Hi there,

I have been using DCA trading bots for more than a year now, so I have been reflecting on the bot’s strategies and I thought of writing here some of the conclusions I came to realize in my voyage.

Using the same asap DCA trading bots strategy that I’ve been using, writing about and creating new bot configurations for the past year, it is a very good way to not just save time and eliminate human emotion out of the equation, but it also minimizes the risk exposure by diversifying your portfolio and limiting the amount of the initial/total investment per deal (when using a modest bot config that is), allowing your investment to surf the markets DCA style and fully automated, and in my case, also reducing my FOMO by allowing me to invest in a new project which I like but still has a small total market capital (meaning it is a very volatile asset and risky to go in with large capital).

Also, DCA bots learning curve is more generous since the TradeAlts community was put in place, you just have to watch TA videos and search TA Discord to find the best tips, configs and which trading pairs to go for, then if you run fully covered, meaning you have the funds available that allow your bots to fully DCA to the extent they were created, it is almost just set it and forget it.

And although asap DCA trading bots will provide you a modest ROI while allowing you to continue performing your daily life usual activities, they also have some negatives, as for example the famous red bags, which is an inevitability if the market drops as much as it did since our last ATH in November 2021.

If you just keep your bots on and running, they will most likely get out of the deal someday (unless the project dies out), now the thing is the timeframe that your capital will be stuck on a deal, which might be going nowhere for the next months, or even years. In those situations your mind will shift, it is no longer that you are losing xx% on a deal, it is that you are not closing any deals daily or weekly, so no ROI for the capital stuck on that bot, and most often than none you will have to make a decision, and the better you understand how markets move and how to read them, the easier it will be for you to make an informed decision and take action. That will also break your daily routines and steal time away from other activities, so have that in mind, bots are “almost” set it and forget it… 😊

If you want to contradict the red bags as much as you can then you would need to use start/stop indicators based on a strategy you see fit for your goals, and maybe even setting up stop losses. The same bot configuration used in a deal but starting in different points/time will return a different result, so if you want to achieve a better time to market entry you definitively will need to use indicators to start your bot deals.

Defining indicators in 3commas is very easy, and you already have some simple ones available, like TradingView (TV), RSI or even Bollinger Bands (BB), but most often than none you will have to study the pair you are investing and adjust the values to the past trends already observed, and nothing is free, in the search of reducing you risk exposure you will most probably have to pay it through a lower ROI due to higher waiting time to start a deal or even ending deals too early.

I don’t know any indicator, custom (created in TV using Pine language) or already embedded in 3commas, even the ones on sale in their market, that will change your life and bring you an easy worry-free automated ROI which is better than just go simple and manage your bags when they do happen… if you do know one please let me know! 😊

