Hey Everyone,

I am a growth stock investor and likes investing, swing trading and position trading in individual stocks for compounding returns over a long period of investing life.

However, I am aware of the benefit of having an Index Fund or Index ETF in one's portfolio. I personally have Mutual Funds and ETF to diversify and to have more 'investing' (Buy & Hold) approach.

Many of the members in GrowWealth and followers feel comfortable to invest but only in mutual funds or ETF due to time commitments and skillset. That is perfectly fine and an effective strategy too. You can, with limited hassle, can have long term wealth creation by a simple, single strategy to invest!

As you know, the resources shared in GrowWealth is not financial advice and do not invest solely based on what you read or hear from GrowWealth. You have to make your own decisions, do your due diligence, and decide on strategies that fits your style and needs.

I am going to share a simple strategy that may help your learning process for investing.

One of the major index in US is Nasdaq 100. This is dominant with technological growth stocks. This strategy can be used in S&P500 and perhaps other major indices too, I guess; but I will use Nasdaq 100 ($NDX) as an example here.

At the very peak of the dot com bubble in 2000, $NDX was at $4816. The recent peak in November 2021 was $16764. If one had a perfect mistiming and bought at the very top in 2000 and held $NDX, they would have made 248%. Not bad at all.

A healthy 11.8% annualised (buy & hold - peak to peak)

To the current market price, post recent correction, it stands at 163% (7.4% annualised). That's average.

We know that the market always goes up in the long term. By having a long term investing horizon you have the edge of winning. By staying with the index fund you eliminate the risk of selecting an individual company that may go bust or not recover after a crash.

By introducing a simple strategy for buy points to this we can exponentially improve on the returns. I will show you how.

When there is a big correction in the market, everyone will be scared to invest and tend to panic sell. But those are the opportune times for long term investors.

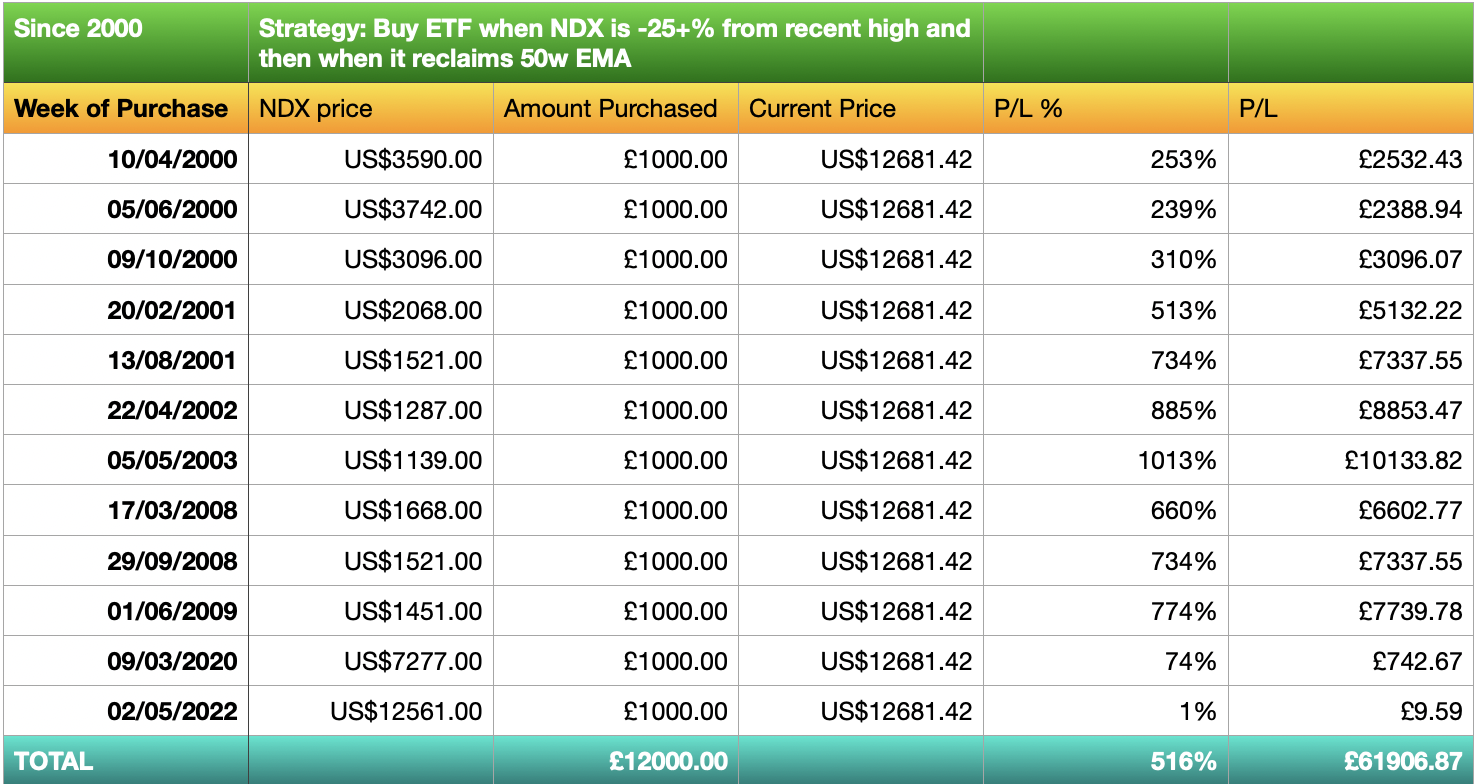

GrowWealth Strategy used in this backtest example is:

Buy Nasdaq 100 based ETF every time it corrects 25% off its recent high, AND

Buy again when it regains its 50 week EMA after such corrections

Hold it long term - until you need the money for other useful purposes

Let us assume you buy a fixed amount of £1000 each time. Here's how the numbers look.

We had 12 occasions when the $NDX dropped 25% off its recent high and reclaimed 50 week EMA since March 2000 peak till date (27 May 2022). You would agree that 12 investments in 22 years isn't that active and those with passive investing outlook can easily manage this. You don't have to babysit the market constantly to identify the 'best' entry points etc.

Just buy when the market dropped at least 25% and then when it gets back above 50 wk EMA.

Compared to the buy & hold return of 163% (7.4% annualised) in 22 years, the above strategy would have netted 516% (More than 3 times the return).

Over 23% annualised return from GrowWealth Strategy

This is a fantastic return without much effort or risk.

For those adventurous investors, they may use leveraged ETF. There are 2x, 3x or 5x ETF. These are very high risk as the drawdown tend to be exaggerated too. A 25% drop in the underlying index can have a massive devastating drawdown with the leveraged ETF. If one choose to invest in it they need to be aware of it.

The upside is it leverages and compounds the return to the upside. A twice leveraged return with the above strategy would result in 1032% return. Over 10 times the invested capital.

This is nearly 47% annualised return (leveraged) using GrowWealth Strategy.

Feel free to modify the strategy as you fit and backtest to find out what you get. One may choose to have additional buy points if the index falls 50%, 75% off its highs, or may be 20% off the highs. These could give additional buying opportunities to benefit from the lowered prices which compounds well when the index recovers in long term. You get the picture, right?

There is always a way to make money in investing. GrowWealth is here to show you how based on my learning and experience. I hope you find these educational material useful and thought provoking.

Happy Learning and Successful Investing.

Disclaimer: This material is intended for educational purposes only, and is not recommendations to buy or sell any financial instruments or products. Do your own due diligence and make your own decision. The value of your investments can rise as well as fall. Capital is at risk when investing in any financial products. You could get back less than you invested. Past performance may not be indicative of future results.