Over the past 3 months, peoples lives have been turned upside down in more ways than one. Not to dive into extensive detail but it has covered all aspects of our lives such as health, social interactions, personal financial hardship and more recently society's disintegration and collapse of social order in some parts of the world. All while the above was occurring, governments around the globe were re-writing history as they released more money into global supply than was ever recorder before.

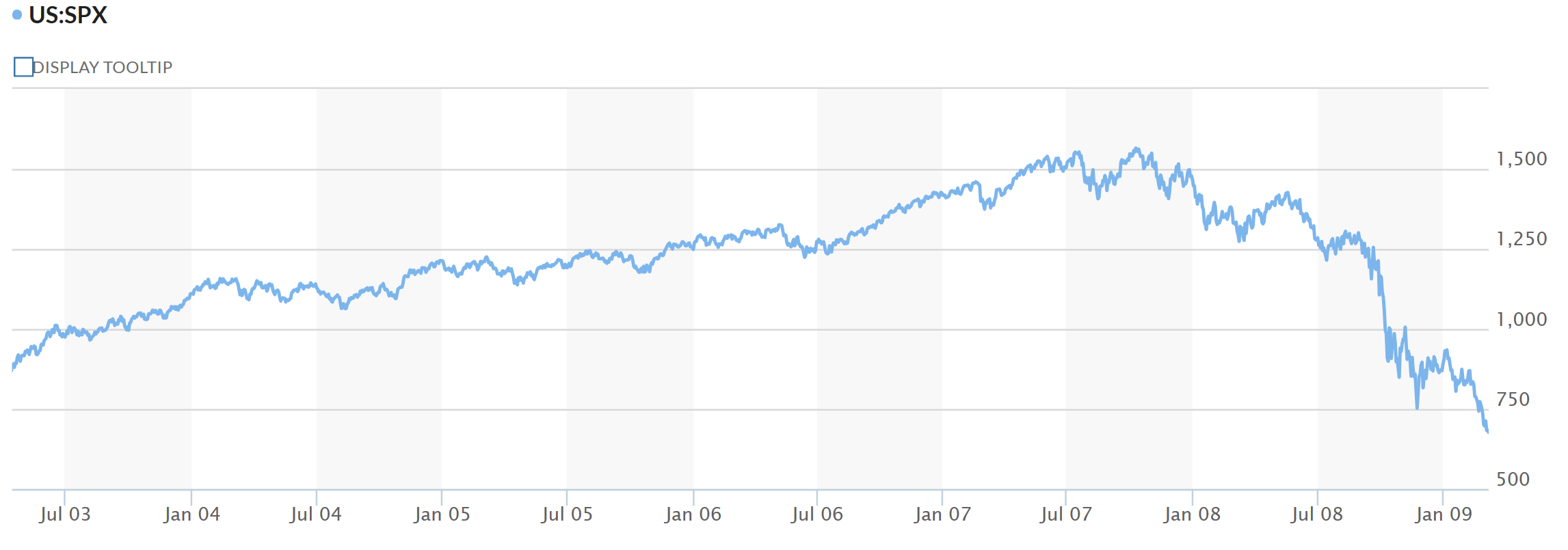

Money supply is the total value of money available in an economy at a point of time. There are several ways to define "money", but standard measures usually include currency in circulation and demand deposits. Over the past 12 years, money supply has rapidly expanded and evolved as central banks remained committed to restoring investor confidence in financial markets after the market crash in 2008, commonly referred to as the "Global Financial Crisis" or "GFC". In mid 2008, the US Federal Reserve was faced with the a rapidly evolving downward trajectory in financial markets, had tried and tested monetary & fiscal policy that wouldn't be as rapid to restore investor confidence and was facing a collapse of its financial institution's which underpinned its economy.

