If you follow the news in the cryptocurrency markets, the broader financial markets, or just watched Saturday Night Live last night, you have heard about NFTs. And, like I was, you might be a little confused about them.

There is a LOT of hype going on right now. This can be exciting to you, terrifying, or both. I am a strong believer in learning about and understanding things before getting involved, especially those things that come with high risk and a high reward. I am passionate about making complex things understandable to everyday people. In this article, I try to break it down for you. Like in all my articles, this is not investment advice.

If you have no idea what an NFT is, or if you know or have heard about them but are still a little confused, join me!

In this article we will dive into:

Basic Concepts

The Hype

The Technology Hype Cycle

Looking Ahead

So… Let’s start exploring the most fascinating use-case of Blockchain i.e. NFTs.

Basic Concepts

Let’s break down some terms before we move forward.

NFT: Non-Fungible Token.

Fungible: adjective. able to replace or be replaced by another identical item easily; mutually interchangeable.

Examples of fungible things:

A US $20 Dollar bill

A quarter

0.1 Bitcoin

A gallon of milk

A gallon of gasoline

Fungible Tokens:

These are cryptocurrencies on a blockchain that can be easily bought and sold. They are not unique. 1 Bitcoin or 0.1 Bitcoin is equal to the same amount of Bitcoin. It doesn’t matter which Bitcoin it is, 0.1 Bitcoin owned by one person is equal to 0.1 Bitcoin owned by another person. There are over 8,500 cryptocurrencies that are tracked at coinmarketcap.com. As of earlier evening on March 28th, there were 2,048 of them that have a market capitalization of $100,000 or more. Market capitalization (market cap for short) means the total value of all tokens of a certain cryptocurrency. This is calculated by multiplying the number of tokens in circulation times the value of each token. These are bought and sold on different exchanges, held in wallets, or paid for goods and services where they are accepted.

Non-fungible: adjective. Not fungible. Not able to replace or be replaced by another identical item easily; not mutually interchangeable; Unique.

Examples of non-fungible things:

The Mona Lisa

A rare antique 1670 violin (on eBay for $275,000)

An original 19th century painting from Austria (on eBay for $100,000)

A 1952 Mickey Mantle rookie card which sold for $5.2 million in January

A family heirloom handed down for many generations

Non-Fungible Tokens:

Certain blockchain networks allow for the creation of unique and indivisible tokens that cannot be directly exchanged for one another, called non-fungible tokens (NFTs for short). Use cases for non-fungible tokens include - digital art, collectibles, gaming, certifications and personal licenses, domain names, music, and in the near future — fashion, finance and insurance.

