This month, our focus is on the thriving AI industry, and today, we turn our attention to C3.ai - a preeminent Enterprise AI company that has cemented its position as a market leader.

According to extensive research conducted by prominent institutions, including MarketsandMarkets, Grand View Research, and ResearchAndMarkets, the Enterprise AI market is set to experience tremendous growth over the next decade, with projections indicating a market size of over USD 50 billion by 2030. This significant expansion can be attributed to the increasing adoption of AI technologies by organizations of all sizes, across a range of industries, to enhance productivity, streamline operations, and gain a competitive edge.

C3.ai is a leading Enterprise AI software provider that specializes in delivering cutting-edge solutions to help organizations accelerate digital transformation.

Founded in 2009 by a team of seasoned software professionals and data scientists, the company has quickly established itself as a market leader in the rapidly expanding AI industry. C3.ai's platform leverages advanced machine learning algorithms and big data analytics to enable businesses across various sectors, including energy, finance, healthcare, and manufacturing, to optimize their operations, reduce costs, and enhance customer experiences.

With its innovative approach to Enterprise AI and commitment to delivering exceptional customer value, C3.ai has earned a reputation as a trusted partner for companies looking to gain a competitive edge in the digital age.

Here are three of their clients and successful case studies:

ENGIE: C3.ai worked with the global energy company ENGIE to create a predictive maintenance solution for their wind turbines. By analyzing data from sensors on the turbines and using machine learning algorithms, the solution was able to detect potential issues before they became serious problems. This led to increased uptime for the turbines and a reduction in maintenance costs.

3M: C3.ai collaborated with 3M, a multinational corporation that produces consumer and industrial products, to develop a predictive maintenance solution for their manufacturing equipment. The solution was able to analyze data from sensors on the equipment to identify potential failures before they occurred. This allowed 3M to avoid costly downtime and increase productivity.

Royal Dutch Shell: C3.ai worked with Royal Dutch Shell to create a predictive maintenance solution for their oil drilling equipment. The solution used machine learning algorithms to analyze data from sensors on the equipment and predict potential failures. This led to a reduction in unplanned downtime and increased efficiency for Shell's operations.

Fundamental Analysis :

