Remember this is just a quick overview of my current settings I'm testing in the Paper trade v5 that are for members only as early access. They may not even be that good, so I won't be sharing them public until I've gathered more data, but for gold members, you can have early access to the data and tests.

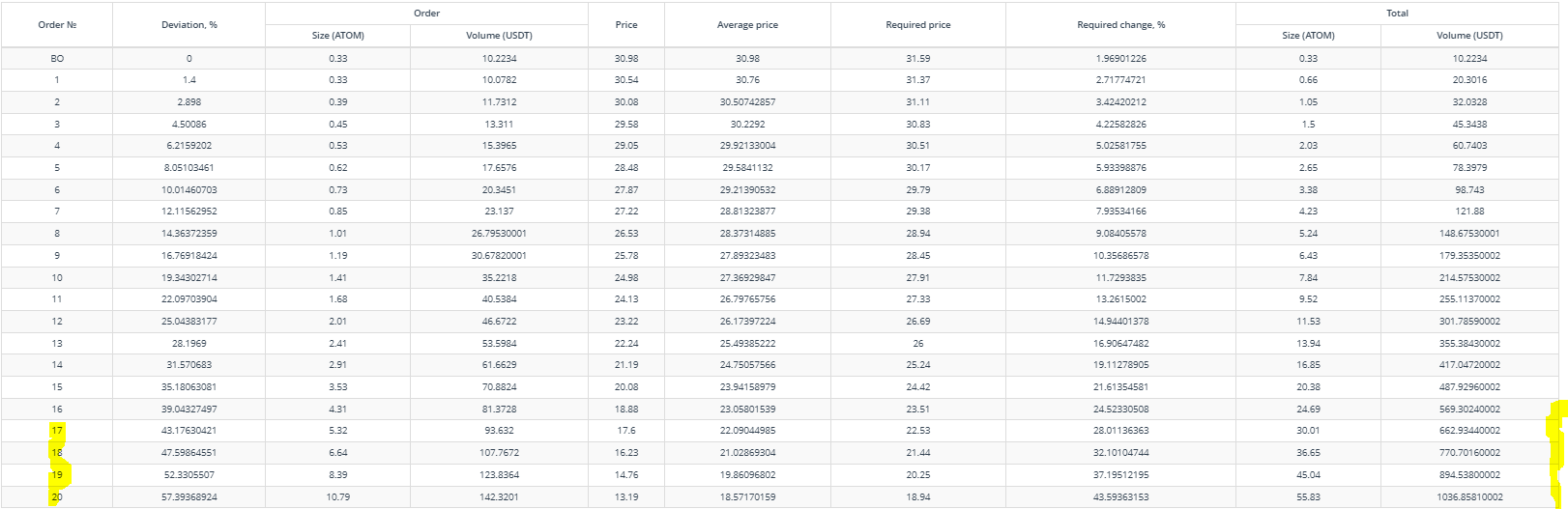

I will give you an overview of what I was trying to achieve for each tests. Remember its important to watch and understand the table view very well to see what I'm trying to achieve.

Also remember to see the forward testing for Members only.

