Things are starting to look very worrying for bots, since November 2021, we've not seen the bullish momentum and high volume and volatility we had in the last bull run, so most settings are struggling to avoid red bags.

Many of us are stuck since November crash, and now April crash was very bloody, losing quite a lot of volume and volatility. I've not added any bots since November and still holding onto red bags from then, and we are at critical levels for Bitcoin. If we lose this low of the big range, we could see even more of a drop for alts. Especially with the way the stock market has been going, I would still be keeping my risk exposure low for now.

From many backtesting of the Nov 2021 to April, even the safer settings are struggling to make decent ROI and hard to say if they are safe enough to close the deals, but we will prolly find out in the next few days/weeks. The paper trade spreadsheets show many settings also with red bags and just hopium for that big recovery bounce.

Jan 2022 to March was ok for dca bots, but not enough to recover from November crash without a safer setting or adding huge additional funds to dca down. But the drop in ROI was very obvious, compared to last year.

I myself would not be in a rush to add bots now until there's really signs of strength and look more for spot buying if we drop much lower. Cheap/Aggressive Settings are just getting slaughtered. So only people with high bankroll and plenty of spare capital to add funds are the ones still in the market and making consistent profits, but they will also be holding red bags, and need to decide if they can rescue them or wait.

Also coin selection in a bullish market was super easy, but in a bearish market, there's only a handful coins that have kept the volatility and trended up. Even well known coins like Solana, Ada look horrible. Coins like luna, near, rune, crv, atom, avax were a handful that did well during the Nov - March period, but its hard to say if they can remain great for bots.

If I was to restart bots, I would really pick only a handful of coins I want to run, even if its low ROI. I'm tempted to just run a BTC or ETH for example, and have spare funds incase I needed to dca more. I would stick to safer settings and wait for market to change before going aggressive with my settings. Being covered to 60%-80% and actually keep RC% low as possible with what I can afford.

For safe settings in a bear market, there's really few options which none is perfect but both can possible work, but both costs a lot of funds. I don't like the ROI gains or the risks even with safer settings, so I'm not going this route.

Pick a setting that covers slightly lower deviation coverage (20-40%) but really keep the RC% super low at say less than 10% to aggressively close deals. Also have spare funds to add if needed. Run only 1-6 coins.

Pick a setting with high Volume Scale to keep RC% low as much as possible (RC% 0-20%) accepting lower ROI gains for the safety. Cover 60-80% deviation, and just pick coins that are doing well. Also have spare funds to add if needed. Run only 1-6 coins.

Don't run any DCA bots until we're back to a bullish market, if your bankroll isn't large enough, and focus on dip buying if market continues to drop to get value.

Run with aggressive settings on the 1-6 coins that keep doing well. Cover for the 60% drop. Understand you have very high chance of red bags, but have plenty of spare funds or be comfortable waiting. (Not recommended)

Settings that are still in profit

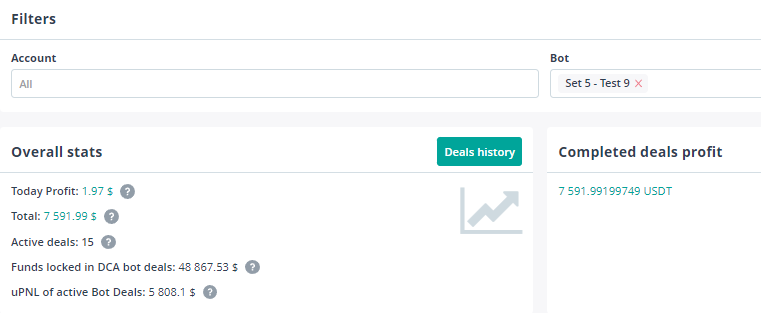

Set 5 - Test 9 is one of the settings that are still in "actual profit" after running for so long in paper test v5. But it costs so much per bot, that not everyone can run it.

Also this is profits running 15 deals for 95 days. At the time of writing this, here are the current red bags for test 9.