The Hype

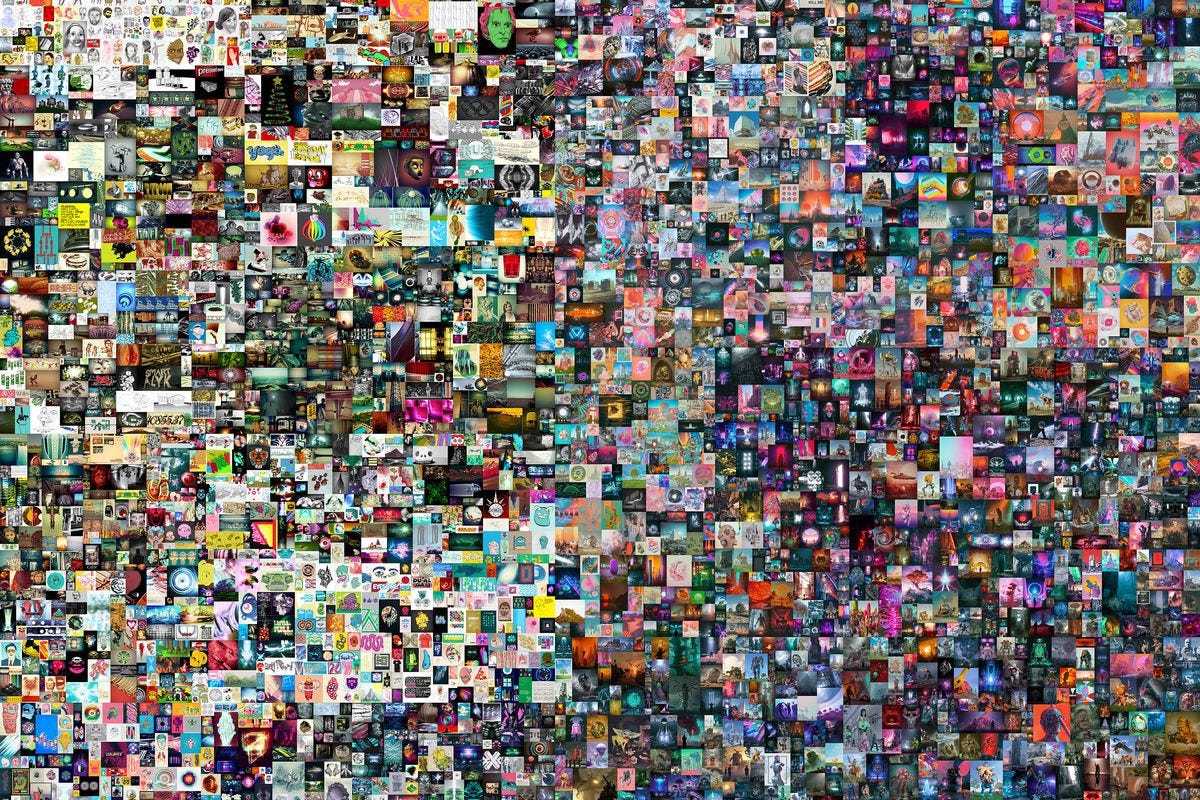

Beeple’s collage, Everydays: The First 5000 Days, sold at Christie’s

Beeple’s collage, Everydays: The First 5000 Days, sold at Christie’s

In case you missed it:

Kings of Leon released an album as an NFT on March 5th, generating over $2 million of sales in the first week.

Beeple’s digital art collage, above, was sold in an auction at Christie’s (a 255-year-old UK-based art auction house) for $69 million USD on March 11th.

Twitter CEO Jack Dorsey sold his first tweet, on March 21, 2006, for $2.9 million (paid in Ether) on March 21st.

Billionaire Mark Cuban launched a digital art gallery called lazy.com to display NFTs. He is also the owner of the Dallas Mavericks of the NBA. The Mavericks already accept Bitcoin and Dogecoin as payment for tickets and are now considering selling tickets as NFTs.

Elon Musk auctioned this song about NFTs as an NFT. He was offered $1.1 million USD for it and then changed his mind, saying he didn’t feel right about it.

What the heck is going on? I believe what is going on is described here:

“We overestimate the impact of technology in the short-term and underestimate the effect in the long run.”

It’s unclear exactly who first made that statement, when they said it, or how it was phrased. The most probable source is Roy Amara, a Stanford computer scientist who said this to colleagues in the 1960s. For this reason, the above is known as Amara’s Law.

I believe there is a price bubble currently, and that it will come down in the short-term, and so does Beeple.

Some speculators seek to buy digital art being sold as NFTs and hope to sell it at a profit. This is extremely risky. While art & collectibles are considered an asset class, it is considered risky for the super wealthy to invest more than 5% of their reserves in collectibles or art. For the general population, it is considered risky to invest more than 1% of their reserves into collectibles or art.

For artists seeking to take advantage of this current trend, to create digital art and sell them as NFTs, there are a number of online marketplaces for this. According to DappRadar, as of March 28th, these are the top-ranking marketplaces by USD volume over the past 24 hours:

NBA Top Shot ($3.36 Million)

Open Sea ($3.25 Million)

Crypto Punks ($1.62 Million)

Rarible ($1.43 Million)

Sorare ($655 Thousand)

Other cryptocurrency investors and traders have shown an increased interest in investing in those cryptocurrencies that support or are involved with NFTs. This includes Ethereum as well as these 127 that are specifically listed by coinmarketcap, as of March 28th. The largest market cap includes Theta (THETA), Chilliz (CHZ), Enjin (ENJ), Decentraland (MANA) and Flow (FLOW). In the previous sentence, I have included the links to their project websites if you want to learn about them in more detail.

As a note, I am not familiar with coinmarketcap.com’s system for considering which blockchains are involved with NFTs. For a deeper dive into its technology and innovation, see my recent Guide on Ethereum.

These NFT-related cryptocurrencies have also been volatile lately, allowing for high risk/reward trading, making winners and losers. For example:

Theta is up 652% since January 1st, and is now the 9th largest cryptocurrency by market cap, at $12.9 Billion.