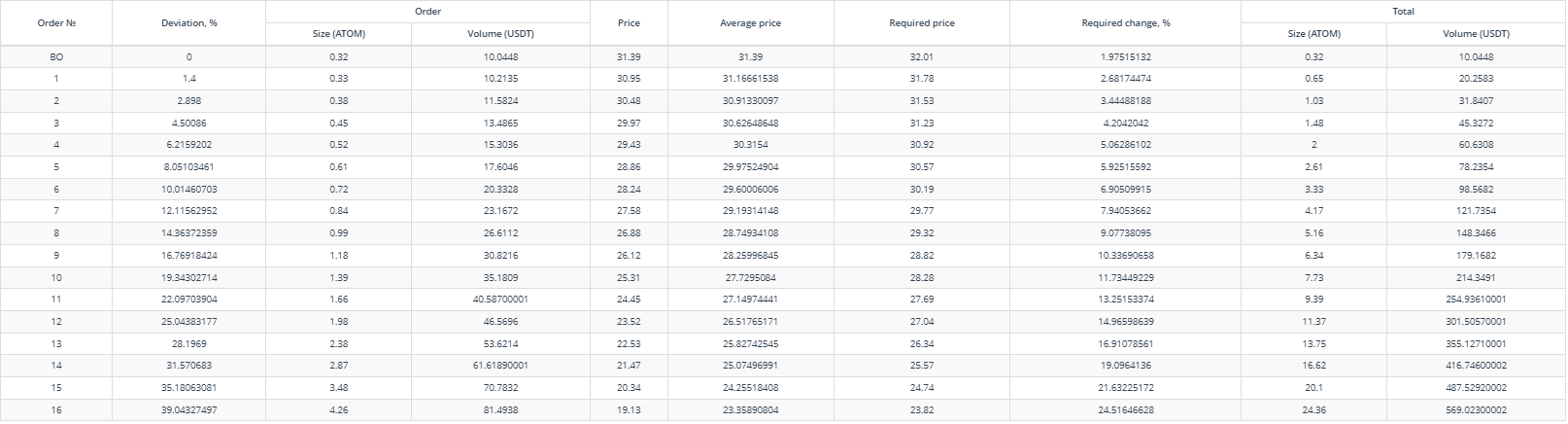

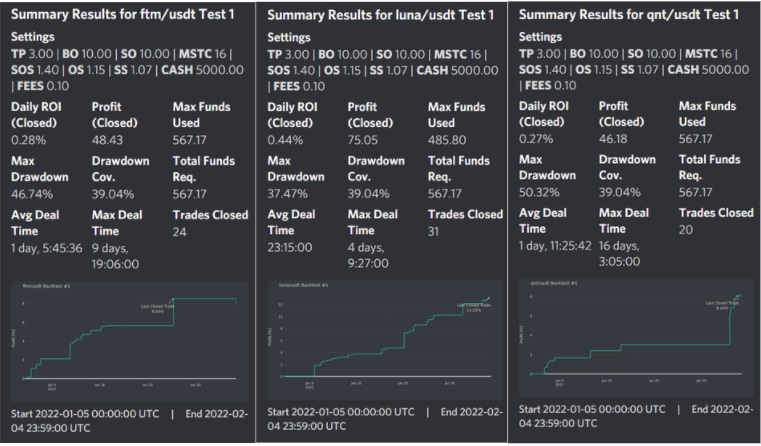

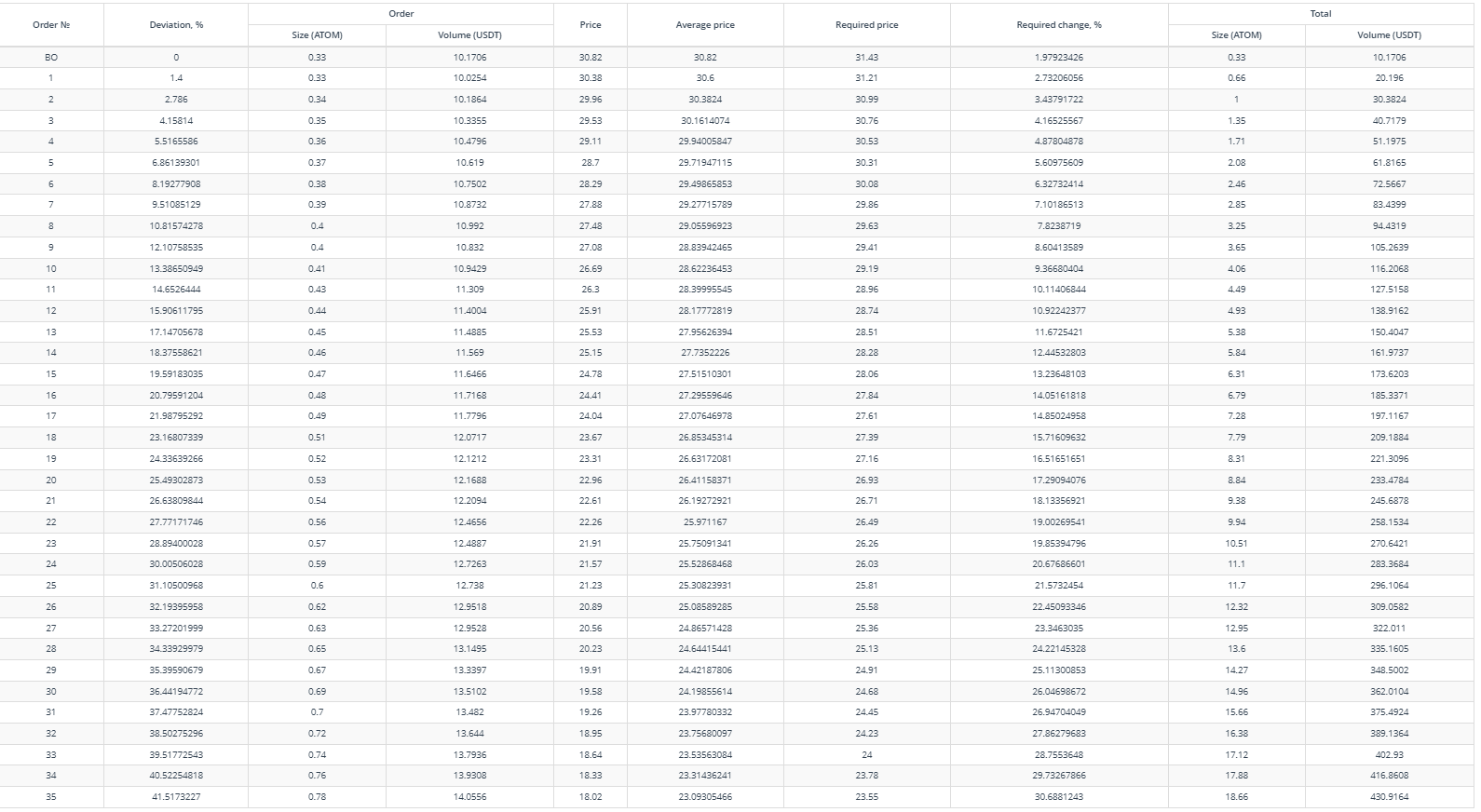

TP: 2.0%, BO: 10.0 USDT, SO: 10.0 USDT, OS: 1.15, SS: 1.07, SOS: 1.4, MSTC: 16

Attempt to squeeze a balanced setting into a 40% deviation drop which starts only spreading the gaps slightly later and costing $569 for a rather affordable bot. It may not work well in a bearish market, but its a bit more balanced and RC% isn't too bad for the costs.

