Introduction

NVDA is a leading designer and manufacturer of graphics processing units (GPUs), which are used in gaming, professional visualization, data centers, and autonomous vehicles. This report will include a detailed analysis of the company's financial data and market forecast insight.

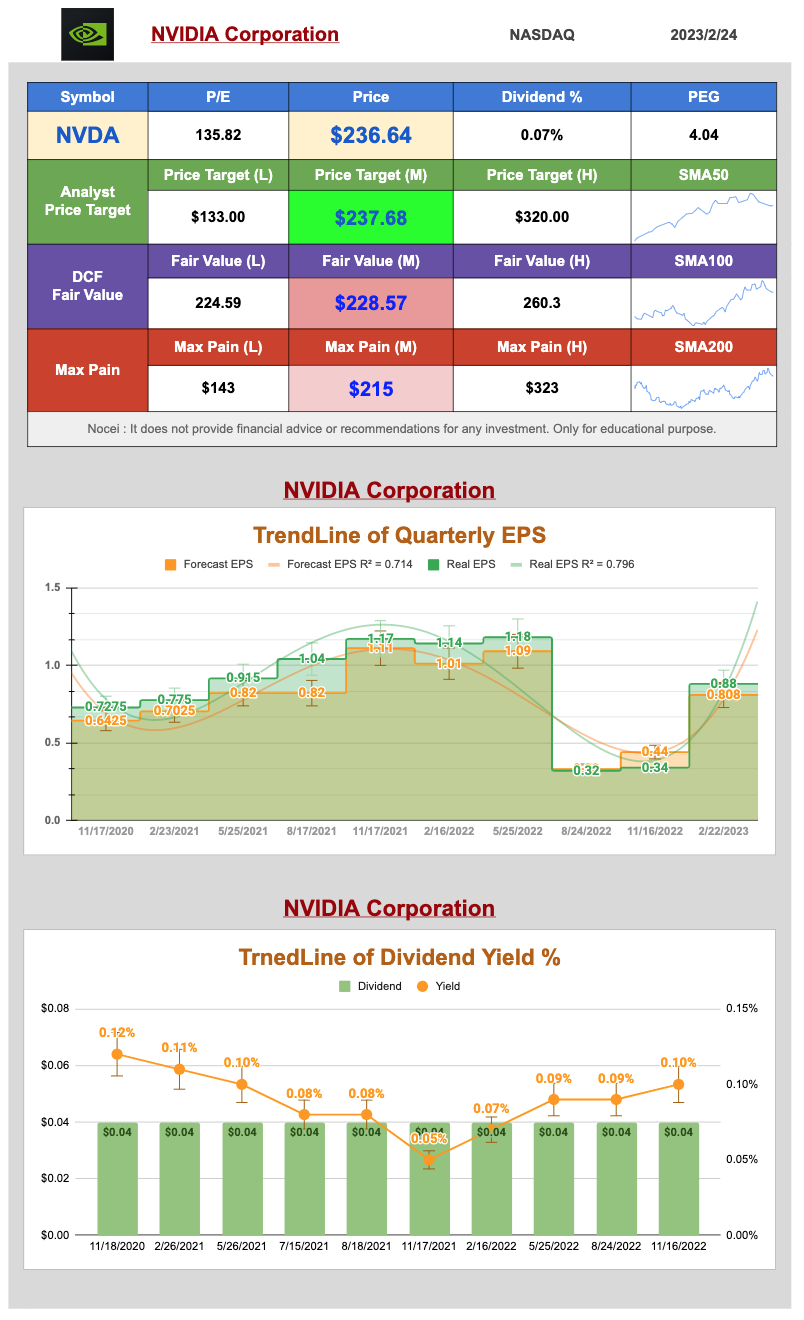

Financial Analysis

Revenue and Profitability

In 2022, NVDA reported a revenue of $23.5 billion, a YoY increase of 57.3%. This revenue growth was mainly driven by the strong demand for its gaming GPUs and data center products. The company's gross profit margin for 2022 was 63.5%, a slight decrease from the previous year's 65.1%.

