Hi there Botters,

On the 20th of March I’ve started new paper tests to all the community configs, so 14 days have passed since then and we had some good uptrend, so it is time to see what configs are performing better in these good conditions.

Where can you find all the TA community configs?

· If you want to access the configurations sheet, go here: https://bit.ly/TACBots

· If you want to add a config to the list, go here: https://forms.gle/qxuvvsprDa3wMJB7A

· Any corrections to the list, @Ribsy has admin rights to it.

Sellium Paper Tests

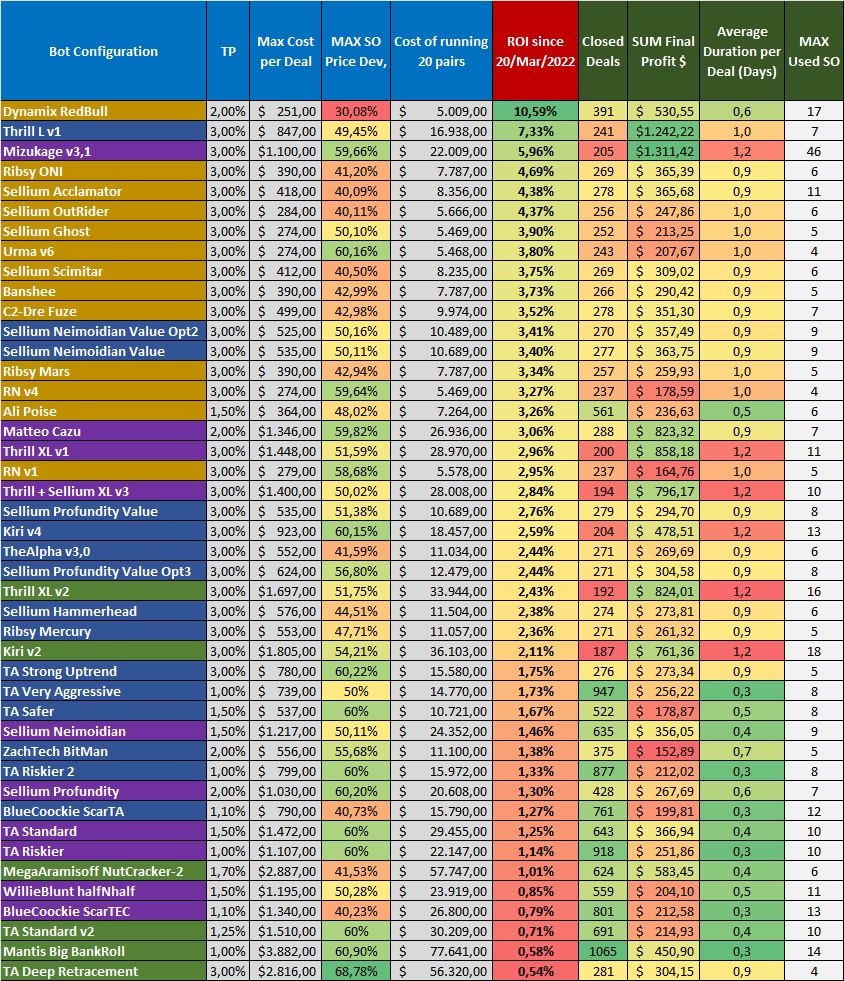

As a reminder, my new paper tests for the community configs were started on 20th March, each bot configuration is a composite bot that runs 20 deals simultaneously, all using the same 20 USDT pairs, and for each the start condition is TV 1m buy.

The 20 coins/tokens were selected randomly, but also trying to keep a diverse bunch, they are:

ACA // ACH // ANC // AVAX // BNB // CHZ // EGLD // HNT // IMX // INJ // IOTX // LUNA // MANA // NEO // NMR // OXT // QTUM // RUNE // TORN // XMR

Results after 14 days running:

Find below the current results, note that the ROI is calculated solely based on the accumulated profit of the close deals, so raw ROI, all the current ongoing deals have not been accounted for yet, will do it after having had the tests running for at least 1 to 2 months.

Quick Top 3 Results Review

Well just amazing those Dynamix Redbull results, but in these last 2 weeks we had some good upside volatility, so this is a very good cheaper config for higher uptrends, mostly because as it has a lower Max Price Deviation it means more of the capital reserved for the bot will be at play and not waiting for raining days, that said, when those corrections come I have a feeling this bot could get stuck for a while, so if you want a setup and forget DCA bot, this is not the one to get, as during a correction you’ll most likely end up having to manual DCA a bunch of red bags, but I'm just speculating here, let's see how it performs in the end.

The Thrill L v1 is also showing great performance during high uptrends, it has a good price point, and it allows for a higher price deviation, could be proven to be a good all-rounder, maybe if used with a TP of 2.0, but time will tell.

The Mizukage v3.1 is also a great bot for high uptrends as it uses a bigger initial deal of 100$, and then 100 safety orders of 10$ each, and if you look at the stats of most configs in the community the majority of your deals will close in the first 3 orders, which is the BO + 2x SO, this config capitalizes on that, and at the same time allows to cover for a price deviation of almost 60%, so pretty much set it and forget it, the only problem I see is the amount of transactions you could end up executing per deal, so in terms of tax reports at the end of the year that might be quite the number of accumulated transactions, and also remember that each SO is actually a limit order, so watch out with the exchange fees you might end up having to pay for each deal… 😊

What are my favorite configs?

I’ve been asked several times what my favorite configs are, so in summary:

Neimoidian – A good all-rounder config, but still on the expensive side, so myself personally I use the Neimoidian Value, which is a more cost-effective version.

Profundity – A good set it and forget it config, but a bit pricy as well, so the Profundity Value could be a better choice if cost is an issue and you’re ok with relinquish 8.7% of automatic DCA capabilities.

Ghost – My budget all-rounder config, works very well with high uptrends, it is a very good config to test out some new coins, or if you want to have pair diversity as it cost only $250 per bot it won't break the bank. Also, if you like to trade based on volatility indicators I'm sure it won't disappoint.

Acclamator – This is the main config I’m using right now, and I personally choose it to ride bullish trends. On all backtests it is just a beast of a config, let's see how it continues to perform in these paper tests.

Sellium PaperTests Data

If you want to access the paper tests data to confirm the results yourself, the file is available here: https://docs.google.com/spreadsheets/d/19tZBkqkRbuxBkHKxKqfeHB3MfCQC64-S9TbjUOYNe_M/edit?usp=sharing

Thank you

And this is all for today, hope the information has proven helpful to you, and I will keep the updates on this paper tests coming, but please don’t forget to like the post and write any comments you see fit.

Trade responsible, trade safe,

- Sellium -