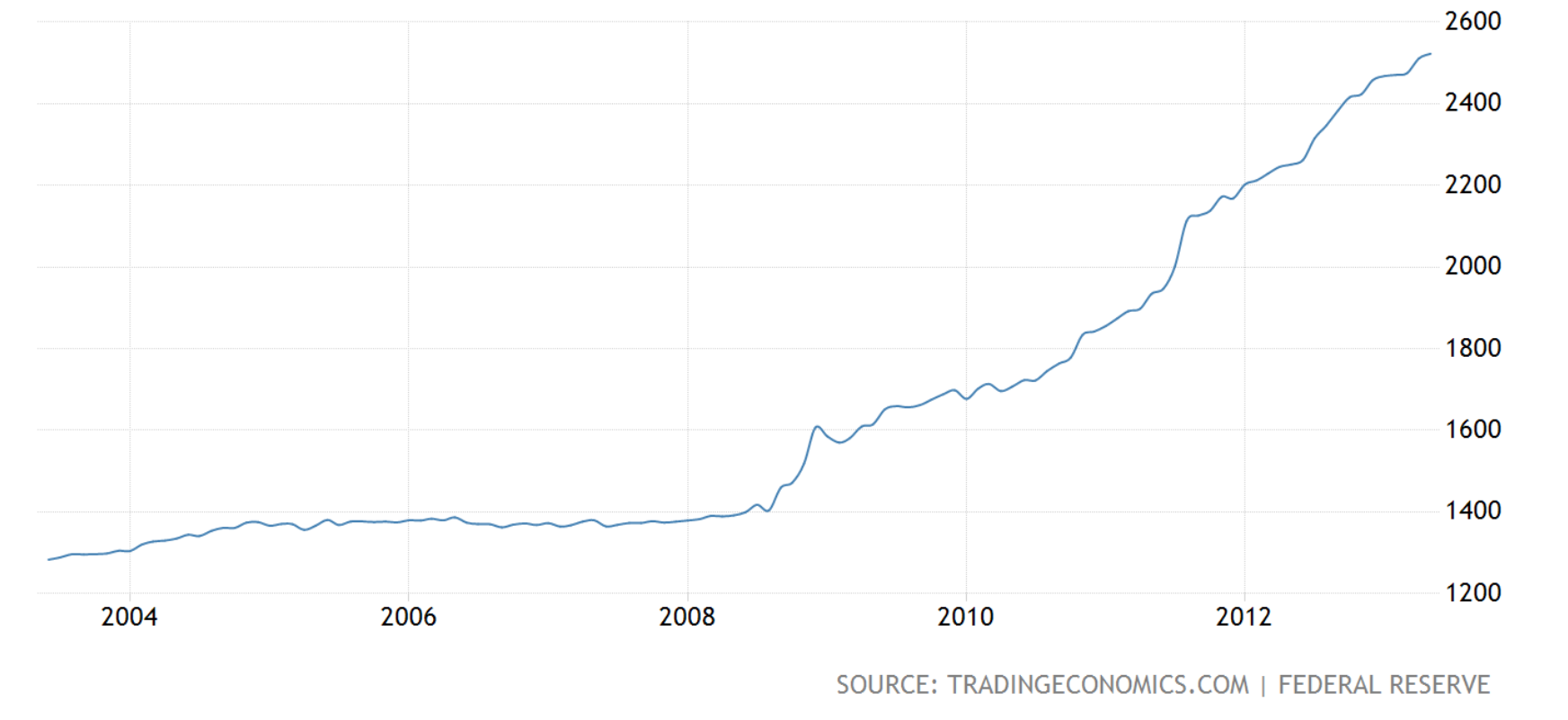

Their answer was "quantitative easing". A term conceived for the action of central banks purchasing long term securities, in order to grow money supply and ensure that this increase in free flowing funds are able to provide liquidity to markets. This can be seen below in the US's money supply measured as M1 (M1 includes demand deposits and checking accounts, which are the most commonly used exchange mediums through the use of debit cards and ATMs).

