this is the workaround by using the RSI 3 min < 100)

This means its constantly running and restarting the same coins selected until there's a STOP signal to remove the coin. When that signal triggers, it will remove the coin and allow more space for whatever your "Max Active Deals" is set to. Remember just because a coin is removed, the CURRENT DEAL is still running as normal and filling safety orders. What happens is when the current deal finally closes in profit, it wont start anymore deals for the removed coin. Then the "Max Active Deals" will have one free space to open up any new coins that are now in the list.

ASAP means less waiting for signals, and hence more ROI, but

These two tests were started on the same time. So it's very important to know that the pairs are so different. So it's dependent on the timing on when deals close and when a new pair is added. Therefore everyone will literally have different pairs running even if they had the same settings. I didn't expect too much Variance, but I was wrong.

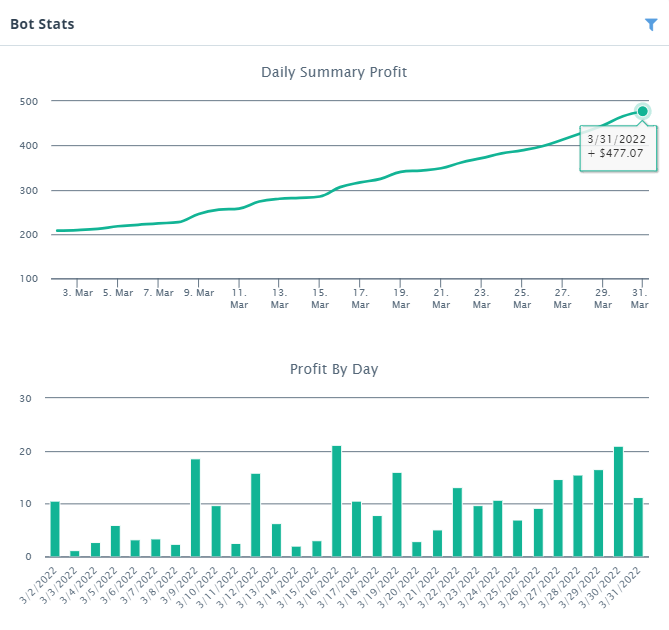

Profits

ROI is better with ASAP, and symrank. Using same settings and bot costs compared to signals. But its really down to preference. Really this whole tests is during a ranging market, its not had major dips, or been in a trending market. But at least we know roughly how well its done in these conditions.

Now the profit by pairs

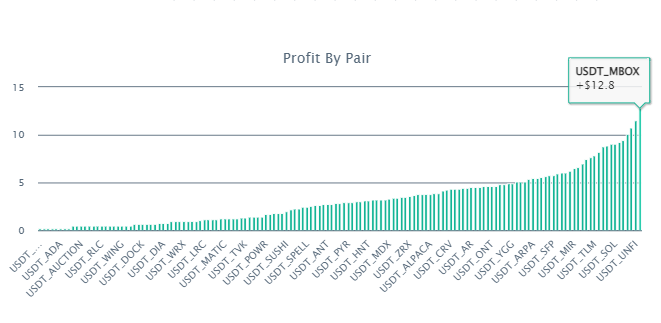

Top 10 Coins

MBOX 12.8

UNFI 11.48

ACA 10.71

KNC 10.07

IOTX 9.43

ANC 9.2

SOL 9.07

API3 9.01

CHZ 8.88

HOT 8.73

Lets look at why it was making so little profits, looking at mbox chart to see the volatility

It didn't look amazing but that's what the market looked like and it could have added and removed the coin anytime during that period. The market wasn't that great.

Its definitely managed to pick difference coins over the time, as even with new signals to add a coin, it still needs space free to add and new coins to the list, otherwise if its full, it just skips.

Here is a log file when of a setup running on my windows pc in a "command prompt"

Now lets look at Neos Test.

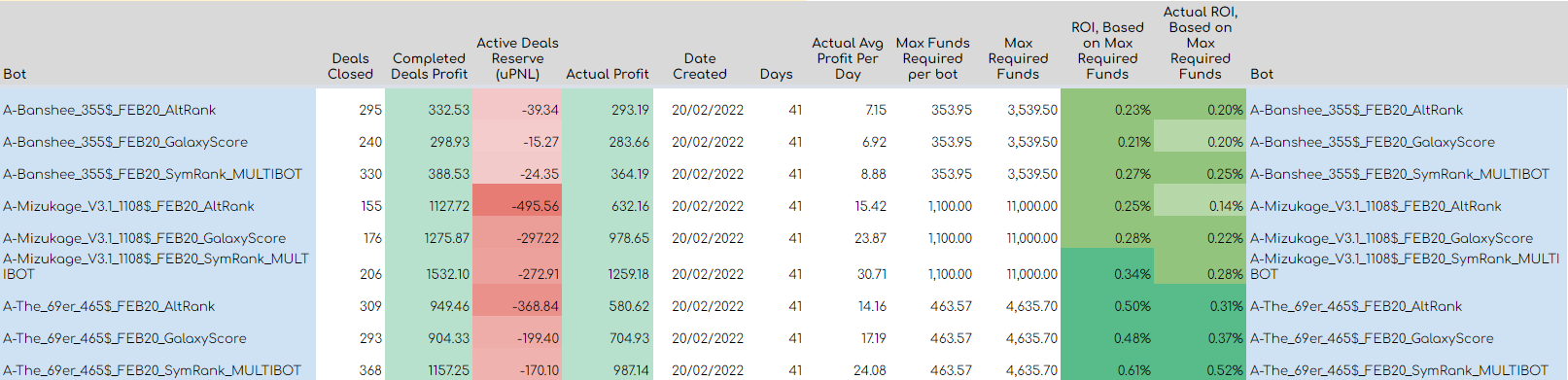

Neos Tests includes 3 different Bot settings and testing 3 different type of automatic coin selections. This was run 41 days ago which was only 2 days difference to my tests settings but those two days made a big difference in the ROI. I'll show why later. The Tests was with 10 coins allowed for all the bots.

