November has traditionally been the most bullish month for crypto.

Contents:

🥺 Is “Moonvember” coming this year?

👀 Under the Radar

📰 ICYM

👊 Sponsors

💸 Coupons

🥺 Where is “Moonvember”?

Historically, the month of November has been the most bullish out of all months for crypto valuations.

In November of 2013, the price of Bitcoin jumped from $206.23 to $1,043.33, increasing a staggering 406%. In 2017, it increased 62%, and last year BTC went from $13,550 to $19,201 giving us 42% gains during “moonvember.”

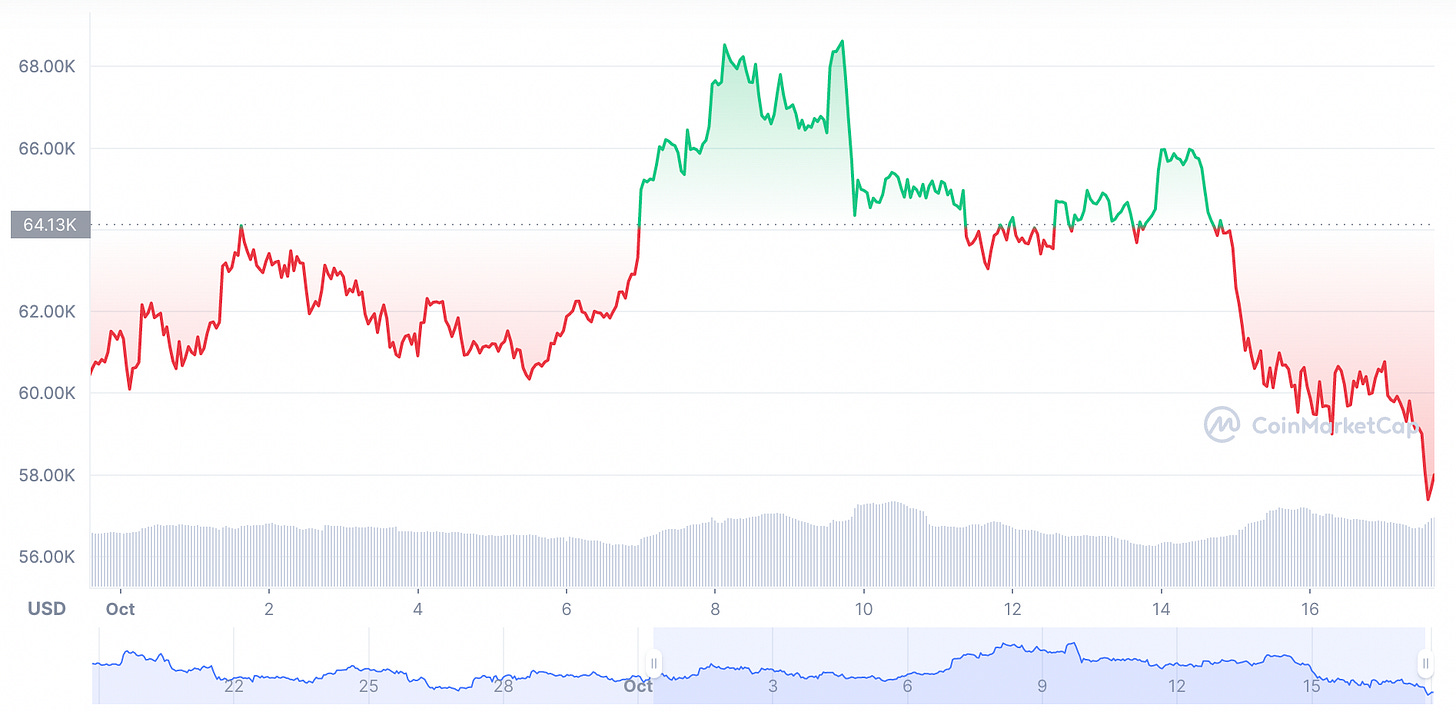

This year’s November has reminded us how volatile cryptos are. Bitcoin and Ethereum hit an all-time-high on November 7th, just to slide back down and lose more that 18% during the following 10 days. Most cryptocurrencies have fallen between 10% to 20% during the second week of November. Bitcoin alone has lost more than $10k recently, and its trading barely above $57k at the time or writing.

BTC to USD Chart - November 2021

BTC to USD Chart - November 2021

November is far from over, the crypto community is bigger than ever, mentally more bullish than ever, more capital is at play, and more applications are being deployed on a daily basis using blockchain and cryptocurrencies and institutions are here to stay and reap the rewards. Valuations will soon increase and more ATH will be witnessed, the questions are when and how.

To Consider for Crypto valuations:

TAPROOT: This enhancement, is the most significant change to the bitcoin protocol since the SegWit (Segregated Witness) block capacity change in August 2017. SegWit effectively increased the amount of transactions that could fit into a block by pulling data on signatures from bitcoin transactions. Three months later, as we shared above, BTC went up 62% during that “moonvember.”

Taproot consists of three separate upgrade proposals. However, at its core, the upgrade will help bitcoin transactions become more efficient, more private, and will allow bitcoin users to execute more complex smart contracts and build apps on top of it. It enables BTC to compete with Ethereum and other blockchains.

Citycoins is a smart contract by Stacks which was built on BTC. We will see more smart contracts and apps like Stacks thanks to the taproot upgrade.