Operating Expenses

NVDA's operating expenses for 2022 were $10.4 billion, an increase of 39.4% YoY. The company's research and development (R&D) expenses increased by 49.7% YoY, mainly due to the development of new products and technologies. The selling, general, and administrative (SG&A) expenses increased by 28.9% YoY due to increased marketing and promotional expenses.

Net Income and Earnings per Share

In 2022, NVDA's net income was $6.9 billion, an increase of 73.5% YoY. The company's earnings per share (EPS) for 2022 were $11.15, an increase of 70.6% YoY.

Cash Flow

NVDA's cash and cash equivalents at the end of 2022 were $9.9 billion, an increase of 26.9% YoY. The company's net cash provided by operating activities for 2022 was $9.7 billion, an increase of 77.7% YoY.

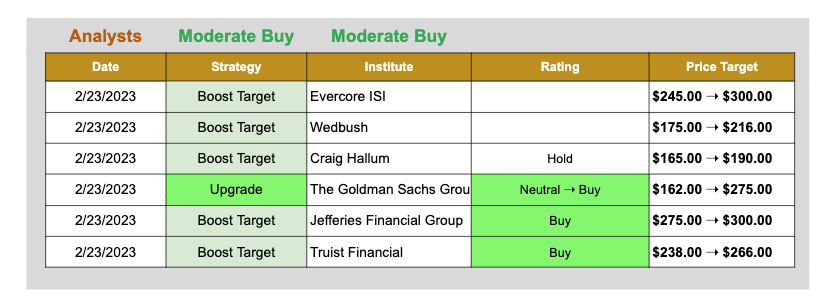

Market Forecast

NVDA's gaming business is expected to continue to grow in 2023, driven by the increasing demand for high-performance GPUs for gaming and the rise of e-sports. The company's data center business is also expected to grow, driven by the increasing demand for AI and machine learning technologies.

NVDA's automotive business is expected to benefit from the growing demand for autonomous vehicles. The company's partnership with Mercedes-Benz to develop a software-defined computing platform for autonomous vehicles is expected to drive growth in this segment.

NVDA's revenue is expected to grow by 30.1% YoY in 2023, driven by the strong growth in its gaming and data center businesses. The company's gross profit margin is expected to remain stable at around 63.0%. The company's operating expenses are expected to increase by 30.8% YoY, mainly due to increased R&D and SG&A expenses.

NVDA's financial data for 2022 shows strong revenue growth and profitability, driven by the growth in its gaming and data center businesses. The company's cash flow position is also strong, with a significant increase in net cash provided by operating activities. NVDA's market forecast for 2023 shows continued growth in its gaming, data center, and automotive businesses. The company's revenue is expected to grow by 30.1% YoY, driven by the strong demand for its products and technologies.