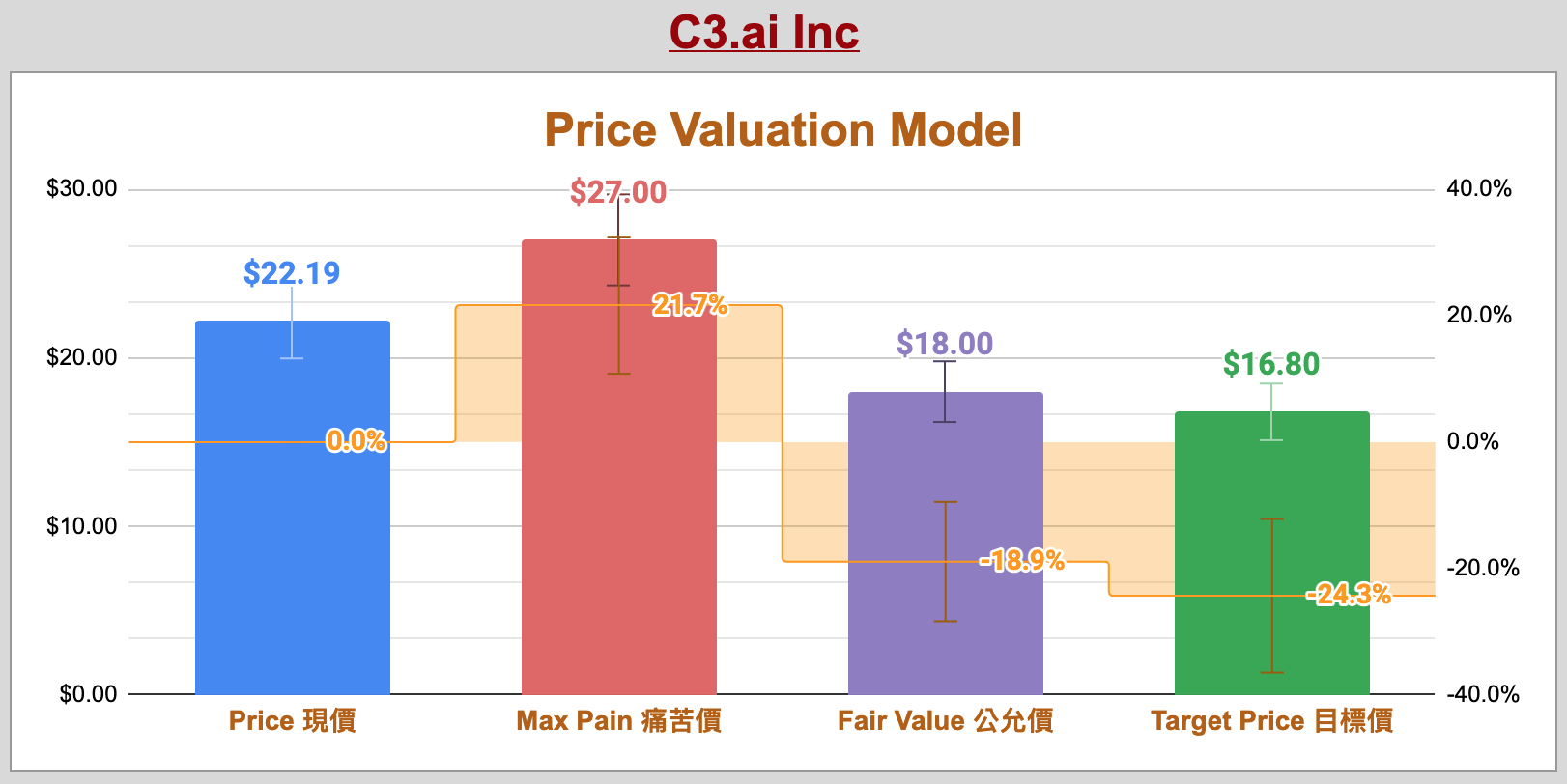

Based on the given data, it appears that C3.ai's current stock price of 22.19 is above both the target price of 16.8 and the fair value estimate of 18. The max pain point of 27 suggests that investors who bought the stock at a higher price are experiencing significant losses.

However, the PEG ratio of 0.32 indicates that the stock is undervalued relative to its earnings growth potential. This suggests that C3.ai may be a good long-term investment opportunity for investors who believe in the growth potential of the Enterprise AI market.

Professional insight and advice would suggest that while C3.ai's current stock price may be overvalued relative to its fair value estimate and target price, the company's strong position in the rapidly expanding Enterprise AI market and its potential for future earnings growth make it a potentially attractive investment opportunity. Investors should consider the company's financial performance, growth prospects, and the broader market conditions when making investment decisions, and should weigh the risks and potential rewards accordingly. Additionally, it may be wise for investors to consider diversifying their portfolios with other stocks and asset classes to mitigate risk.