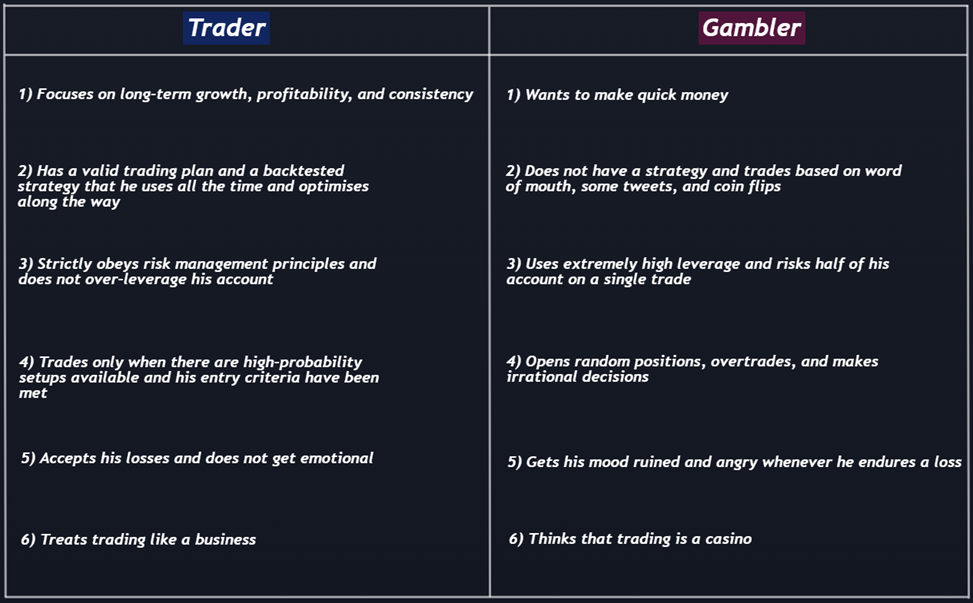

The table above, which was publish a couple of weeks ago in Trading View website, clearly translates the attitude you must have in investment, being it crypto or stocks. It feels good to make some easy passive income with bots, but if you want to take it to the next level you must do it responsibly and intelligently. And although trading is not a casino, there isn’t anyone on the planet that can guarantee with 100% certainty what markets will be doing tomorrow, so you must always try to be the house! (Casino is such a good euphemism though)

Exactly like a casino, being the house does not mean you will never lose, even the most experience traders that deal with billions of dollars will sometimes get it wrong, but it is the way that you do it regularly that will eventually define the win/lose rate and what type of investor you are. You must always strive to minimize your losses, and for that you will need to take very well-informed decisions, have diversity (investment types, strategies, assets, timeframes, etc.) and for sure, you must learn technical analysis and keep your greediness in check!