Their answer was "quantitative easing". A term conceived for the action of central banks purchasing long term securities, in order to grow money supply and ensure that this increase in free flowing funds are able to provide liquidity to markets. This can be seen below in the US's money supply measured as M1 (M1 includes demand deposits and checking accounts, which are the most commonly used exchange mediums through the use of debit cards and ATMs).

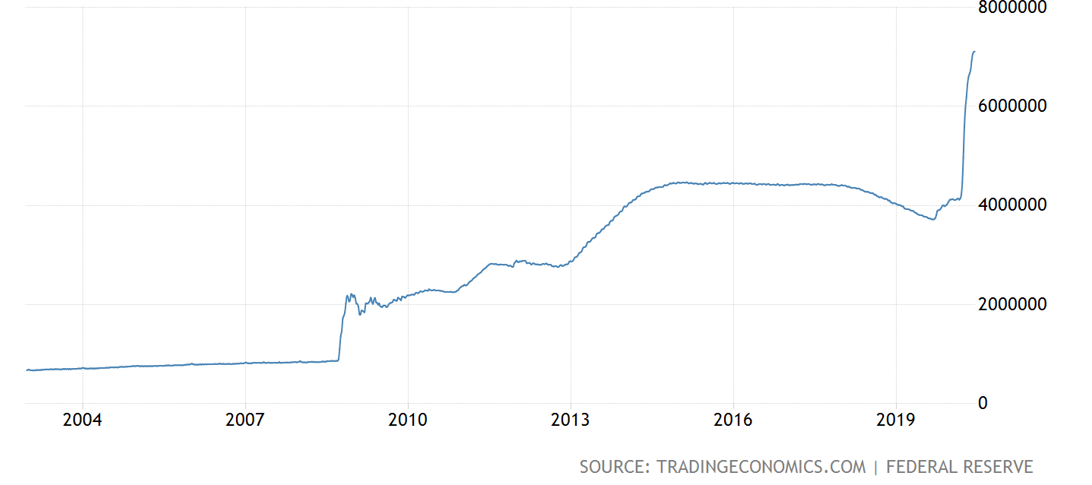

To quote a movie that defies political correctness, "freedom isn't free". This increase in money supply was funded by the US Federal Reserve and resulted in the federal reserve balance sheet doubling, as it increased from approx. US$1trillion to US$2 trillion. These funds were raised by the US Federal Reserve printing more money and using the funds to purchase the US government's long term bonds ("IOU's" issued by the government to investors with a propose to repay). The ability to print money and artificially reduce your interest rate, therefore you interest costs and debt repayments, was effective in helping the US financial market recover. Fast forward 10 years to 2018 after two more waves of quantitative easing and US$4 trillion dollars later, the US have financial markets setting new all time highs, with investors and businesses continuing to use debt to fund growth.

To quote a movie that defies political correctness, "freedom isn't free". This increase in money supply was funded by the US Federal Reserve and resulted in the federal reserve balance sheet doubling, as it increased from approx. US$1trillion to US$2 trillion. These funds were raised by the US Federal Reserve printing more money and using the funds to purchase the US government's long term bonds ("IOU's" issued by the government to investors with a propose to repay). The ability to print money and artificially reduce your interest rate, therefore you interest costs and debt repayments, was effective in helping the US financial market recover. Fast forward 10 years to 2018 after two more waves of quantitative easing and US$4 trillion dollars later, the US have financial markets setting new all time highs, with investors and businesses continuing to use debt to fund growth.

This debt funded market rally delivered on the objective to improve market conditions and restore consumer/business confidence. Where it missed a beat is the increase in social equality and the ever increasing consumer reliance on debt to fund asset purchases has set people up to rely on debt and .

This debt funded market rally delivered on the objective to improve market conditions and restore consumer/business confidence. Where it missed a beat is the increase in social equality and the ever increasing consumer reliance on debt to fund asset purchases has set people up to rely on debt and .

The change in market conditions over March and April this year have forced the hand of the Federal Reserve to restore confident and liquidity as a much more rapid pace than in 2008. It resulted in the FED having to increase its balance sheet by almost doubling it to US$7 trillion within a 2 week period.