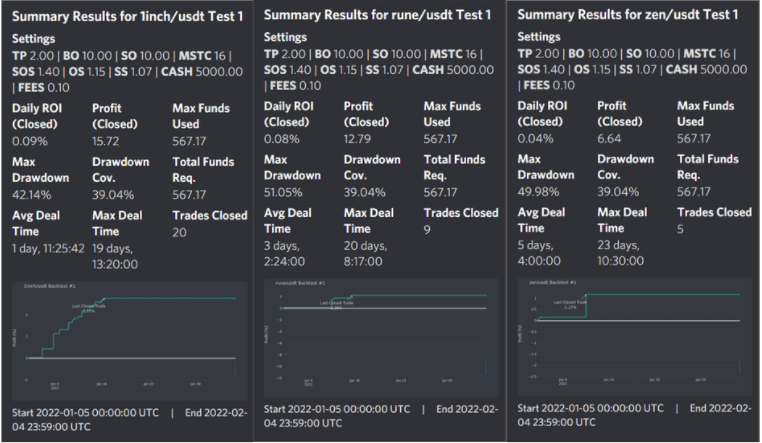

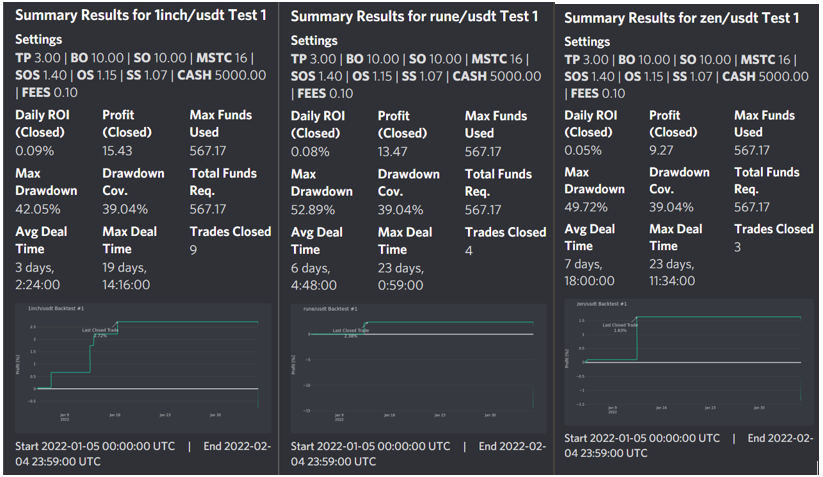

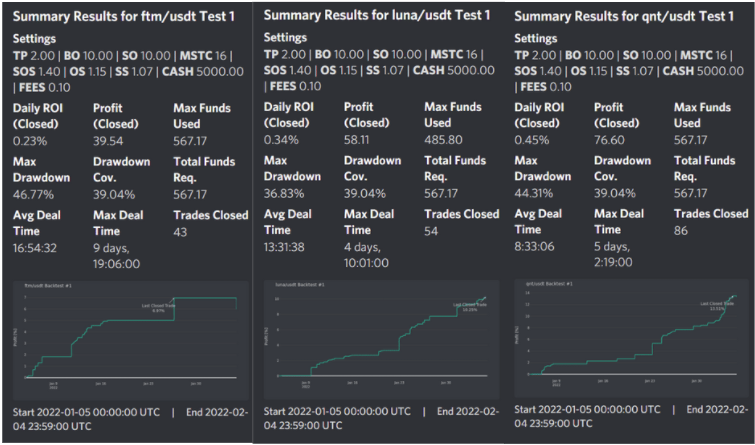

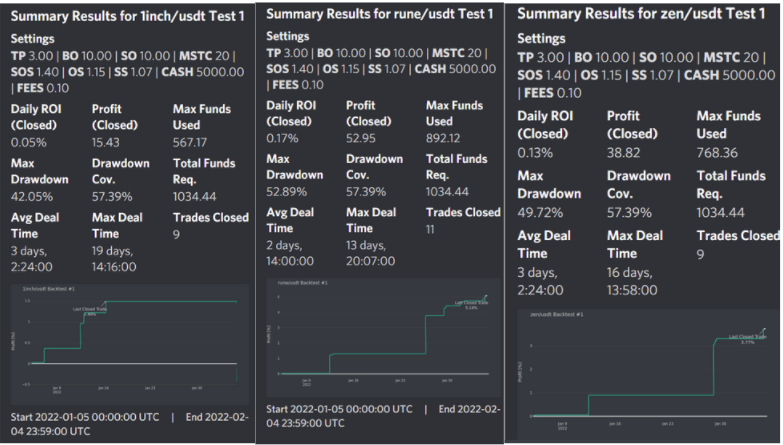

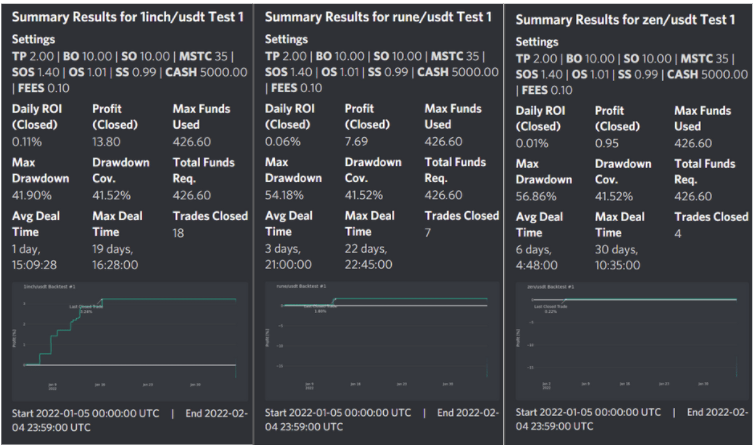

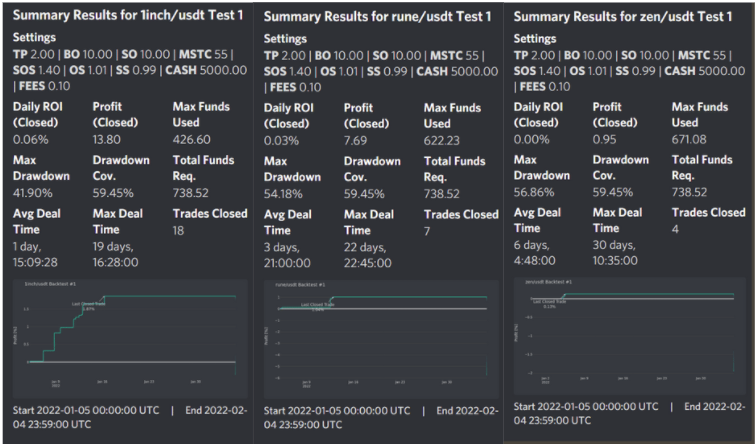

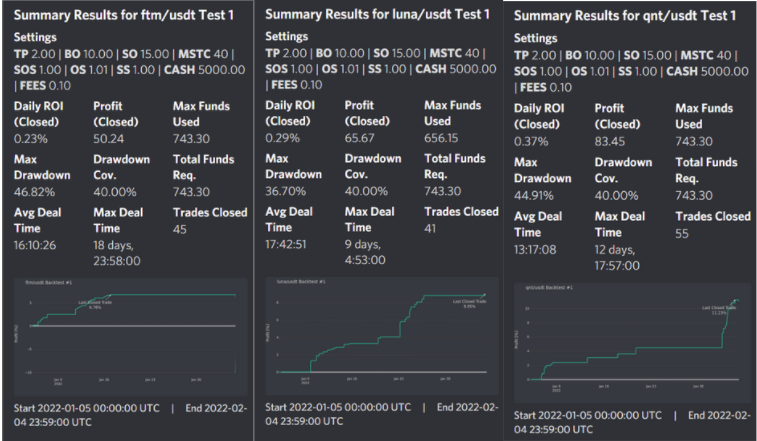

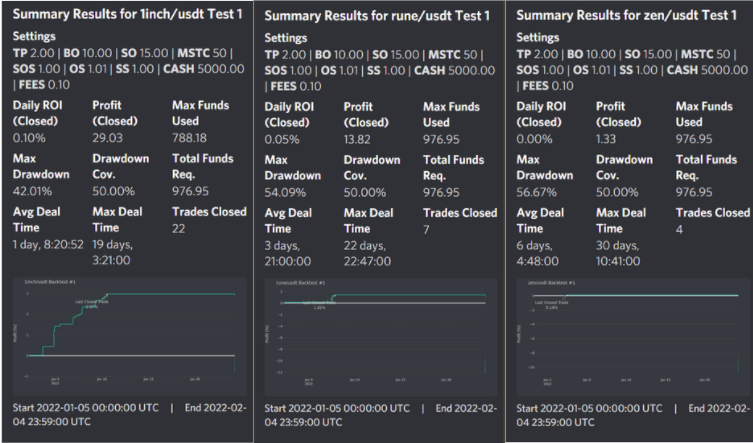