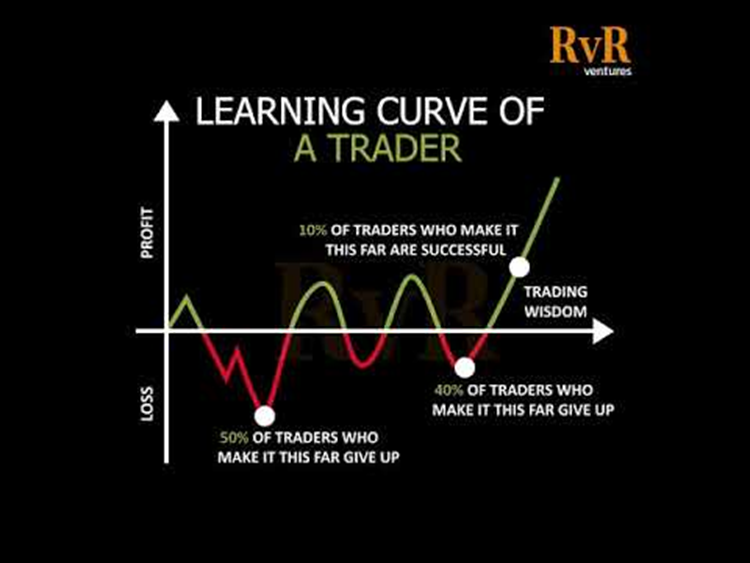

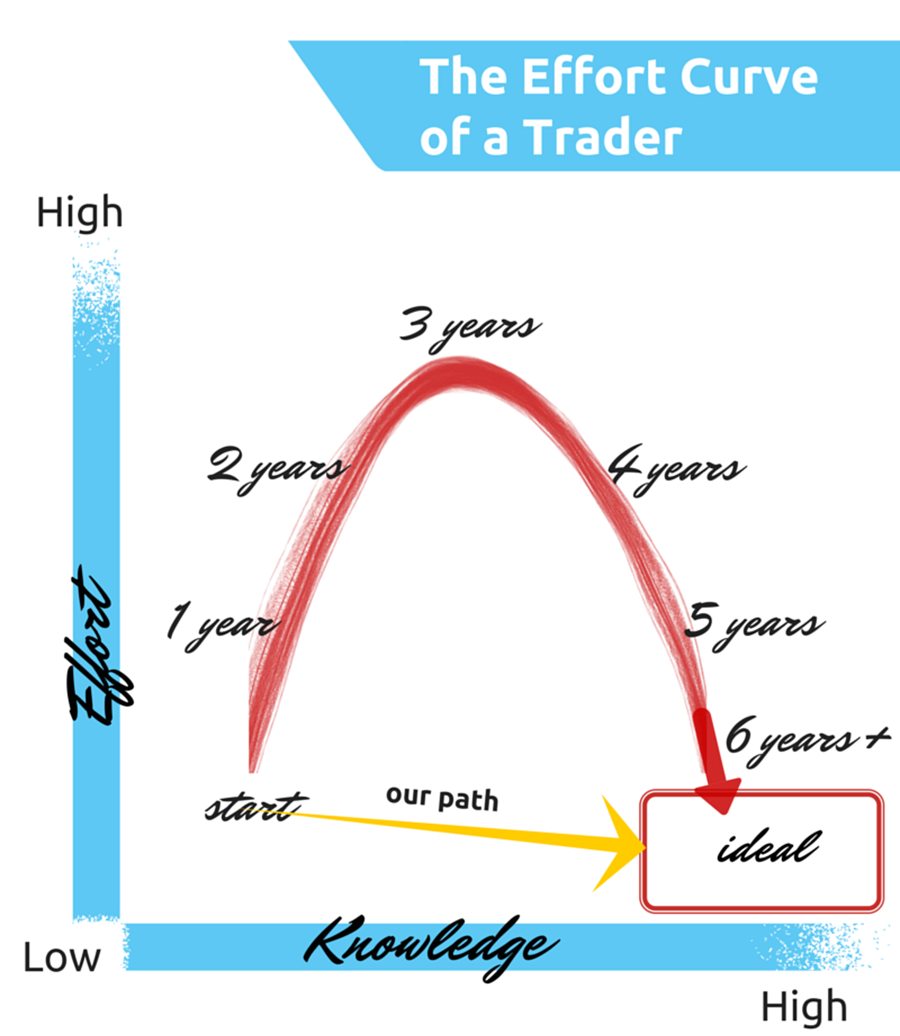

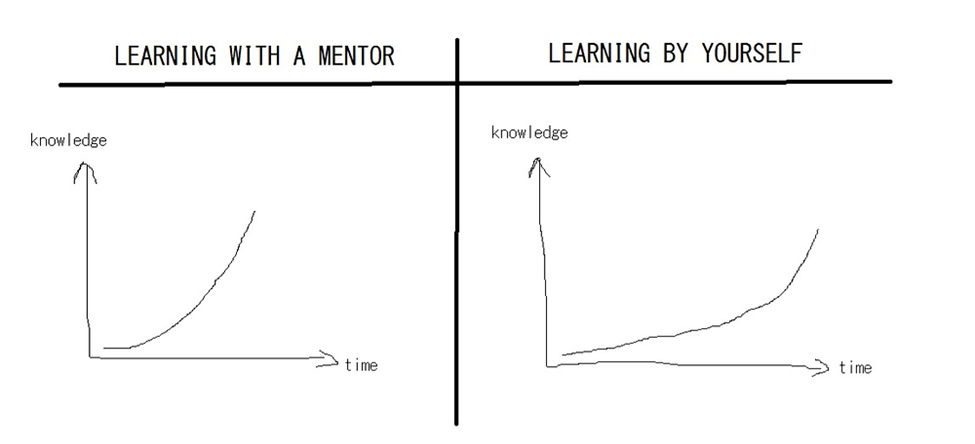

Now, if learning asap DCA bots is very easy, learning proper Technical Analysis is another level. The learning curve and the time investment required to learn it properly could be a challenge to some of us, specially if you have a full-time job not related to Finance and a family that needs your current attention. My advice is never giving up, it will be hard, it will be slow, but little by little you will be getting the bases that can bring you a lot of wins in the future.

If you want to cut corners the best option is to get a training course from an established trader or trading company, some of them might seam expensive, but after having gone through hours and hours of materials, videos, articles, books, I can say that having someone just pointing you out the best strategies, tools, indicators, and solutions is priceless. But be careful, there are a lot of scammers out there trying to sell shitty trading courses when they aren’t even skilled enough to execute trades. Search someone in your own town/country that is an established professional investor, which you can attest, and even if he/she only trades stocks and not crypto, go for it, the bases are the same, risk is risk, up is up, down is down…

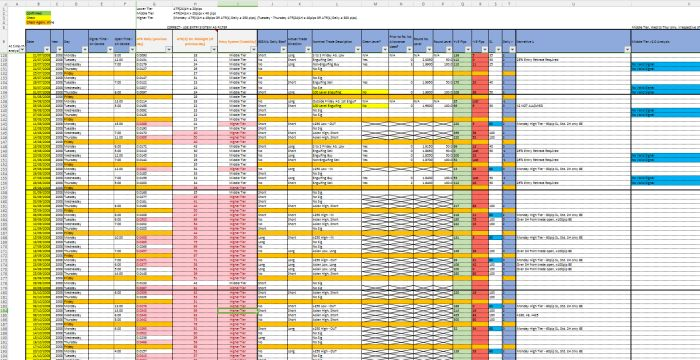

Also, if you want to do it seriously and learn from your mistakes while optimizing the strategy you have adopted, you will need to maintain a proper trading journal.

