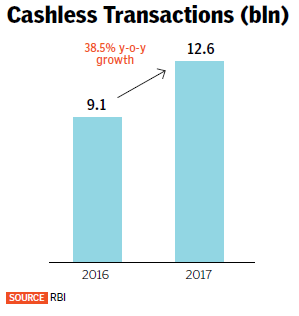

Digital Payments has seen a significant uptick amongst Indian consumers, and in fact, from 2016 to 2017, non- cash transactions jumped by 38.5%[1]. This was primarily led by the adoption of digital wallets and the success of e-commerce. Of course, one cannot forget about the biggest demons of that year, Demonitisation. What all this did was spur Indian consumers into moving out of the comforts of cash, and discovering the benefits of digital payment instruments. This would lead to the insurgence of fin-tech companies in the coming year, driving innovation in the payments space.

But not many tried to address very core questions like, that of good credit behaviour or even shed some light on what constitutes a good credit behaviour. And that is the opportunity that serial entrepreneur, Kunal Shah looks to play in. Shah believes that you need to reward and recognise good behaviour first for more and more people to adopt it! And that is exactly what he has done in the credit space with his startup, CRED.

What is Cred?

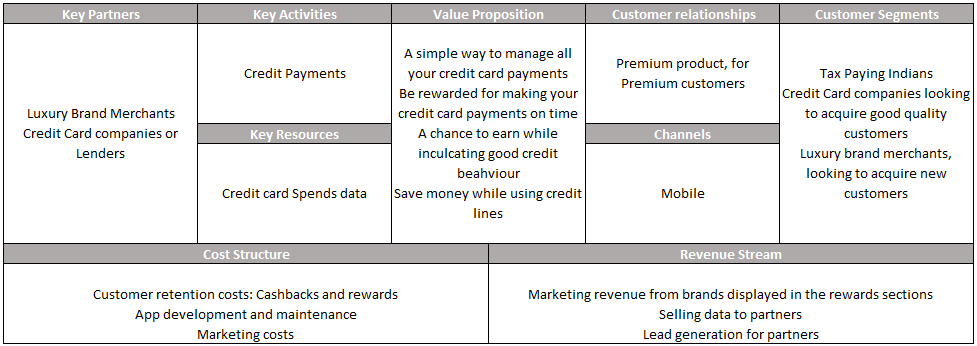

Now, if you’re a millennial with multiple credit cards, keeping track of them all at once becomes a challenge. Regularly updating that excel tracker can sometimes be a pain. So CRED offers a solution of linking all your different credit cards in one app, and constantly sends you reminders before the due dates, so you never have to miss a payment. But then, anyone could’ve done this. Right?

What makes CRED so exclusive?

Well, not anyone can join CRED. You need to have a sufficiently decent credit score issued by either CRISIL or Experian! And of course, if you are such a great customer, you deserve to be appreciated. So CRED gives you “coins” equivalent to your credit score, to be used on their reward store. Now that is a great acquisition strategy. But, we all know how much fin-tech companies bleed when it comes to customer retention. And while CRED too spends a lot on their retention strategy, they do so in a way that is aligned with their overall goal of improving creditworthiness. How do they do that? Simple!, Every time you pay your credit card bill before the due date, you get an equivalent amount of Coins as your bill amount. These coins can be redeemed to get direct cashback on your bill payments. Then there are those numerous freebies you can buy with your coins as well. I mean, a new generation of Cult customers came in after they redeemed a 7 days days’ free workshop on CRED.

But the exclusivity factor at CRED goes far beyond the offers and cashback they provide. They use the concept of “KIMO” as Set Godin puts it. Knowing I Missed Out! So, if you fail to meet their credit score cut off, CRED does not outright reject you. It tells you that the doors will be opened for you if you can come back with a better score. It’s a different thing if it was just FOMO. By telling prospective customers why they weren’t allowed in, and what they should’ve done if they wanted in, they play on the ego of consumers. And it has been working so far. As in an interview with ET Prime, Shah mentioned that over 30% of their rejected customers come back in the next 6-12 months with the requisite credit score.