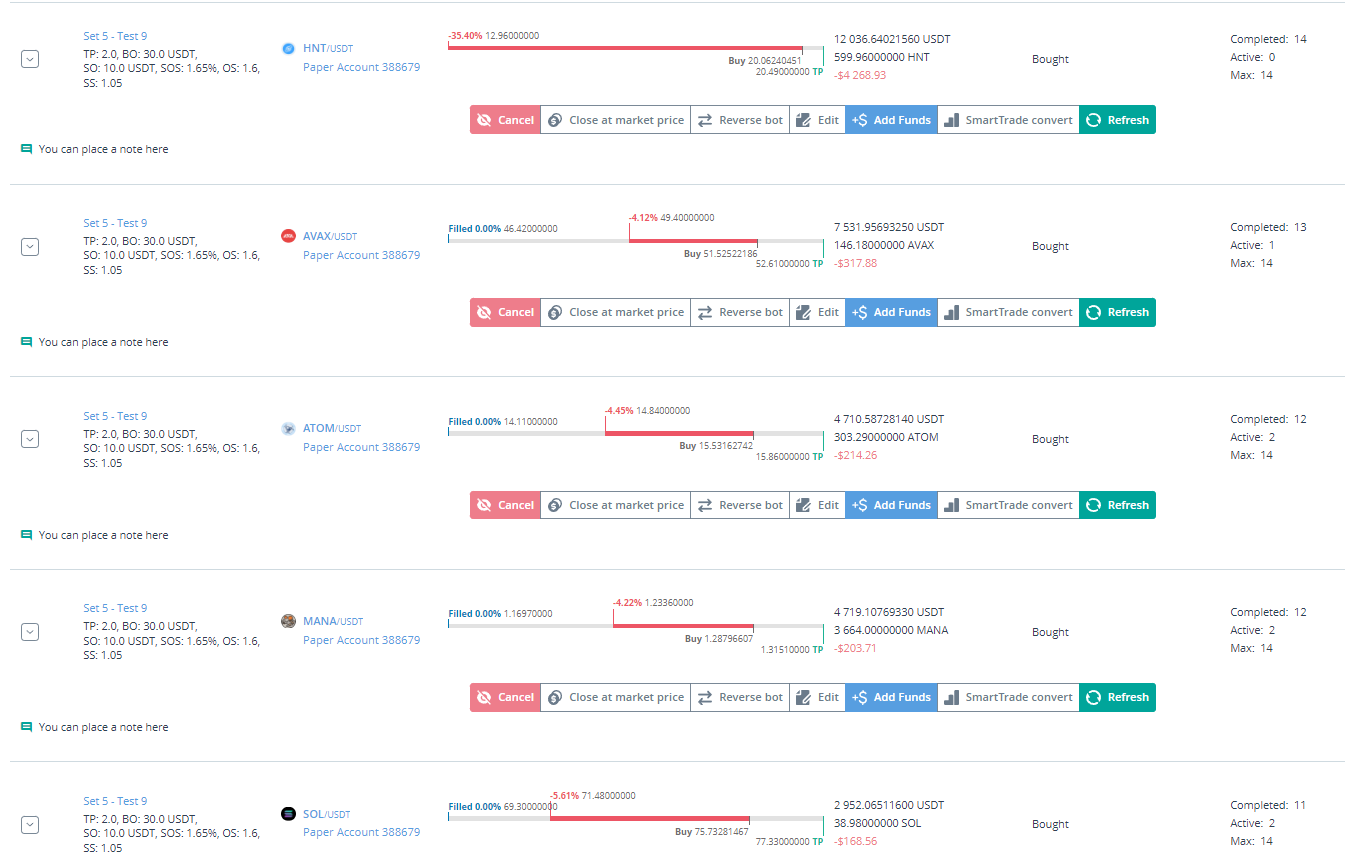

The main one that is struggling is HNT, so I decided to look into the charts.