There are many ways of doing it, being apps or just using excel, the most important is that you start taking notes and keep it updated, and for example by knowing why you though it was a good time to start a deal (indicators used, market sentiment, your emotions at the time) you will learn how to perfect your trading strategies (entry and exit).

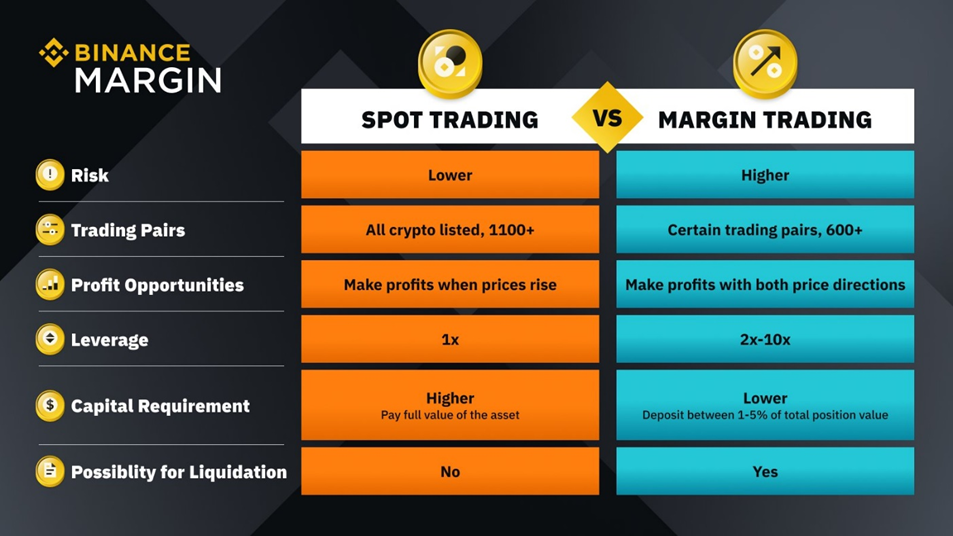

From my point of view, if you want to make real money you have to learn how to do manual trade (spot trading), it will also give you more control over your investments and a brighter vision of the state of the markets, and once you have learned to control your emotions and have a well defined strategy for manual trading, then your returns will really start to grow (you invest bigger and bigger amounts per deal), and once you have it proven over and over again, only then could you start to consider leveraging or going into future markets. The negative, it will require a lot more time and real personal dedication to do it in a professional and profitable way. The positive is that you can do it free of charge and risk if you use paper trading to perfect your strategies, and yes, paper trading is not as thrilling as the real thing, but you can test several different strategies at the same time.

In April of 2021 the markets were going up and up, it was very easy to trade and everyone was making easy money, even with some mistakes you would quickly recover, and I remember one discussion I had with someone in Discord that was already considering quitting his job and dedicate 100% to trading. Don’t let some wins cloud your future, a salary is guaranteed, markets are volatile, and you will need to pay the bills at a fixed date, the landlord will not care if you must wait for the markets to recover for you to pay the rent!

And with this I’m not saying that it is not possible to live out of trading, it is, a lot of people do it, but you must have a proven strategy, one that has been giving twice or triple of your current salary for over a year at least, and please have some uninvested money readily available for your monthly costs that can also cover some emergencies, to be on the safe side consider at least 12 months of your current cost of living.

And to end this reflection I will now state the obvious, money makes the world go around, to make money you need money, for money to generate money it needs to be in motion, to be successful you need to follow a well-defined plan, be well informed, be patient and dedicate a lot of time and effort, and never, never invest money that you cannot afford to lose, because even the best sometimes loses.