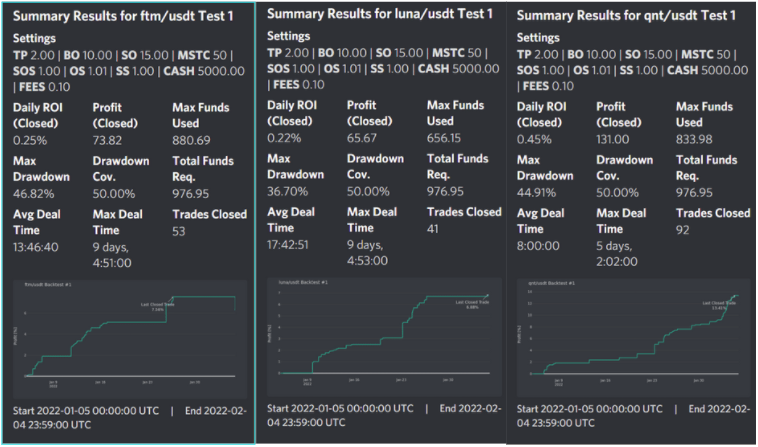

I will run a 30 day backtest on a few coins and leave it for you to run your own tests if you like the look of any settings. 1inch, Rune, Zen (Bad charts) and FTM, QNT, LUNA (Good charts)

Looks like they suffer still from getting stuck with bad coins. Not a great idea to run on bad coins