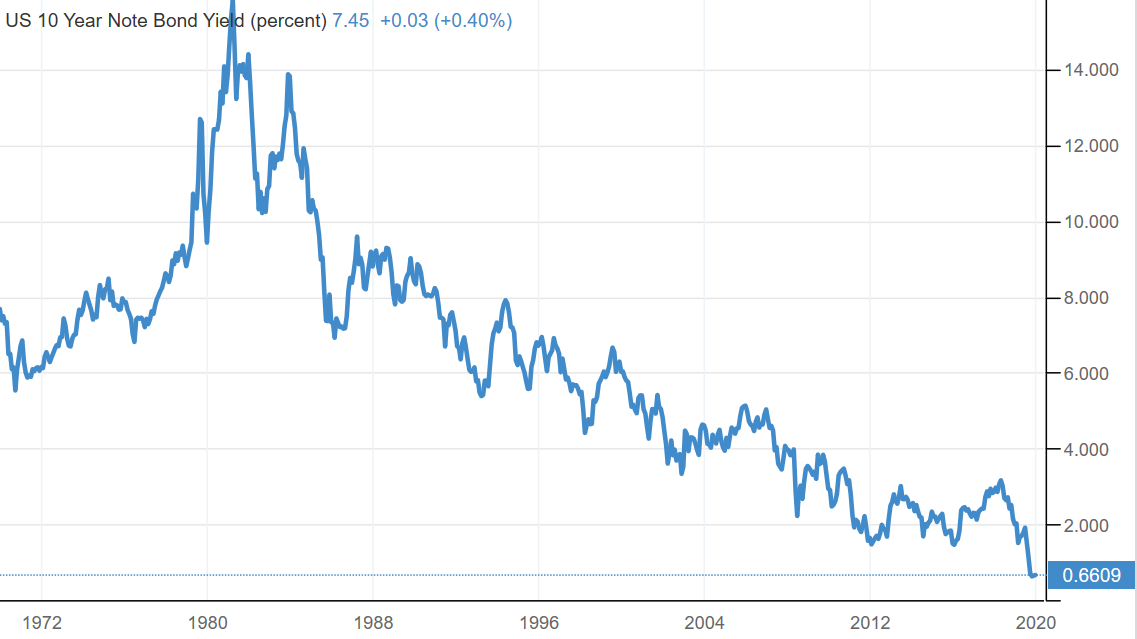

The effective DOUBLING OF THE US GOVERNMENTS BALANCE SHEET within a 2 week period sent shockwaves through financial markets and indeed into the hearts and minds of many. The FED used their tried and tested recipe for success by buying back US bonds. As an example the US 10 year bond yield was halved within a week and now yields 0.66% interest per annum.

The effective DOUBLING OF THE US GOVERNMENTS BALANCE SHEET within a 2 week period sent shockwaves through financial markets and indeed into the hearts and minds of many. The FED used their tried and tested recipe for success by buying back US bonds. As an example the US 10 year bond yield was halved within a week and now yields 0.66% interest per annum.