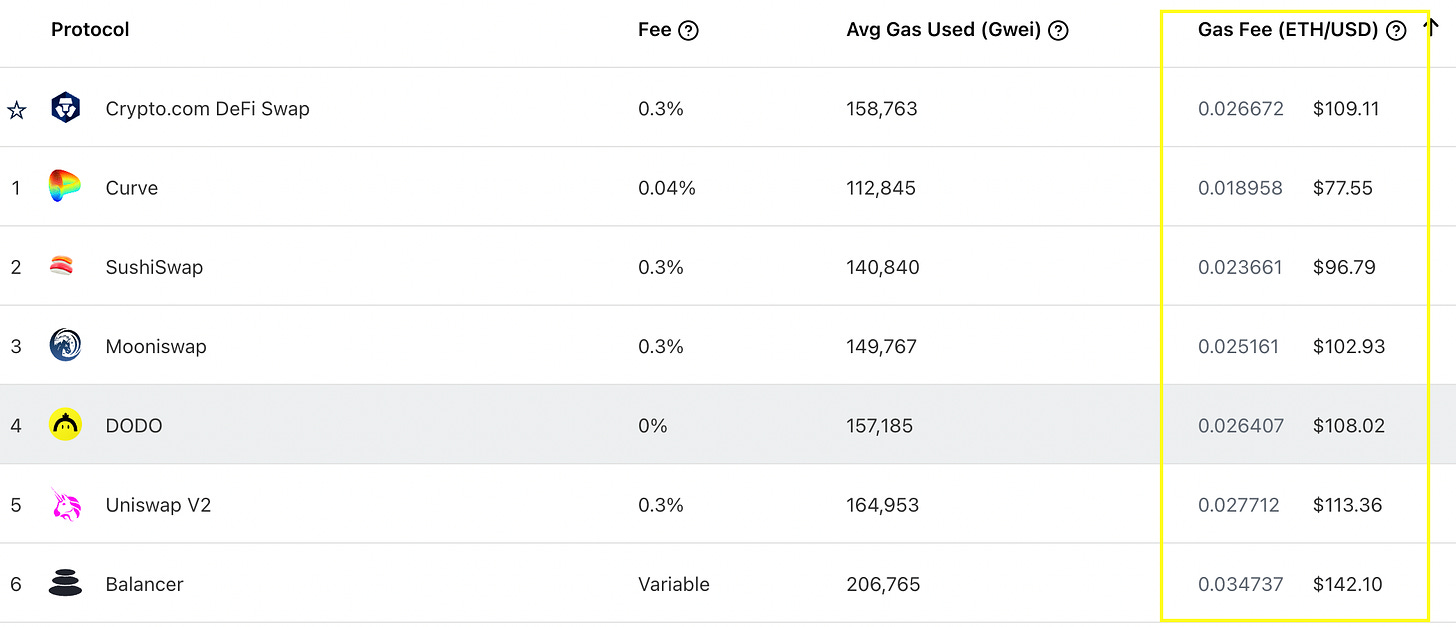

GAS FEES: Ethereum “Gas fees,” the transaction fees that users pay to miners on a blockchain protocol to have their transaction included in the block are outrageously expensive. I personally wanted to register my ENS with .eth but was nable since the fee alone was more than $300.00 for a $5 dollar transaction.

More Gasless and affordable blockchains that use technologies such as Sharding are coming into the market, democratizing the space for those not able or willing to pay ridiculous fees. We mint our NFTs using polygon and use apps like matcha for swapping and trading and save hundreds in the process. Ethereum layer-2 promises to solve this issues, but in the meantime many more attractive alternatives are becoming available.

REGULATION: President Biden signed The Infrastructure Bill this week. This bill has a clause which states that crypto brokers and traders who trade more than $10k will be subject to a higher tax bracket than previously stated. The term brokers and traders leads to a lot of questions since it is not clear who falls on this category.

As we know, China has been very strict with their crypto prohibition laws while other nations are adopting Bitcoin as legal tender and other are opening their borders to crypto entrepreneurs and companies. We must follow local and global regulation closely since it has always had an impact on prices.

MASS ADOPTION: According to GlassNode the number of active crypto addresses today is around 1 Million. Ten years ago there were barely 10k active addresses. Since July of this year, we have seen a 30% increase in the number of active crypto addresses. Companies like Coinbase and Gemini are making it easier than ever to open an account and participate in the crypto economy.

DeFi has exploded the last 2 years and now we have hundreds of platforms available for trading, staking, swapping, borrowing and lending as well as hundreds of pools at our disposal.

FTX exchange went Hollywood this year by hiring Tom Brady as a spoke person and buying air-time on most professional sports broadcasts including a Super Bowl Ad.

A few days ago, Crypto.com announced that they paid upwards of $700 million dollars for the naming rights of the former Staples Center and Coinbase has bought advertisement space on all NBA arenas.

This is just the beginning, we do believe that “MOONVEMBER” is COMING soon.

✓

👀 Under the Radar

Matcha: Decentralized exchange platform that finds the best prices across exchanges and combines them into one trade.

Division Network: A blockchain-based VR content ecosystem, which also powers the NFT marketplace. Presents a new virtual reality world, where humanity can lead an affluent life, at the very center of the ICT based fourth industrial revolution.

Netvrk: A social virtual world built on the blockchain, that allows users to make and monetize their creations.

Blocktopia: Bloktopia is a VR skyscraper made of 21 million floors, in honor of 21 million Bitcoin. It’s the VR metaverse that aims to become the edutainment hub for all levels of crypto experience. Built on Elrond.

Elrond: blockchain protocol that seeks to offer extremely fast transaction speeds by using sharding. The project includes fintech, decentralized finance and the Internet of Things. Its smart contracts execution platform is reportedly capable of 15,000 transactions per second, six-second latency and a $0.001 transaction cost.

📰 ICYM

Meta’s sci-fi haptic glove prototype lets you feel VR objects using air pockets

Google’s keyword search data shows interest in NFTs has surged to record highs

VanEck’s Bitcoin Strategy ETF is set to launch on the Chicago Board Options Exchange

The Robinhood hack has exposed millions of phone numbers and email addresses