TP 2%

TP 3%

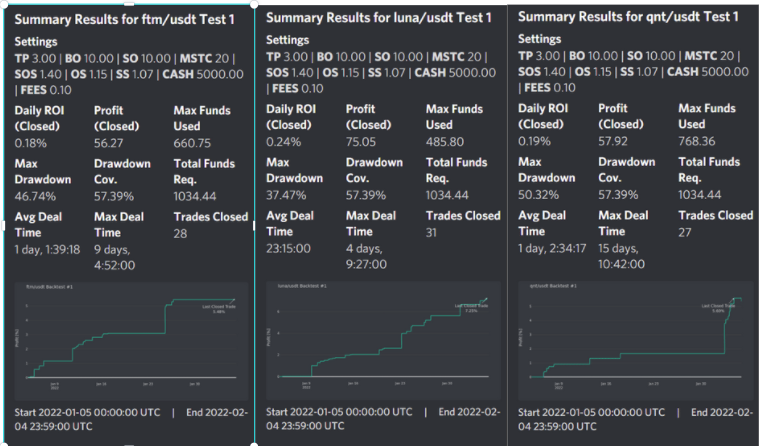

Performed ok with these coins not stuck too long, but used up all the capital, so maybe the passive one was more safer to run.

TP 2%

TP 3%

TP: 2.0%, BO: 10.0 USDT, SO: 10.0 USDT, OS: 1.15, SS: 1.07, SOS: 1.4, MSTC: 20

Same as Test 1 but with 4 more safety orders to be run more passively and cover better deviation for set and forget. Bringing max bot costs to $1k

Hopefully the bad coins wont be too badly stuck.

Results for the weak coins were slightly better than Test 1 if you scroll up and check apart from 1inch which was very difficult to close due to how badly it dropped. 1inch is going to be a good test for all the settings.

Now the strong coins, we will obviously lose some ROI because bot costs are more expensive, but we need to look at the average ROI or would you run some coins with less coverage? That's all up to you.

Does this setting suit you? Run your own tests if the data seems interesting.

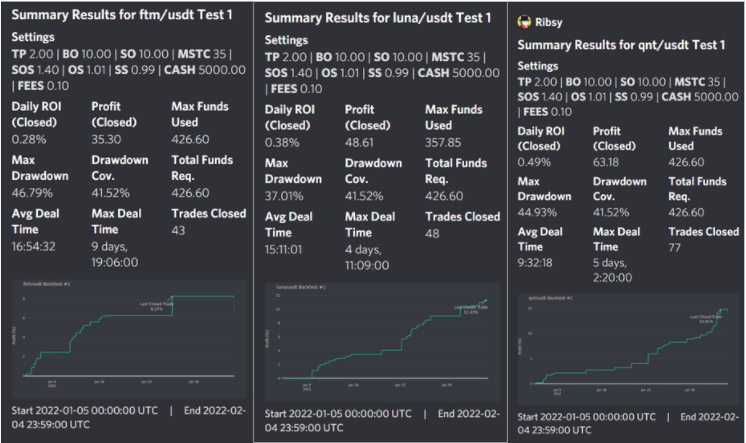

TP: 2.0%, BO: 10.0 USDT, SO: 10.0 USDT, OS: 1.01, SS: 0.99, SOS: 1.4, MSTC: 35

This setting is to reduce the Safety order gaps as you drop further down. There's quite a few safety orders needed to achieve this, so if you are not a fan of many safety orders due to tax calculation reasons, then its not for you. Main fun of this setting is the Step Scale being less than 1.0 so the safety order gaps reduce as you drop much deeper down.

Cheapest Bot costs $430 and covers 41% deviation for a RC% of 30% which isn't great but its cheap!

Roi is pretty good for good coins, but terrible for bad coins. Definitely needs to be tested more in a bullish market/coin.

