The Tax Foundation

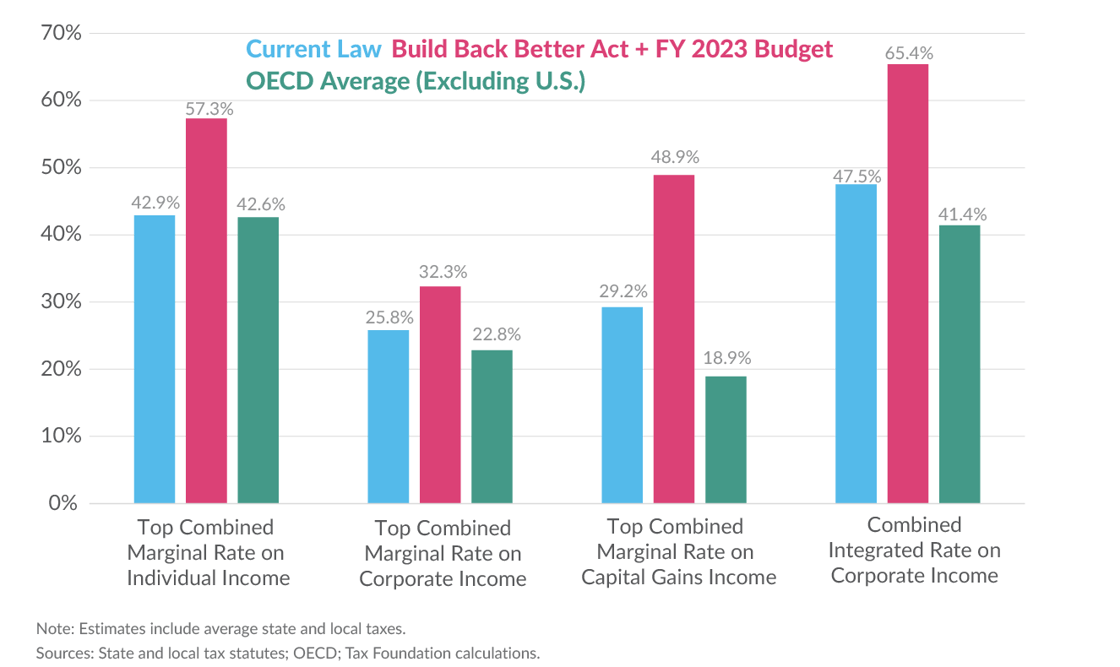

On top of the world: Treasury Secretary Janet Yellen is expected to testify on Capitol Hill next month about President Biden's FY 2023 budget, which in combination with the Build Back Better plan would give the U.S. the highest top tax rates on individual and corporate income in the developed world.

Take a hike: The largest proposed tax hike is an increase in the corporate tax rate from 21 percent to 28 percent, which we estimate would raise over $950 billion over the next decade but would shrink the economy by 0.7 percent and eliminate 145,000 jobs.

On the spending side, the budget proposes increased spending for several public infrastructure programs, including $8 billion for bridges, $1.4 billion for electric vehicle chargers, and $4.7 billion for Amtrak, among other programs.

Our analysis, like that of the Congressional Budget Office, indicates public infrastructure programs paid for with higher income taxes results in reduced economic growth.

Recommended reforms: To assist lawmakers in navigating current tax reform conversations, we modeled how 70 changes to the U.S. tax code would affect the U.S. economy, federal tax revenue, and distribution of the tax burden. Learn more about the budget and see our tax policy recommendations.