Chilliz is up 2500% since January 1st, and is now the 40th largest cryptocurrency by market cap, at $3 Billion. However, it is also down 37% from its all-time on March 13th.

Enjin is up 1930% since January 1st, and is now the 49th largest cryptocurrency by market cap, at $2.08 Billion. However, it also took a 26% drop between March 16th and March 23rd.

The Technology Hype Cycle

I believe we are still at the very beginning of a worldwide shift in technology from legacy systems to digital, decentralized systems. Blockchain technology and cryptocurrencies, both using fungible tokens and non-fungible tokens have tremendous uses. Most of them are unexplored. Additionally, I believe there are non-financial related uses of blockchain technology that will likewise transform our world.

Going deeper than Amara’s law, let’s look at the technology hype cycle or Gartner Hype cycle. While this is not a scientifically proven law like the principles of gravity and has its doubters, this makes sense to me and seems to describe what’s occurring with NFTs and digital currency in general. For a deep dive, click the link above. I break it down more briefly here:

New technology: The media picks up on the existence of a new technology that may not exist in a usable form yet. Nonetheless, the publicity leads to significant interest. At this point, people working on research and development are probably not making any money from it. Lots of mistakes are made. If it seems like something new will have a dramatic payoff, it probably won’t last. If it seems we have found the perfect use for a brand-new technology, we may be wrong.

The peak of inflated expectations: A few well-publicized success stories lead to inflated expectations. Hype builds and new companies pop up to anticipate the demand. There may be a burst of funding for research and development. Scammers looking to make a quick buck may move into the area. It’s here that we overestimate the future applications and impact of the technology.

The trough (the depression between waves) of disillusionment: Prominent failures or a lack of progress break through the hype and lead to disillusionment. People become pessimistic about technology’s potential and mostly lose interest. Reports of scams may contribute to this, as the media uses this as a reason to describe the technology as a fraud. If it seems like new technology is dying, it may just be that its public perception has changed and the technology itself is still developing. Hype does not correlate directly with functionality.

The slope of enlightenment: As time passes, people continue to improve technology and find better uses for it. Eventually, it’s clear how it can improve our lives, and mainstream adoption begins. Mechanisms for preventing scams or lawbreaking emerge.

The plateau of productivity: The technology becomes mainstream. Development slows. It becomes part of our lives and ceases to seem novel. Those who move into the now saturated market tend to struggle, as a few dominant players take the lion’s share of the available profits.

Looking Ahead

The current craze in digital art is real — the FOMO (fear of missing out) is causing large inflows of finance. Risk appetite and greed seem to be pretty high. It appears to be a bubble. How long it will last or if it will continue to go higher, no one knows. At least I don’t. What I am much more certain (and this is my strong opinion and prediction) is that the technology hype cycle will play out. Digital currency and NFTs appear to have the power to disrupt and democratize many fields. In looking at these use cases, we will see a complete worldwide adoption and shift, and we are still very early in the game. I believe we have not yet seen 1% of the adoption of this technology that will occur in:

Collectibles

Digital art

Gaming

Personal certifications & licenses

Patents & copyrights

Domain names

Music

Fashion

Finance

Insurance

That’s it for today :-)

Hope each of you has a great start to your day. I’ll talk to everyone tomorrow.

— Amit

I am a technology enthusiast, entrepreneur & creative thinker, who enjoys crafting Tech Products to make a real difference.

Follow me to find what’s more in the bucket:

Pingocard | Twitter | LinkedIn | Instagram | Facebook

Amit Unboxed Supporters

These companies/people make this newsletter and podcast possible, so go check them out and thank them for their support!

Pineapple Group - A Web3 company focused on tech product development. They also provide end-to-end techno-functional consultancy for startups.

Glasban - Your technology growth partner providing software development from conception to delivery - helping you to simplify, strengthen and transform your business.

Versatalia Labs - A next-gen technology product development company working in Computer Vision, AI, ML, Advance Analytics and Blockchain.

Team Dhanashree - Renowned public figure - a dancer, choreographer and creative movement therapist. She is my inspiration and motivation too :-)

You are receiving this interesting content because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Please note that all the content in this newsletter is only for educational purposes. You are advised to do your own research!