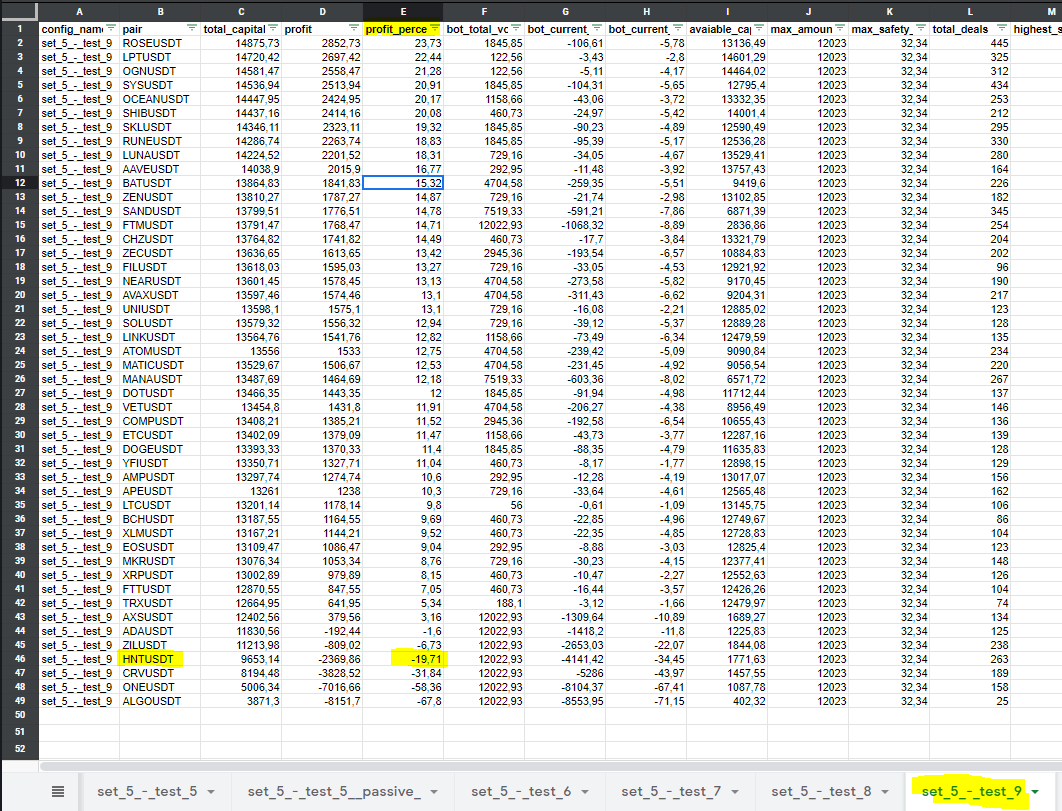

The concern with test 9 is it was deliberately tested on purpose to really keep RC% down but it only covered up to 32% deviation, so after that, you really had to decide if you would add funds or wait. Out of the 15 deals, only HNT did not work and filled all safety orders. So picking a bad coin can still really give you trouble even with a relatively safe setting. Because of the crazy costs, not many would be running this test setting anyway. But look at the other backtesting spreadsheets, in previous posts, sort it by profit %, and see which other safer settings did well. Would you be comfortable with the ROI made?

Below is Alex backtest from Nov to April for Test 9. HNT is one the coins that did struggle with, which confirms the same problem I had with it in my live Paper trade. So there will always be some coins that will struggle even with safe settings. CRV, ONE, ALGO all seemed to suffer.

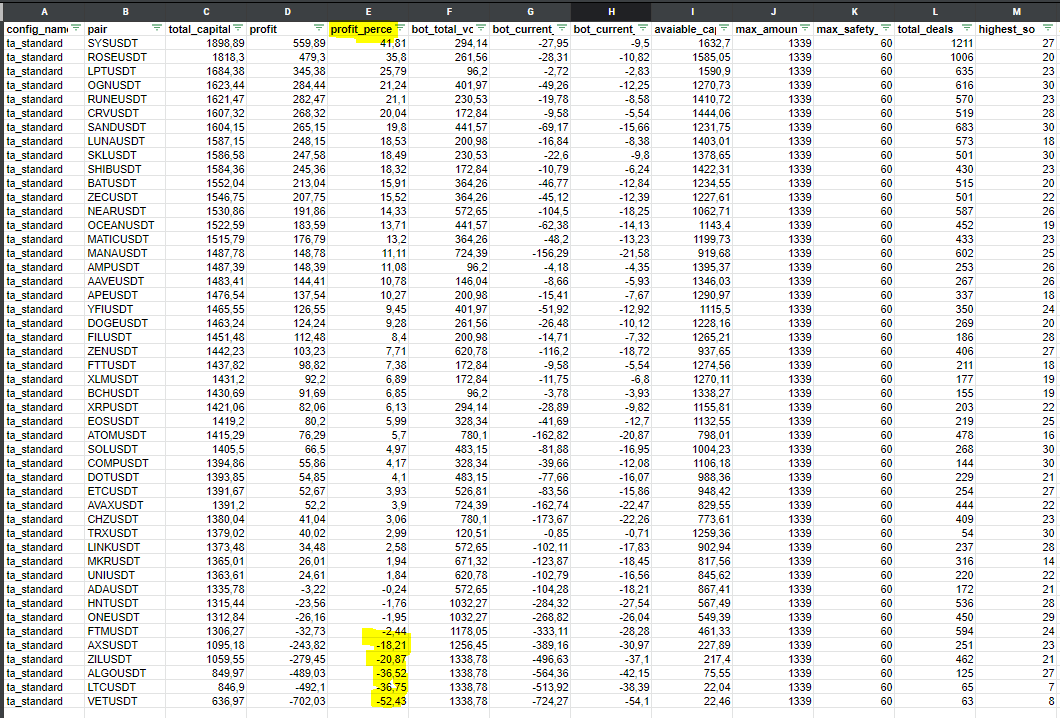

Lets have a quick look at another safe setting, the TA Standard.  So slightly different red bags and different profit percentages for the same selection of coins. This confirms there's no perfect setting and you just need to find and tweak a setting to match your own strategy.

So slightly different red bags and different profit percentages for the same selection of coins. This confirms there's no perfect setting and you just need to find and tweak a setting to match your own strategy.

Grid Bots

I've seen many people move to grid bots and can work if you spot a very good range, but the hassles of not being able to see the true profits/costs easily, and the consistent amending the range if it falls out, messes up the actual profit. So keeping a good record of true profits is tedious with 3commas. There's much better grid bot alternatives.

Short Bots

Short bots for portfolio holds is decent if used properly, but for red bags, its very similar to grid recovery bots. If the market keeps plummeting, you would still have been better off just selling for a smaller loss early. Its also not a set and forget, as you need to constantly know when to turn off the short bot, or amend the settings if it drops too deep. There's too many problems with short bots that I don't like about that would make it my main strategy for a bear market.

Auto Coin selection tools.

Symrank has so much potential, but if the market is crashing like April, even these tools won't protect you. I would really think they work well in a bullish market where you are trying to maximize ROI, but they won't protect you from a mass dip. It's the same with using indicators, if you are already in many deals, even if its a good coin selected at the time, or a good signal, they will still suffer from big market dips.

TLDR - Be careful running bots, its not the optimum time to be increasing risks, its much harder to make gains without getting stuck with red bags. I've not seen any setting that I would want to run in this market. I'd rather hold onto cash myself.