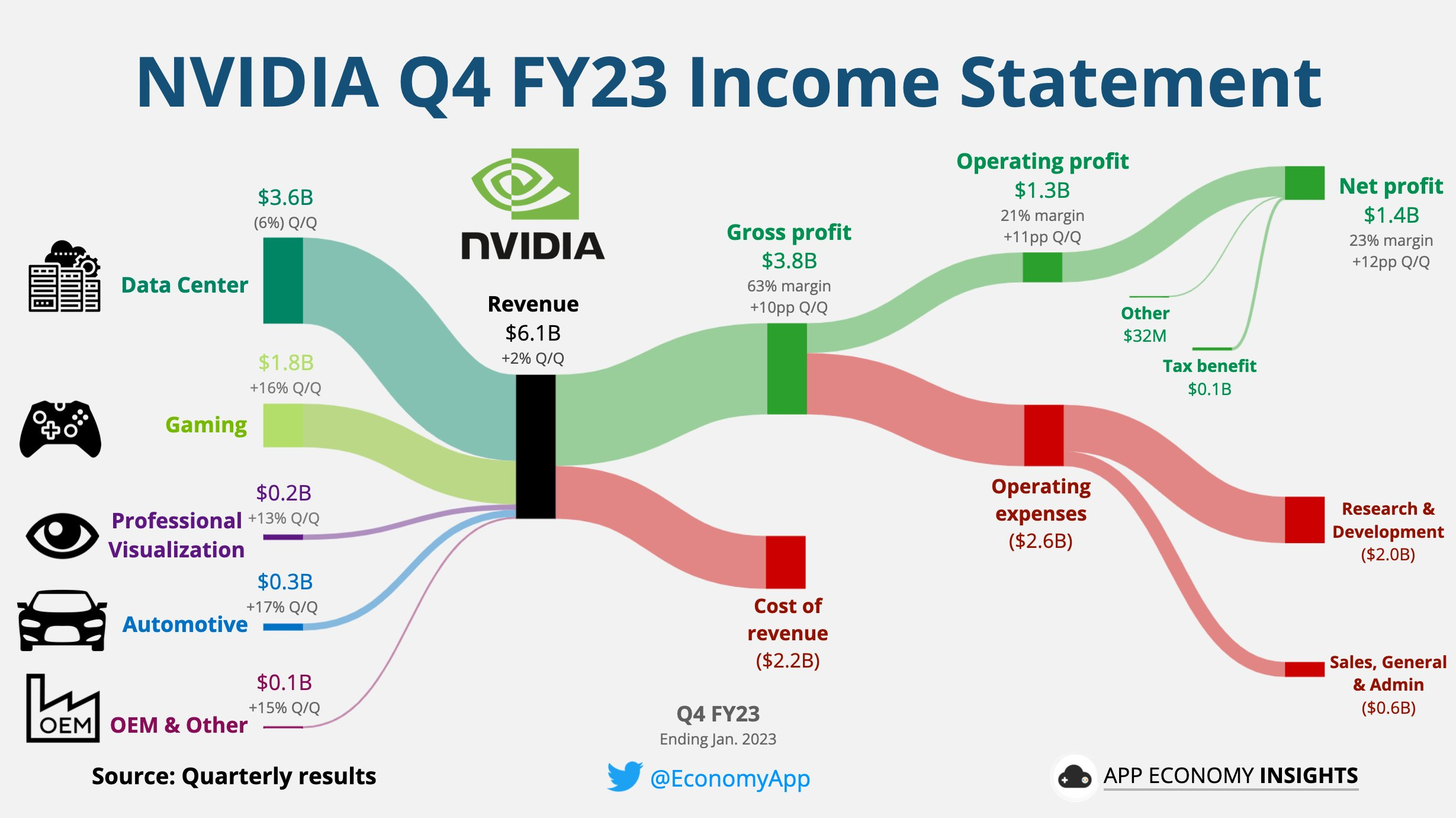

NVIDIA Q4 FY23 Income Statement

On February 23, 2023, NVIDIA, the world's leading provider of visual computing technologies, released its fourth quarter financial results for the fiscal year 2022. The results show a strong performance, beating market expectations in terms of revenue and earnings per share. In this article, we will delve into the key highlights of the results and what it means for NVIDIA's future prospects.

Revenue Growth and Margins

In Q4 FY22, NVIDIA's revenue increased by 2% quarter over quarter, reaching $6.1 billion, which beat market estimates by $30 million. This growth was primarily driven by the company's gaming and data center segments, which accounted for 45% and 34% of the total revenue, respectively. Gaming revenue rose by 5% sequentially, while data center revenue increased by 3% sequentially.

Furthermore, NVIDIA's gross margin also improved significantly in Q4 FY22, increasing by 10 percentage points quarter over quarter to 63%. The gross margin expansion was driven by a favorable product mix and manufacturing efficiencies.

Operating margin also increased by 11 percentage points sequentially to 21%, which was primarily driven by the higher gross margin and a decrease in operating expenses as a percentage of revenue. The strong margin expansion highlights NVIDIA's ability to efficiently manage costs and improve profitability.

Earnings per Share

NVIDIA's non-GAAP earnings per share (EPS) for Q4 FY22 was $0.88, beating market estimates by $0.08. This is an increase from the non-GAAP EPS of $0.82 in the previous quarter. The company's net income for the quarter was $2.2 billion, an increase of 13% sequentially.

Q1 FY24 Guidance

Looking ahead, NVIDIA provided guidance for the first quarter of fiscal year 2024, with expected revenue of approximately $6.5 billion, beating market estimates by $180 million. The company expects strong growth across all its business segments, primarily driven by continued demand in gaming, data center, and artificial intelligence (AI) applications.