Coin selections: Altrank vs GalaxyScore vs Symrank

Settings tested : Banshee vs Mizukage vs 69er. (in terms of aggressiveness)

Now lets look at the ROI, they seemed much higher than my tests settings almost doubled the ROI, and I was running Mars (passive) which is safer as its was running with a 57% coverage. The Banshee is the 8 safety order version which covers 42% deviation. So we expect some drop in ROI for being safer. Now lets look at the time they were started.

Paper Trade v4 started on 18th Feb

Neos Tests Started 20th Feb

BTC dropped about 5.31% since then and dropped further down the rest of the day so depending on when the bots were started, there could be a 5.31% - 9.27% drop in price just for btc so Neo's one would have started at a more comfortable time for bots.

Most may think that this drop is insignificant, but when btc drops, usually alts can drop harder. So we do expect Neo's one may have had some extra advantage avoiding any dips and filling safety orders. Its hard to say, if its advantageous or not as dips if they recover fast = $$$. Or dips that fill safety orders then get stuck for days or weeks before closing may be making less overall. All this is variance and why we get such different ROI results.

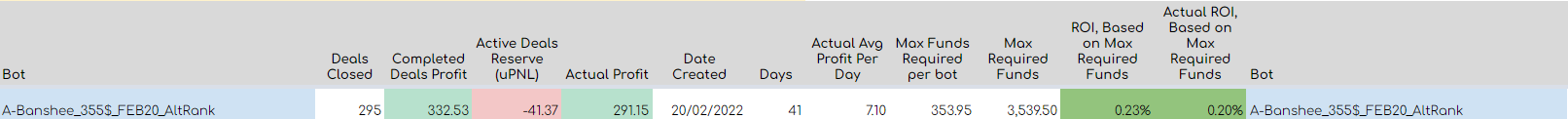

Now Lets compare Banshee with Symrank again a Normal selected Banshee with manual coins selected.

Symrank beat the Manual coin selection which is quite a good achievement. ADR so far is still good, so we haven't tested it hard against dips yet, but its working in a ranging market which has been trending up recently. Also depending on how good you are with coin selection and rotating out bad coins, you may be able to beat Symrank, but I cant fault it for finding the volatile coins from its calculations and giving it a scare based on volatility and price action score. The actual Calculations I don't know as but Mantis has done a pretty amazing job so far in beating Alt Rank and Galaxyscore in picking coins automatically. Ofc there will be flaws with this, but its becoming a popular strategy that people are beginning to want to test themselves. I've even had a few coaching requests to set it up for people.

Also worth noting that I was using a older version of the code and Neo's one was a newer version. I was impressed with the results so far, but there are coins that I would not want running.

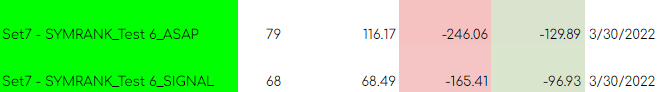

So myself, I would want to maintain a blacklist in 3commas or the settings to avoid picking certain coins I'm not fond of. Also because the results have been pretty positive, I decided to run a new set of tests on the 30th March 2022 using a newer version of Symrank using Test 6 of my experimental tests to emulate what a 84k bankroll could achieve.

min BTC volume I left as default to 100, but for extra safety you could raise it to 150-200 to avoid low cap coins being run, even if they were selected. You would have to tweak this to your preference.

Was the setup easy? Main issue was getting the config file edited properly. If everything went smoothly, it was 30mins to an 1hrs work. Otherwise if you had a bug or couldn't work out what was wrong, it would take quite a while longer. I only tested the code worked in windows for myself and 2 other users. The documentation is decent enough for most tech savvy people to get working. A lot of extra info can be found in our discord in the #scripting-tools-talk. So now I have 4 instances of 3CQS running on my PC waiting to receive signals when to stop and replace new coins for me. I've yet to try it in real account and I want to gather more data before putting real money to it.

Which one did I prefer? Signals or ASAP?

There's no obvious best. I just prefer my bots to run non stop so ASAP was my preferred option, as signals sometimes leaves deals not opening and lots of waiting time. But at least it was able to swap out coins easier under signal mode.

https://github.com/TBMoonwalker/3cqsbot is where you can download the code and read the instructions to test it yourself, or if you struggle, just book a session if you want it set up for you. But the main issue is needing it on everyday. So some clever people have managed to run them in servers, or on a raspberry pie. But for testing purposes, I'm happy to just run it on my pc which is on all day anyway.

What I want to see is Symrank tested and working well in a bullish trending market! And see hope to see better ROI gains and hopefully not too risky picks for certain coins, or at least be able to remove the coins in time before any major drops. This is not an easy task tbh, as even people running strict safe signals can still get caught with red bags. If its constantly able to add and remove the best volatile coins, its doing a good job. What worries me is it picks coins like ICP, SLP which looking at the long term trend, its not something I would be comfortable running a bot for.

There's already people running it with real money and posting their results in the #post-your-profits channel in our discord. So keeping an eye out on their performance is fun.

I hope this was a useful read and see if this is something you want to test yourself. I wish you all the best with your bots!