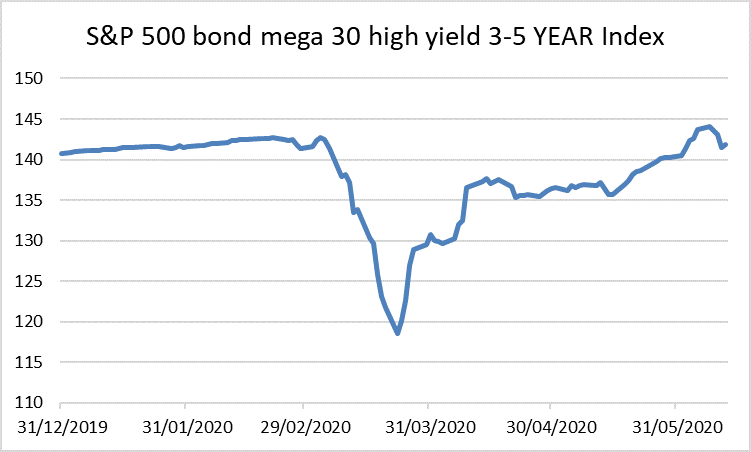

The sheer quantum of the money supply supersizing then provided new challenges...…..They needed to finds other ways to get the money into the system. This resulted in funds flowing into higher risk assets such as equities and high yield bond markets, through the FED purchasing Exchange Traded Fund securities. For individuals who aren't aware, high yield bonds are the debts of companies where they may low credit worthiness and therefore high risk. Investors buying these bonds are rewarded for the higher risk with higher interest rates. As a result of the FED's high yield buying, these bonds were repriced at normal interest rates while many of the underlying companies announced financial hardship and some be placing into administration or becoming bankrupt. These high yield bonds that are not credit worthy (effectively junk bonds) are currently paying a yield until maturity of 4.25%, which is approximately the ASX 200 index dividend yield as at March 2020.

The sheer quantum of the money supply supersizing then provided new challenges...…..They needed to finds other ways to get the money into the system. This resulted in funds flowing into higher risk assets such as equities and high yield bond markets, through the FED purchasing Exchange Traded Fund securities. For individuals who aren't aware, high yield bonds are the debts of companies where they may low credit worthiness and therefore high risk. Investors buying these bonds are rewarded for the higher risk with higher interest rates. As a result of the FED's high yield buying, these bonds were repriced at normal interest rates while many of the underlying companies announced financial hardship and some be placing into administration or becoming bankrupt. These high yield bonds that are not credit worthy (effectively junk bonds) are currently paying a yield until maturity of 4.25%, which is approximately the ASX 200 index dividend yield as at March 2020. Now the US isn't alone in its quantitative easing measures. Its important to note that the majority of the developed world are undertaking quantitative easing in one way or another with a global estimate of US$8 trillion in COVID19 stimulus packages announced. As an example, the Reserve Bank of Australia have commenced the bond buying program for Australian bonds, implemented employment programs (JobKeeper and JobSeeker) and unveiled incentives for the construction industry (Home Builder).

Now the US isn't alone in its quantitative easing measures. Its important to note that the majority of the developed world are undertaking quantitative easing in one way or another with a global estimate of US$8 trillion in COVID19 stimulus packages announced. As an example, the Reserve Bank of Australia have commenced the bond buying program for Australian bonds, implemented employment programs (JobKeeper and JobSeeker) and unveiled incentives for the construction industry (Home Builder).

