Dear GrowWealth Supporters,

One of the keys to successful trading is understanding how you emotionally respond when you’re invested in the market.

Whenever you are risking your hard earned money, you can expect to experience a variety of different emotions that can cloud your judgement and lead to some poor trading decisions.

Let’s look at two very common trading scenarios where a lack of emotional control leads to potentially bad decision-making:

Fear: If a trade is losing, you could feel a lot of pressure to close the position immediately. Instead of risking further losses, you decide it would be best to cut the trade short and limit the damage that’s already been done.

Greed: Your trade is going very well. You’re making good money, but you really want to press your advantage. It seems like the market could keep running in your favor, so you double your existing position size.

I’ve had both of those situations happen to me more times than I can count.

But in both examples, it’s not the decisions themselves that are dangerous. The danger is that the decisions were made because your emotions took control.

The two most powerful emotions that drives human behaviour are Fear and greed. To overcome this powerful emotional force, and to protect your portfolio against yourself, it’s crucial to have a detailed trading plan in place before you pull the trigger – a pretty much pre-determined script that you can stick to as your trade develops.

Let us look at one of the trades where these emotions have influence & spoiled my trade.

Let us look at one of the trades where these emotions have influence & spoiled my trade.

$AMD has given a classical cup with handle breakout set up with an entry point also backed by positive earnings reaction. This is as close to a perfect entry one could aim for and the volume clue was there too. (see picture below)

I took this trade and as expected it quickly moved from around $95 to $122 in just six trading days. That's about 28% in 6 days. The greed wanted to hold on to it longer and not book any partial profits. In the subsequent two months it had almost lost all of the move and retraced to $99.51. It still was above the entry point ($95.7) and above the initial stop loss level at $89.

I felt a too guilty that I hadn't alerted my members to take at least a partial profit at around 25% profit level, and was worried that the price might breakdown further as the broader market, particularly for the growth stocks, were very weak at that time. So I exited the trade to 'protect' the capital.

Protecting the capital is good thing. You tend to stay in the game for longer so you can fight another day to win the next battle. But this was done based on emotional decision making. That isn't right.

When the market improved, I had invested that money elsewhere and didn't gain adequate confidence in this stock to re-enter it. And then, the stock did this:

$AMD gained an impressive 65% in the next 2 months.

I made an emotional decision out of fear and greed in this example. I didn't lose any money on this trade as I exited around breakeven price. However, when I realise that my entry signal was right, my initial stop loss position was right, the natural pullback to previous breakout level to be retested as support is natural , I feel that I had lost in this trade from the missed opportunity of potentially gaining 60+% profit. Although I didn't lose actual money from the portfolio, it is indeed a loss from the potential gain.

This goes to show how at the point of decision making, emotional decisions may make absolute logic and convincing argument, but it isn't right to allow the emotions to decide the trade management. Have a trading plan and stick to it.

A sample trading plan may look something like this:

Entry at breakout pivot point with a stop loss around 8-10% (based on price action or support zones)

Take Partial Profits around 20-25% mark and raise stop to breakeven.

Allow the trade to evolve as long as the chart/price action didn't breakdown (heavy selling on high volume and close below certain moving average eg., 50 or 200 MA or support zone)

You could also have a plan to trail your stop loss if there were further higher support zones to lock in the profits and let the trade work its way up.

There are numerous ways to draft a trade plan. It depends on individual trader's personality, their investment thesis, portfolio size, position sizing, and risk tolerance. No one can create a trade plan for another person. I can do that for you, because my trading psychology would be different to yours.

However,

EVERYONE MUST HAVE A TRADE PLAN &

STICK TO THE TRADING PLAN.