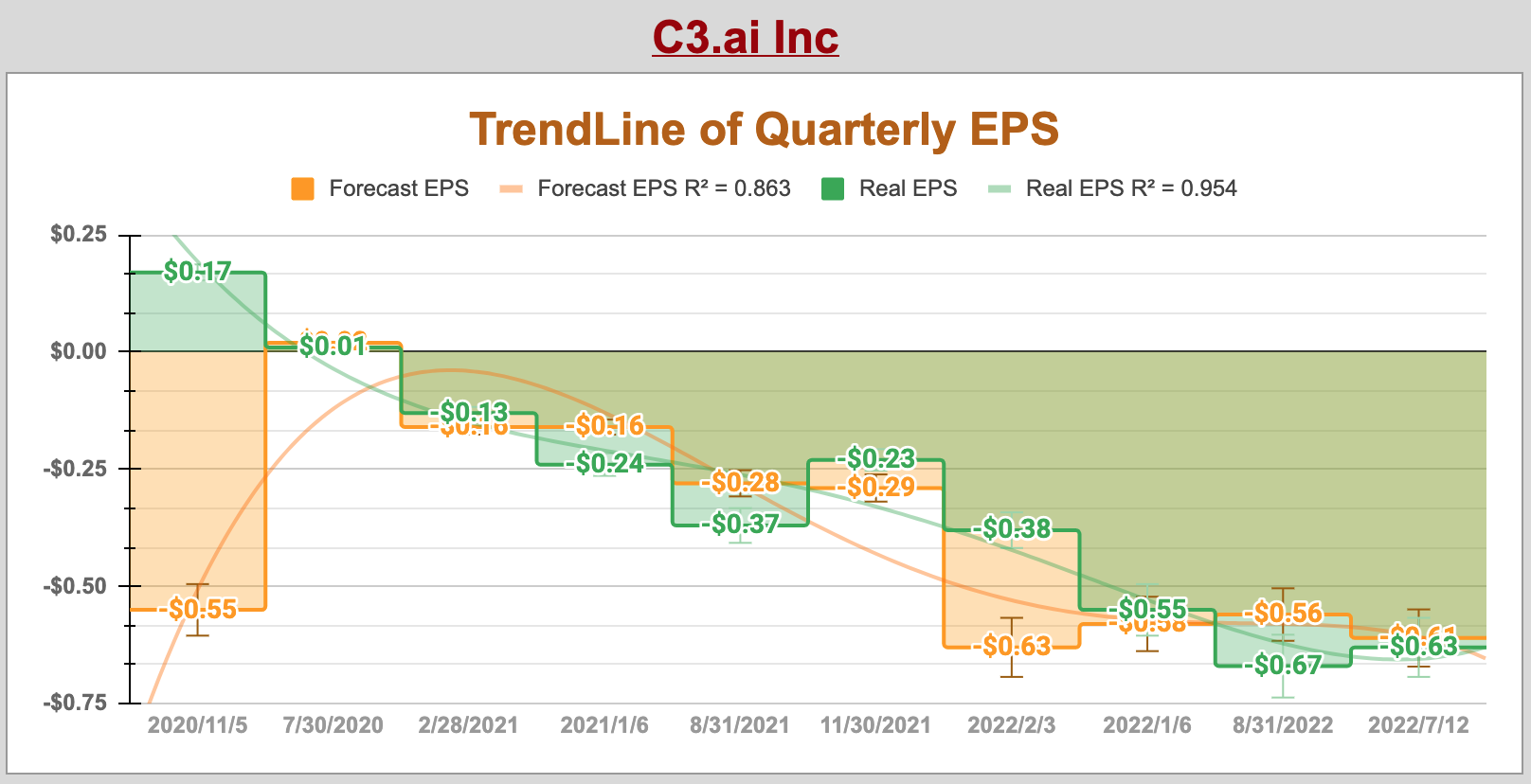

Financial Analysis :

Looking at the income statement for C3.ai, there are a few key takeaways.

First, the operating revenue has been steadily increasing over the past few quarters, reaching $9.5 million in Q3-2022. However, the cost of revenue has also been increasing, which has resulted in a relatively stable gross profit of around $9.5 million per quarter.

Second, the selling, general, and administrative expenses have been relatively stable, with some slight fluctuations. Other operating expenses have been increasing, especially in Q3-2022, which resulted in total operating expenses increasing from $2.9 million in Q3-2021 to $5.2 million in Q3-2022. This has led to a positive operating income of $4.3 million in Q3-2022, compared to a negative operating income in the previous quarter.

Third, interest expense has been increasing over the past few quarters, reaching -$3.9 million in Q3-2022. Other income and expenses have also been fluctuating, resulting in a total other income and expense of $0.2 million in Q3-2022.

Finally, income before income taxes has been positive for the past two quarters, with a net income attributable to common shareholders of $2.8 million in Q3-2022. However, there have been some income taxes owed, resulting in consolidated net income of $3.4 million in Q3-2022.

Overall, the income statement for C3.ai shows that the company is steadily increasing its operating revenue while also managing its expenses. While there have been some fluctuations in other income and expenses, the company has been able to maintain positive income before income taxes for the past two quarters. However, it is important to note that the company is still not profitable on a GAAP basis.