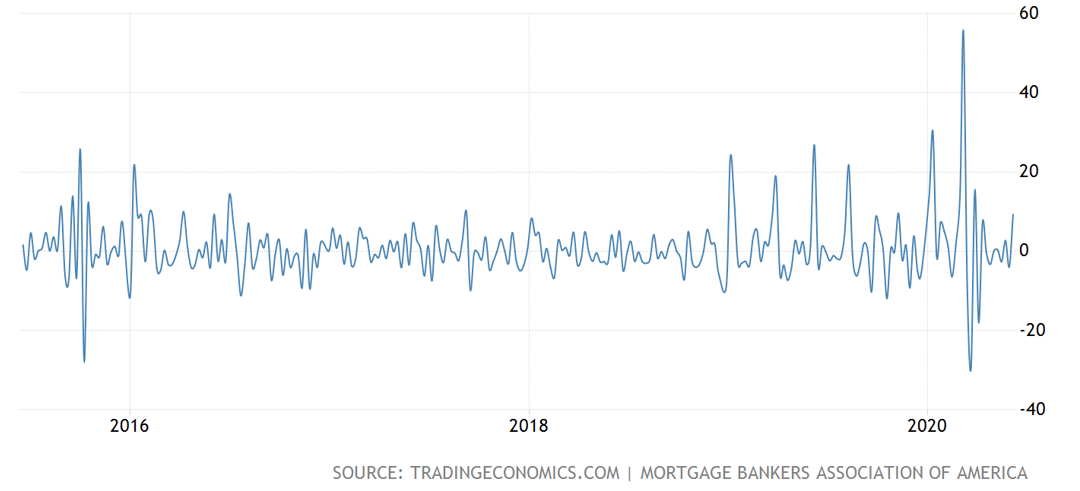

This mispricing of risk is only further fuelling the medium term debt cycle. The "new norm" in interest rates has pushed investors into growth assets in their search for returns. Evidence of this is US mortgage applications reaching 5 year highs and in Australia, the big 4 banks within the space of a week had an average increase of 25% in their share prices. This is all in the face of property vacancies rising, mortgage delinquencies rising and the Australian banks cutting or deferring their dividends.

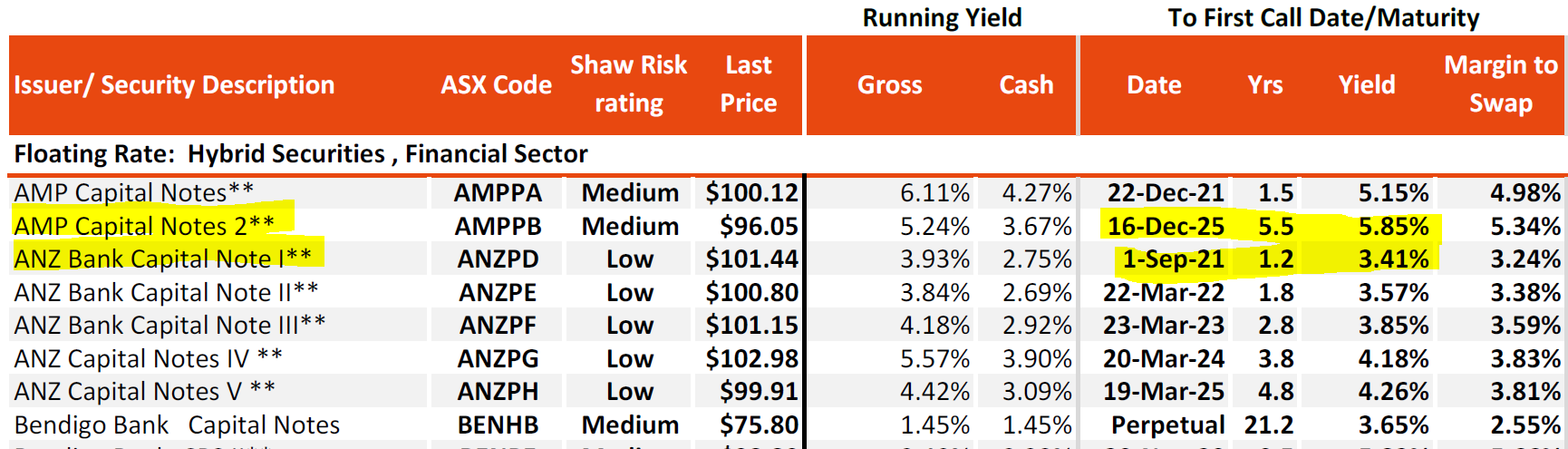

So where do you invest when "funny money" economics are at play. the answer depends on everyone's unique circumstances but if funds need to be invested anywhere, you are limited to stocks, property and alternative assets if you want to get a return above 2%. Bonds are currently yielding 0%-2%, cash is at 1%-2% for term deposits and even convertible notes/hybrids/preference shares are only bringing in 3.5 to 5.8% yield depending on the security, noting that the higher quality and shorter dated hybrids are the lowest yielding.

