The Tax Foundation:

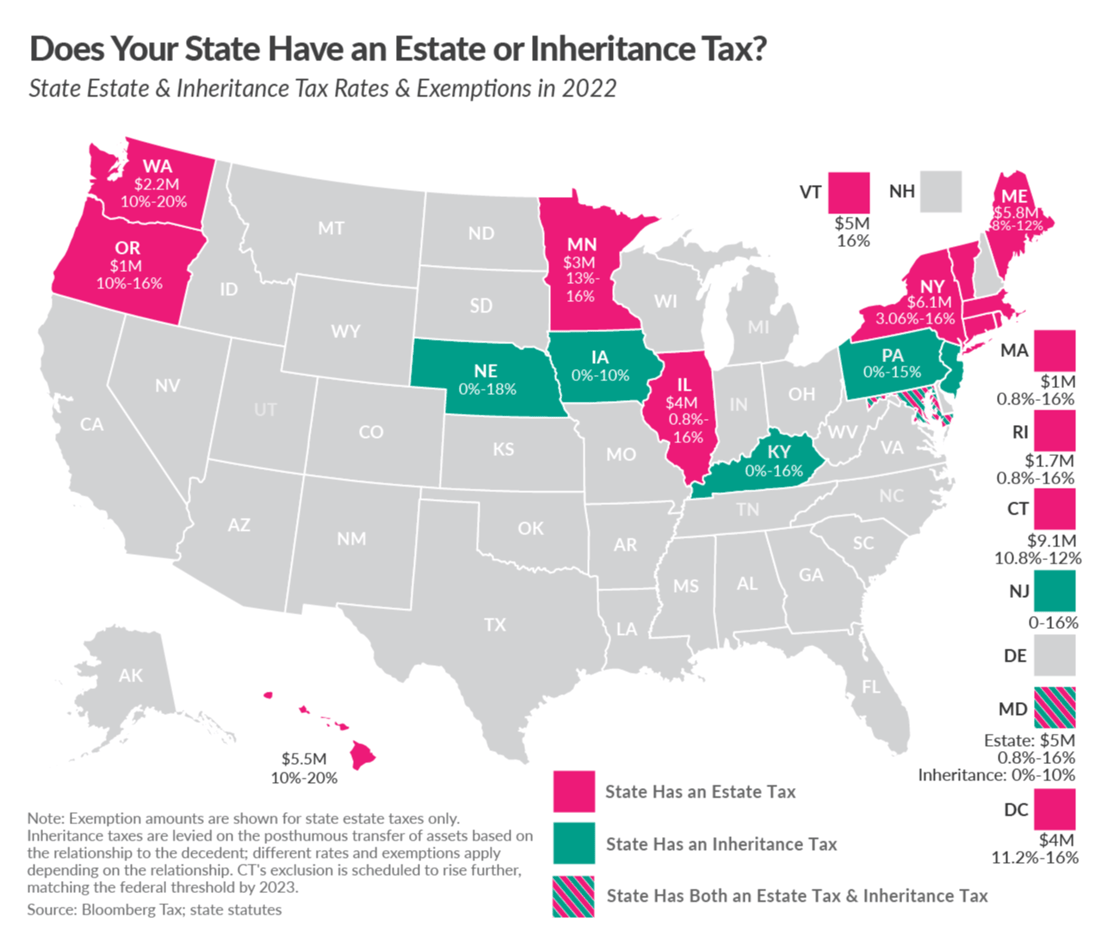

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

Estate taxes are paid by the decedent’s estate before assets are distributed to heirs, and are thus imposed on the overall value of the estate.

Inheritance taxes are remitted by the recipient of a bequest and are based on the amount distributed to each beneficiary.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without a federal exemption hurt a state’s competitiveness.

Estate and inheritance taxes are burdensome. They disincentivize business investment and can drive high-net-worth individuals out-of-state.

They also yield estate planning and tax avoidance strategies that are inefficient, not only for affected taxpayers, but for the economy at large.

The handful of states that still impose them should consider eliminating them or at least conforming to federal exemption levels.