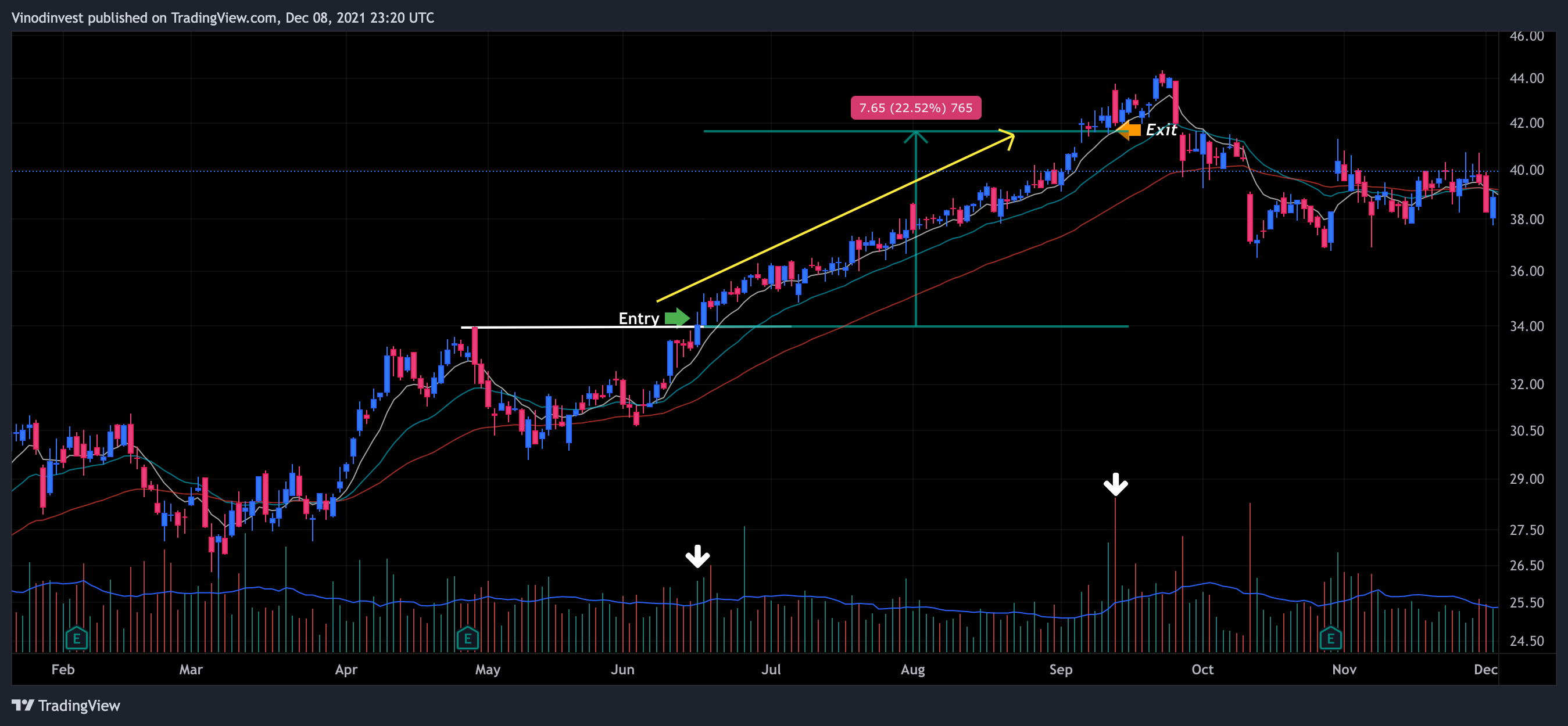

A fantastic example of how a trading plan need to be executed without any emotional interference can be seen in one of my other trades - $AVTR.

$AVTR had fulfilled the CANSLIM (IBD concept) criteria and I bought it at the exact entry pivot point, held the stock for long enough until it reached around 20-25% gain and when it showed some stalling action and had high volume selling days started to come in, I booked the profit and exited the trade with 22% gain as per my trading plan.

The stock had a small pop above that level for 4-5% but soon gave back over 12% of its price from my sale price. I did not get the exact top, but that is alright. It was never the intention to get the exact bottom for the entry price or exact top for the exit price. That would be impossible to achieve. I have had others trades that resulted in over 100% gains. But I am most proud of this 22% profitable trade because this is a perfectly executed trade with a clear trading plan.

We can't totally eliminate our emotions. Reaching a point of emotionless trading is a work in progress! But I use various strategies and specific trade plans, many of them are used in the VIP real money portfolio that members can access, to keep my emotional interference to a minimum.

Happy Learning & Successful Investing.

Disclaimer: This material is intended for educational purposes only, and is not recommendations to buy or sell any financial instruments or products. Do your own due diligence and make your own decision. The value of your investments can rise as well as fall. Capital is at risk when investing in any financial products. You could get back less than you invested. Past performance may not be indicative of future results.