The Business Model

Now let’s take a look at some of the business numbers of CRED. In their first year of operations Nov’18 – Mar’19, CRED had a negative cashflow of around INR 118 Cr, and an operating loss of around INR 60 Cr. Most of their costs were in customer acquisition and retention cashbacks. Their cash outflow for FY 20 stood at INR 164 Cr. However, they also witnessed a INR 3 cr interest on deposits, signifying a large cash reserve which can fund their growth prospects. That is not all. Shah has been one of the few founders who has been able to raise capital during Covid-19 pandemic as well. They have raised around US$ 180 million as of April’20.

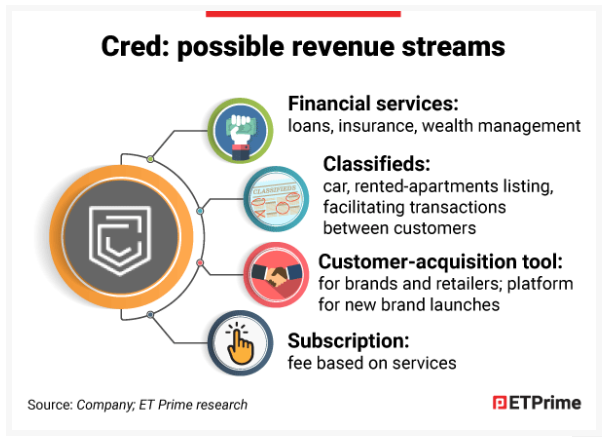

But, with so much of money flowing in, does CRED have a credible revenue source it can tap into? One of the means of revenue is through the promotion of allied brands. Brands Like Cult paid a hefty sum to be featured on top of CRED’s reward page, thereby driving a lot of traffic to their workshops. In fact, the success of these brands drew many more luxury brands to CRED’s platform.

Another model that CRED is working on is extending the credit line for monthly payments such as rent. So far, rental payments have never been done on credit. But with CredCRED’s Ren-to-pay, you can pay your landlord your monthly rent on credit for a flat fee to CredCRED. However, there has been no mention of the amount of fee income the company has received with this new feature.

CRED is also experimenting with extending credit lines to its customers for personal use. For the pilot, CRED tied up with IDFC first. The entire journey, from acquisition to disbursal was entirely paperless, a 100% digital, very quick and required no collateral. CRED and IDFC First did the underwriting based on the past payment and credit limit utilization patterns. Loans were capped at INR 5 Lakh rupees. The biggest selling point was that these loans were much cheaper compared to your typical credit card interest rates.

Another revenue stream CRED is exploring is to act as a sourcing channel for credit card companies and lenders. And because the customers on CRED are a bit on the premium side, with good credit behaviour they can charge up to almost 3 times the acquisition fees from your typical competitors like Paisabazaar or BankBazaar. Another reason for the premium is that the leads passed on from PaisaBazaar or BankBazaar are that of a credit hungry customer. Whereas the base on CRED, are customers who can take on extra credit but aren’t desperate for a loan! Which makes a world of a quality difference in the credit space.

CRED has also launched another fee based product which is aimed at managing your expenses. The platform analysis your credit card spends, and highlights sections you could’ve saved had you used an alternative credit card, or an alternative funding option. The caveat here is that users have to depart with sensitive personal information, as to do this, CRED scrubs your mailbox and reads your mails!

And finally, CRED has a huge role to play in the payments Hub economy [2], and they know it. In recent times, CRED has come up with a series of reports on consumer spends pattern, gleaned from the data they scrub off their consenting customers. A recent report by CRED sounded cheer to economy, as their analysis showed that people at the top of the pyramid, those in tier 1 cities, have gone back to their pre-Covid spend levels. This trajectory is led by e-commerce. The only drawback of this report is that, it fails to account for the new customers who have started transacting digitally due to the fear of contracting the virus. Nor does it account for the fact that the uptick could be because of people transacting more online than in cash, due to the above reason.

So, it won’t be farfetched to claim that in the future, instead of credit bureaus lenders may be willing to pay CRED to get insights and data into the behaviour of the credit worthy customers, and where they stand in comparison to their competitors!

Sources:

1) The cashless revolution, Forbes India, 11th Oct 2019

2) The Hub Economy, HBR Apr’2017