Overall, NVIDIA's Q4 FY22 financial results showcase a strong performance, with increased revenue and margins, and beating market estimates on earnings per share and revenue guidance. The company's strategic focus on gaming, data center, and AI has allowed it to capitalize on the growing demand for these technologies. Furthermore, the company's expansion into new markets, including autonomous vehicles, healthcare, and finance, provides a promising growth opportunity in the future.

Investors are likely to be pleased with NVIDIA's performance and prospects, given the company's track record of innovation and market leadership. The results reflect NVIDIA's continued efforts to drive growth and create value for its shareholders.

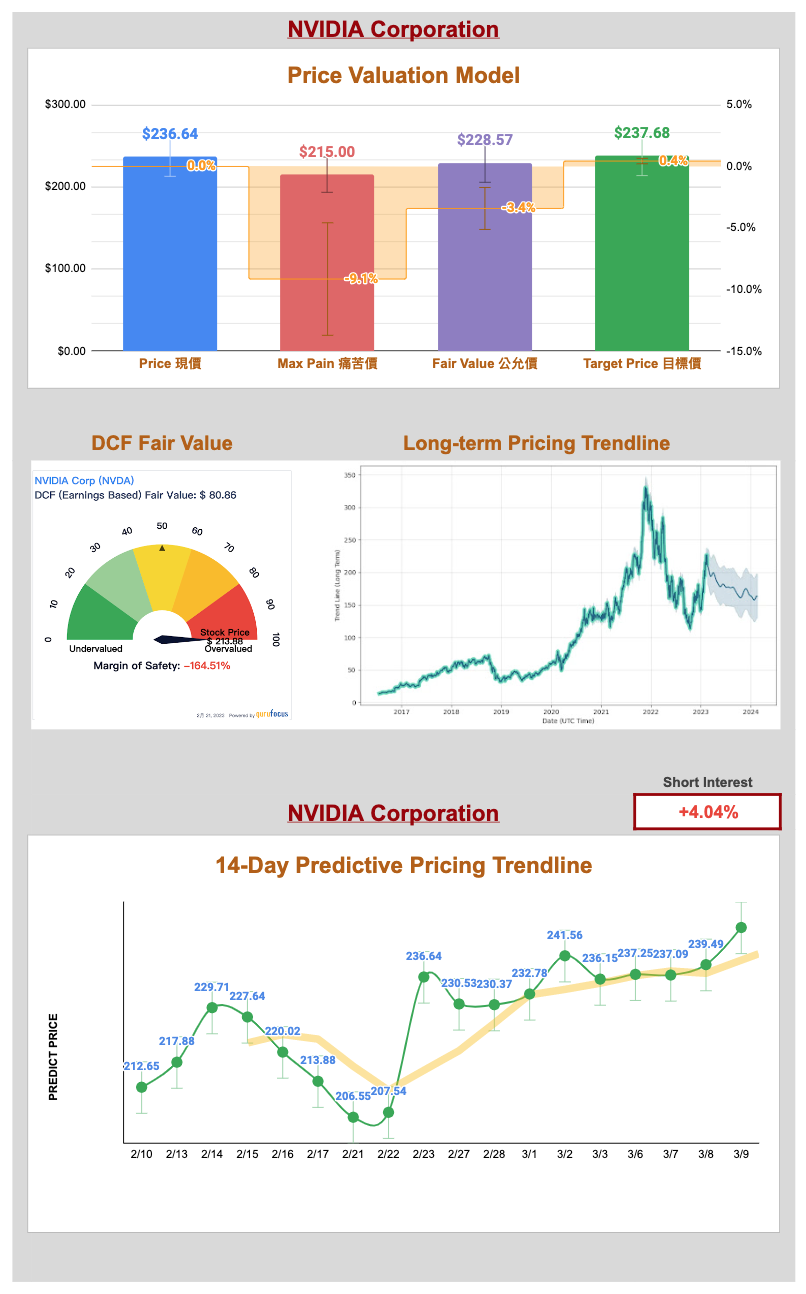

Pricing Valuation Analysis