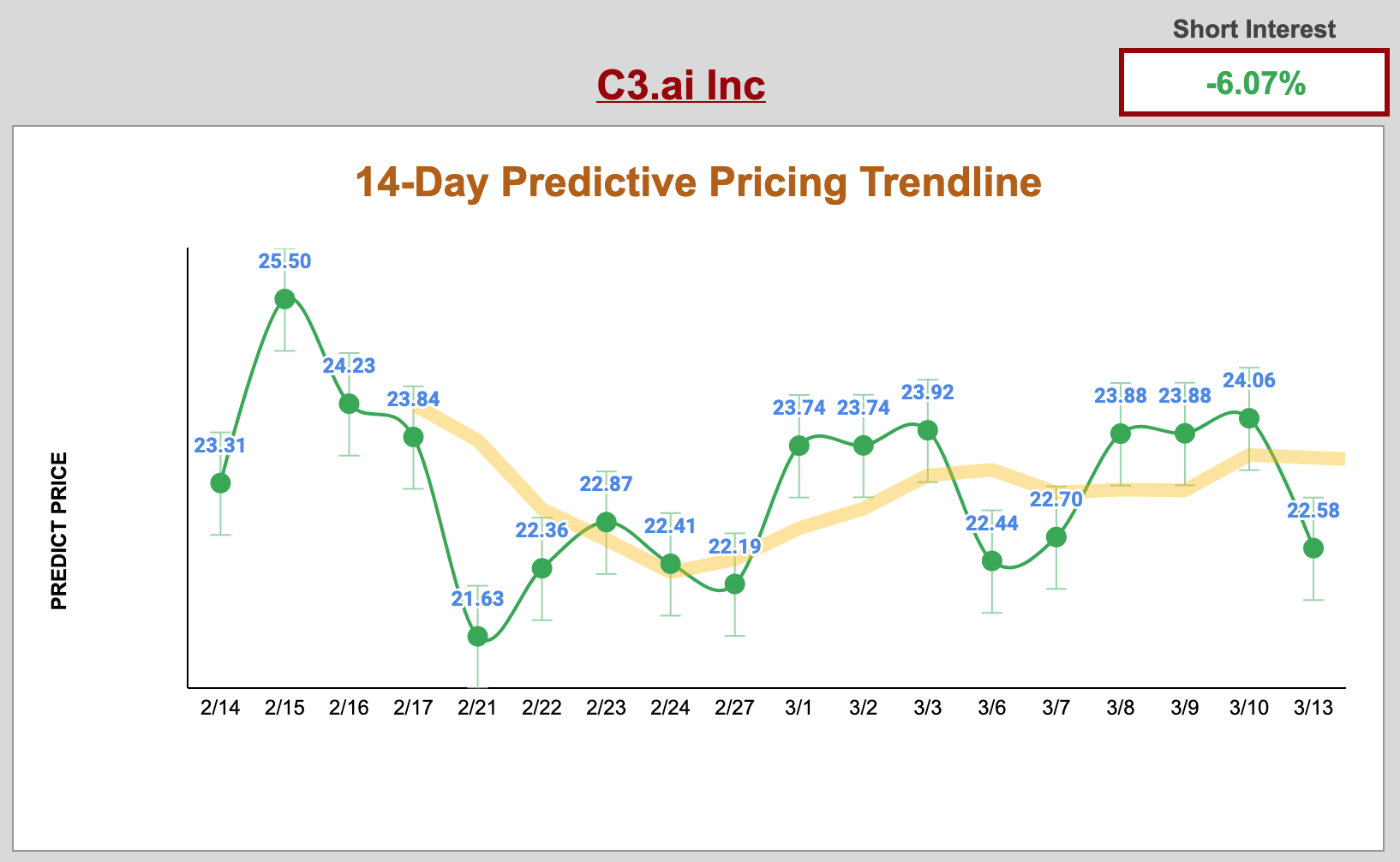

14-Day Predictive Price TrendLine :

C3.ai has been in the news lately due to its fluctuating share prices. As of the last two weeks, the company's stock prices have seen ups and downs. It is a well-known fact that share prices are driven by market forces, and there are a lot of factors that can influence them. The question remains: what factors are influencing C3.ai's share prices, and what can we expect in the future?

The predictive pricing data for the next 14 days tells an interesting story. Looking at the data, we can see that the company's share prices have been on a downward trend since February 16, when they peaked at $25.50. Since then, the prices have steadily decreased, reaching a low of $21.63 on February 21. The stock prices then rebounded slightly, reaching $22.87 on February 23, but have since stabilized at around $22.19.

Looking at the predictive pricing data for the next 14 days, it appears that C3.ai's share prices are likely to remain stable in the short term. On March 1, the predicted price is $23.739, which is slightly higher than the current price. The price is expected to remain steady on March 2 at $23.742. However, the data shows a small increase on March 3, with the predicted price at $23.918.

The data then shows a decline in price, with a predicted price of $22.441 on March 6. This is a sharp drop from the previous days, and it could be due to market forces or other factors influencing the price. The predicted price rebounds slightly on March 7, with a price of $22.704. The price then increases over the next few days, reaching a predicted price of $24.058 on March 10.

The predictive pricing data for the next 14 days gives us some insight into what we can expect from C3.ai's share prices. While the data shows that the stock prices are likely to remain stable in the short term, there may be some fluctuations in the coming days. Investors should keep an eye on the company's financial performance and other market forces to get a better understanding of the factors that are driving the share prices.