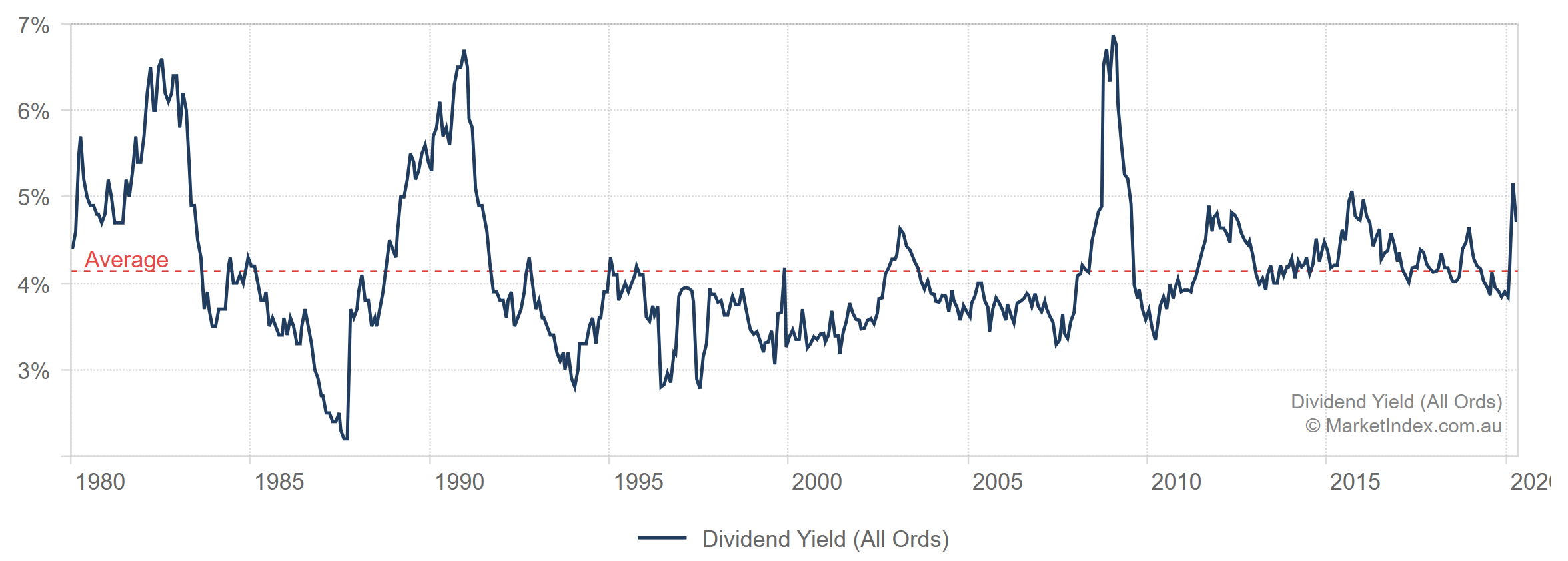

So now the race is on for yield and the answer is shares. The ASX200 dividend yield has historically averaged approx. 4% (currently at 4.71% exc franking credits), which is unique to Australia as other share markets like the US average 2.5% dividend yield.

The capital growth appeal of shares is equally let with the capital preservation fear in the current conditions which leaves many investors turning their focus and investment strategies around dividends and being less focused on share price rise and falls. In these volatile times, the personal energy one places on price volatility is better served on great company's which will reward you in the near turn with cashflows in the form of dividends and that have long term value where you are comfortable to hold the shares for the next +5 years.

The capital growth appeal of shares is equally let with the capital preservation fear in the current conditions which leaves many investors turning their focus and investment strategies around dividends and being less focused on share price rise and falls. In these volatile times, the personal energy one places on price volatility is better served on great company's which will reward you in the near turn with cashflows in the form of dividends and that have long term value where you are comfortable to hold the shares for the next +5 years.

Nick

Fully Funded Lifestyle

Instagram @fullyfundedlifestyle

Disclaimer: The information on this post is for general information purposes only. It is not intended as legal, financial or investment advice and should not be construed or relied on as such. Before making any commitment of a legal or financial nature you should seek advice from a qualified and registered legal practitioner or financial or investment adviser. I am not sponsored by any companies and all information provided is purely from my opinion at the time of posting.