Introduction:

In this report, we analyze the top 10 creations and redemptions in the Exchange Traded Funds (ETFs) market for the week of 02/17/2023 - 02/23/2023 to provide investment insight.

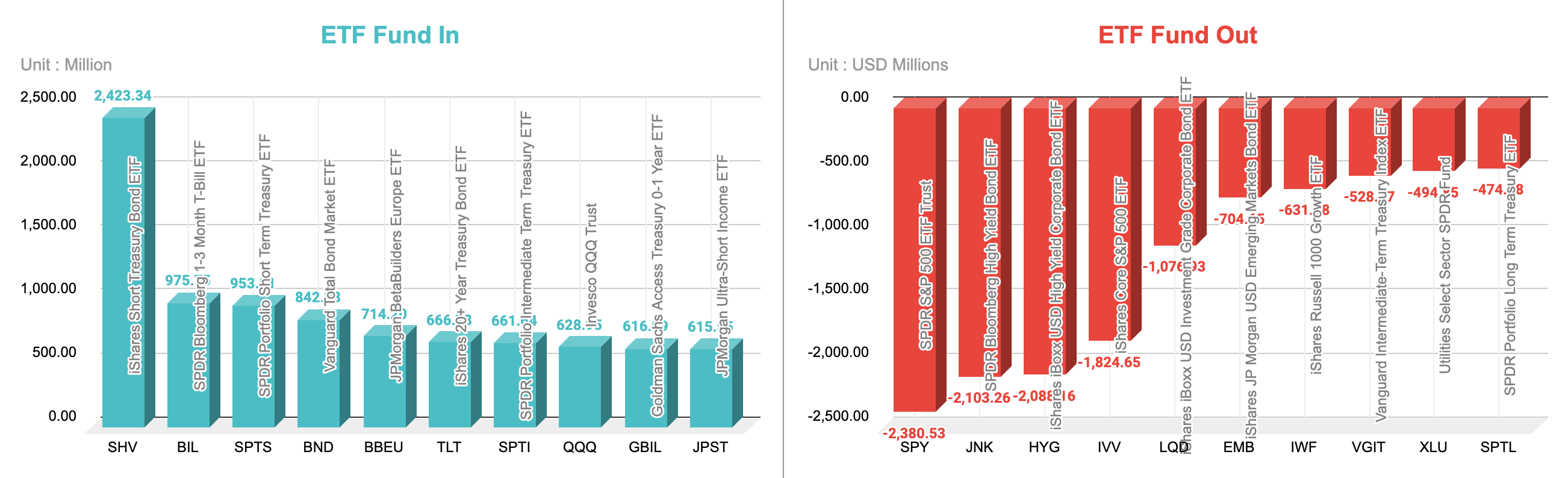

Top 10 Creations:

The top 10 creations for the week were dominated by fixed-income ETFs, with the iShares Short Treasury Bond ETF (SHV) leading with net flows of USD 2,423.34 million. This indicates a preference for lower-risk investments as the bond market is considered to be less volatile than the equity market. The SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) and SPDR Portfolio Short Term Treasury ETF (SPTS) were also among the top 3 creations, suggesting investors' focus on short-term bonds with lower risk.

However, the JPMorgan BetaBuilders Europe ETF (BBEU) was the only equity ETF in the top 5 creations. This suggests investors are showing some interest in international equities, particularly those focused on Europe, likely due to the positive economic outlook for the region.

Overall, the preference for fixed-income ETFs, particularly short-term treasuries, indicates investors are taking a more cautious approach and positioning their portfolios towards safety and liquidity.

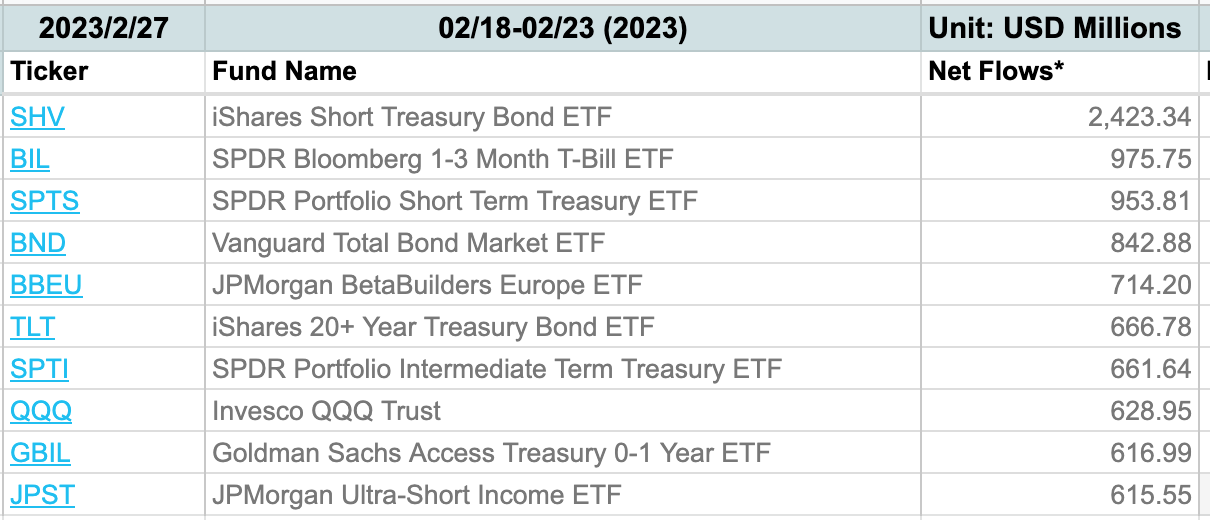

Top 10 Redemptions:

The top 10 redemptions were dominated by equity ETFs, with the SPDR S&P 500 ETF Trust (SPY) leading with net outflows of USD 2,380.53 million. This could be due to concerns about rising inflation and interest rates, which could potentially impact the stock market negatively.

The iShares Core S&P 500 ETF (IVV) and iShares Russell 1000 Growth ETF (IWF) were also among the top 10 redemptions, suggesting investors are taking a more cautious approach towards US equity markets, especially those that have exposure to growth stocks.

Furthermore, the Utilities Select Sector SPDR Fund (XLU) was also among the top 10 redemptions, indicating investors are less interested in defensive sectors, which are considered to be less volatile.

Investment Advice:

Given the current market conditions, we recommend investors to consider a more defensive approach to their portfolio, with a focus on fixed-income ETFs such as the iShares Short Treasury Bond ETF (SHV), SPDR Bloomberg 1-3 Month T-Bill ETF (BIL), and SPDR Portfolio Short Term Treasury ETF (SPTS).

Investors could also consider the JPMorgan BetaBuilders Europe ETF (BBEU) as an opportunity for international equity exposure.

Investors may want to avoid equity ETFs with significant exposure to US equities, particularly growth stocks, as the market may be susceptible to inflation and interest rate risks. Defensive sectors such as utilities may also not be the best investment at this time.

Disclaimer

IDI.Capital is a research project and this website provides information for educational purposes only. It does not provide financial advice or recommendations for any investment. You must acknowledge that all your investment decisions are totally at your own risk.