In conclusion, C3.ai is a company that is experiencing a lot of fluctuations in its share prices. The predictive pricing data for the next 14 days shows that the stock prices are likely to remain stable in the short term. However, investors should exercise caution and do their due diligence before making any investment decisions. As always, it is important to consider all the relevant factors and make informed decisions based on sound investment principles.

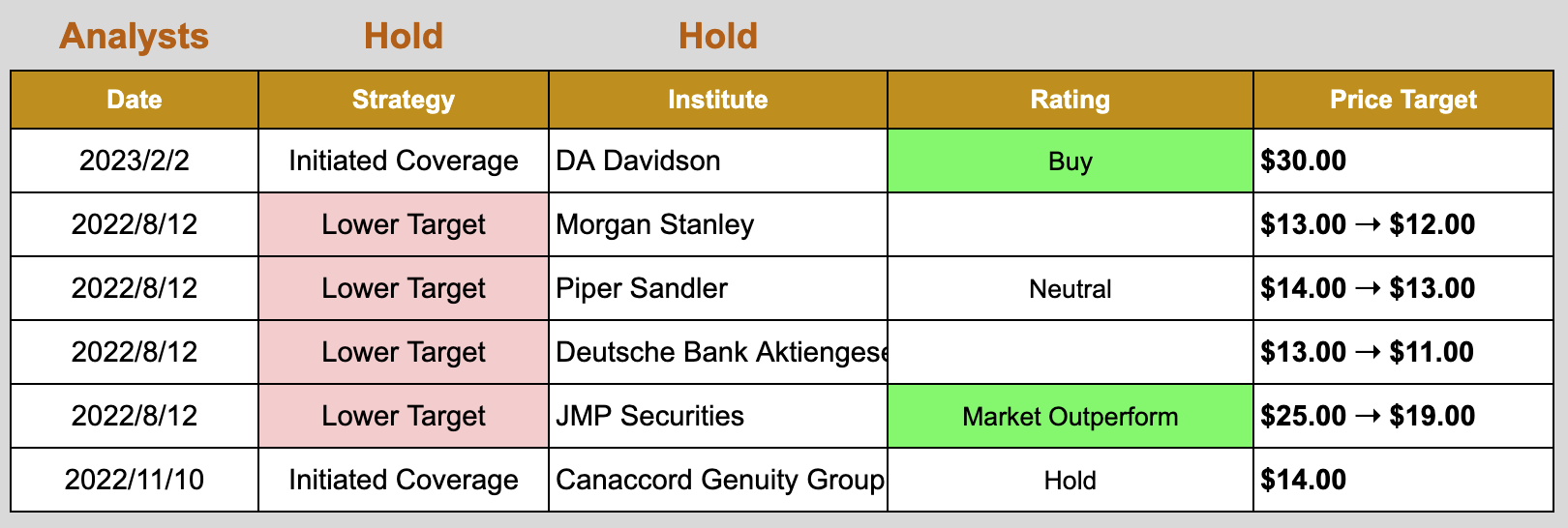

Analysts Rating Analysis :

Based on the analysts' ratings, there seems to be mixed opinions on C3.ai. DA Davidson initiated coverage with a buy rating and a price target of $30, indicating a positive outlook on the company. However, several other institutions have lowered their price targets, including Morgan Stanley, Piper Sandler, Deutsche Bank Aktiengesellschaft, and JMP Securities. Canaccord Genuity Group initiated coverage with a hold rating and a price target of $14, suggesting a neutral stance on the stock.

Summary :

Based on the predictive pricing data for the next 14 days, it appears that C3.ai's stock price will experience some volatility and potentially decline over the next week before increasing slightly towards the end of the 14-day period. Investors should consider this potential short-term volatility when making decisions about buying or selling C3.ai stock.

Regarding the analysts' ratings and price targets, there is a mix of opinions on C3.ai's stock. While some analysts have initiated coverage with a Buy rating and a $30 price target, others have lowered their price targets and shifted their strategies to Hold or Neutral. This divergence of opinions suggests some uncertainty about the future of C3.ai's stock price.

Therefore, investors should carefully consider their investment goals and risk tolerance before making any decisions about investing in C3.ai. It may be advisable to wait for further news or developments related to the company's operations or financials before making any investment decisions. Additionally, investors should conduct their own due diligence and seek advice from financial professionals before investing in C3.ai or any other stock.

Disclaimer

IDI.Capital is a research project and this website provides information for educational purposes only. It does not provide financial advice or recommendations for any investment. You must acknowledge that all your investment decisions are totally at your own risk.