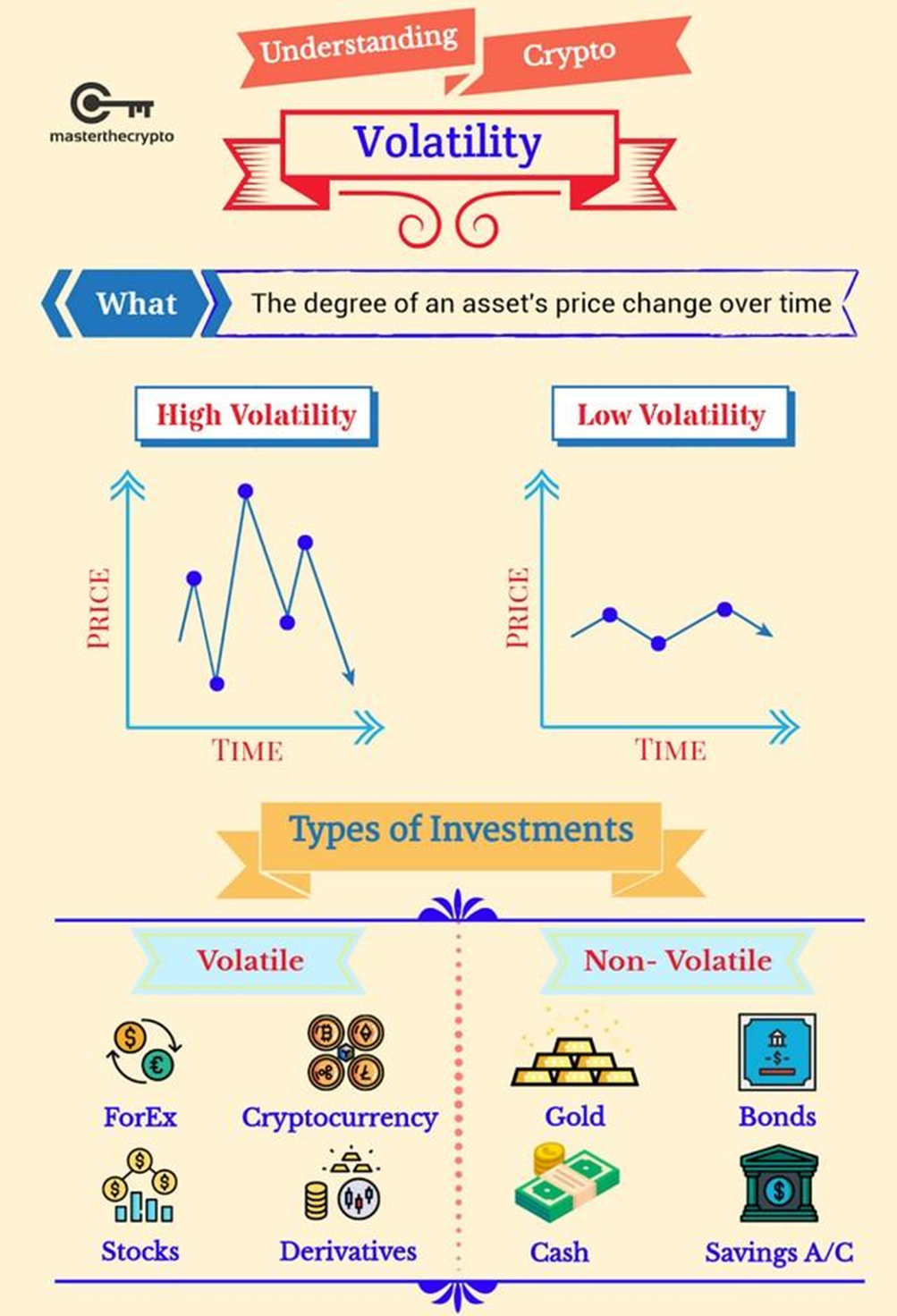

And looking at the recent inflation rates the conclusion is obvious, if you don’t invest your money, it will continue to lose value, so the best decision is to just invest in something, crypto, stocks, commodities, etc…

Crypto is still in its infancy, yes, and we don’t know what future awaits us, correct, but myself personally thinks that crypto is the future of finance and we are just its pioneers!!!

So pioneers, Trade Safe, Trade Smart!