Set 5 - Test 2 (Passive) - Same as Test 3 but more Safety orders to be more passively run

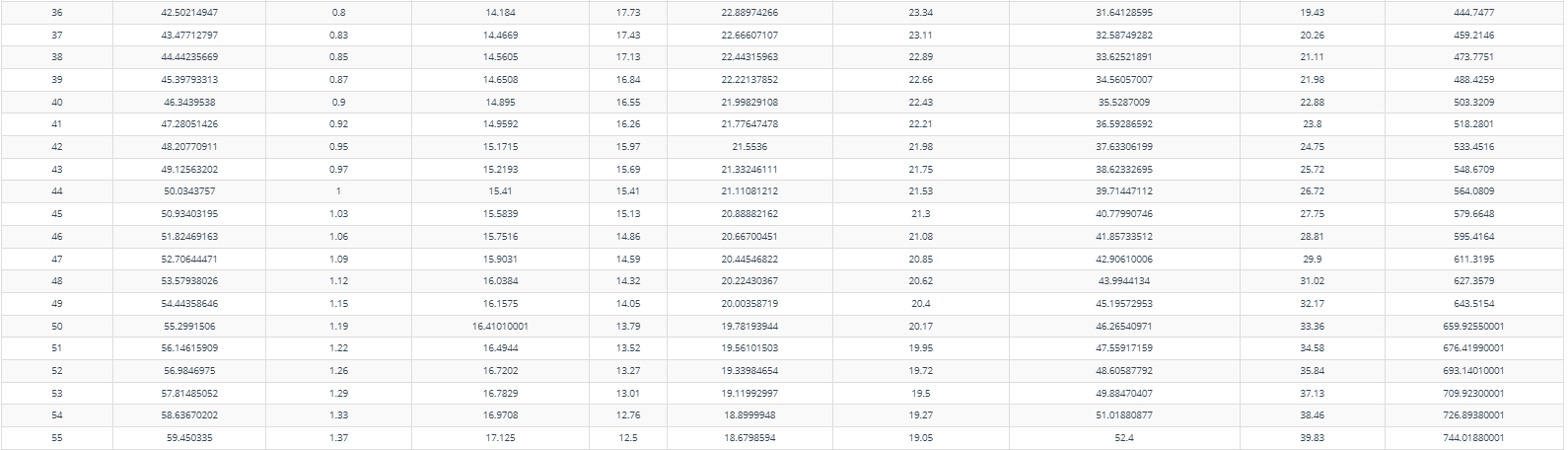

TP: 2.0%, BO: 10.0 USDT, SO: 10.0 USDT, OS: 1.01, SS: 0.99, SOS: 1.4, MSTC: 55

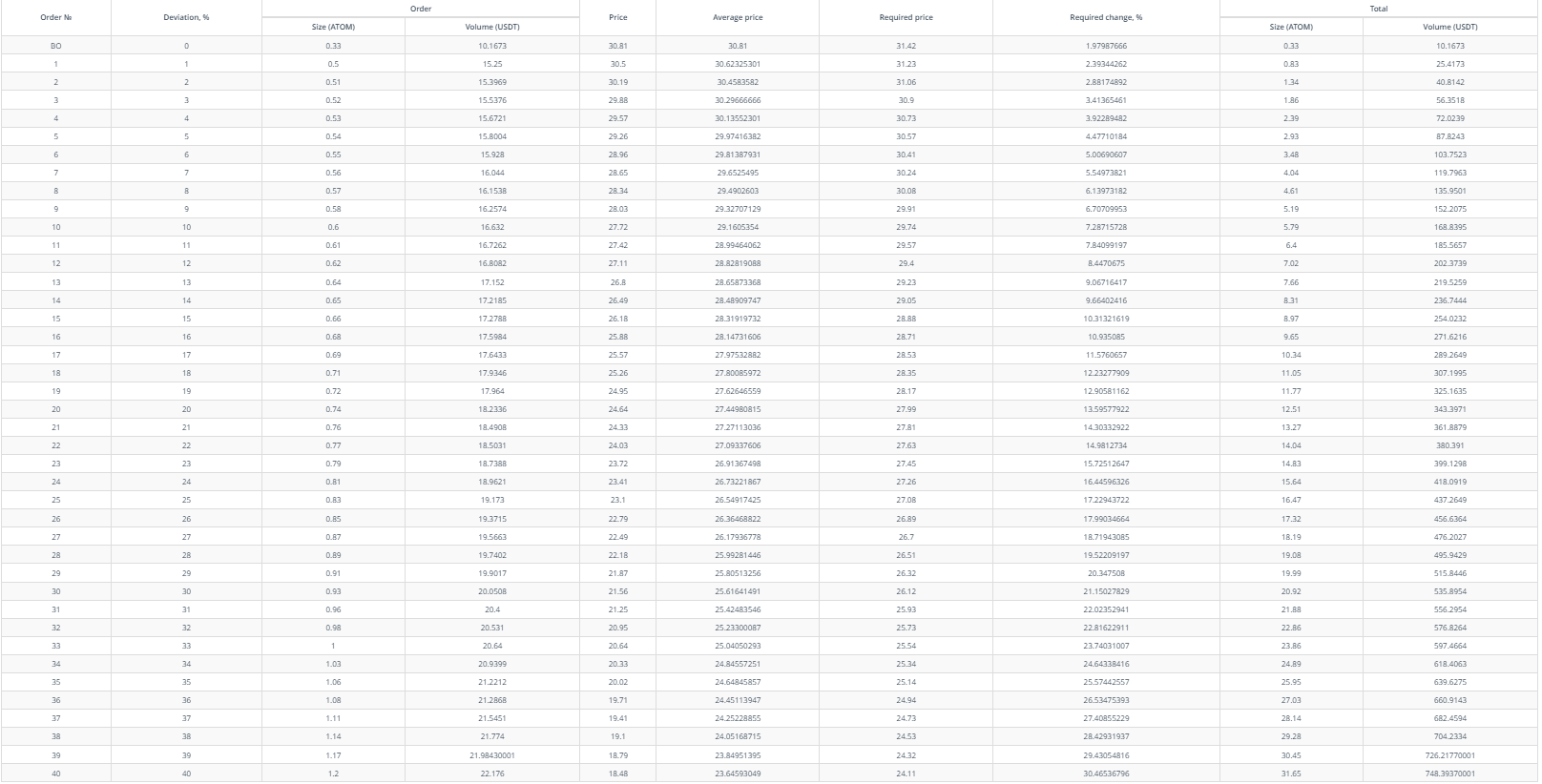

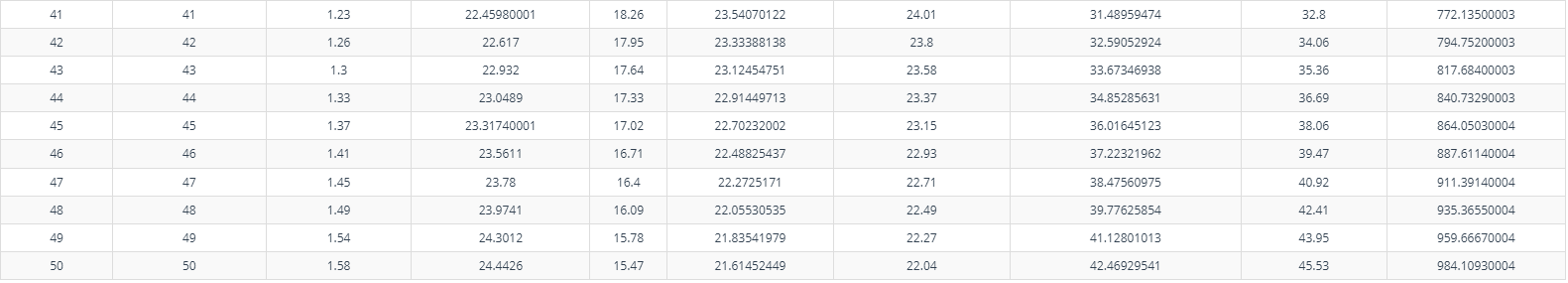

Table view below only covers safety order 36 to 55, the rest are exactly same as the table view above.

Total Costs is $744 but RC% sucks at 52.4%, for me I would rather manually add safety orders myself if it drops lower than 46 safety orders. So maybe a bot covering 50% might be better as passive. The idea is there anyway for those wanting to play around with the Step Scale 0.99 to reduce their safety order gaps as they drop further.

For bad coins this does passive setting does not work because RC% is too high and cannot handle a bear market

Good coins

I would prefer to run this type setting on a bullish market, it makes decent ROI with good coins and low coverage. I think this passive setting is a disaster. But I'll keep it running just for tests purposes. And it seems that there's not much reason to add more than 45 safety orders as its too weak in RC% afterwards.

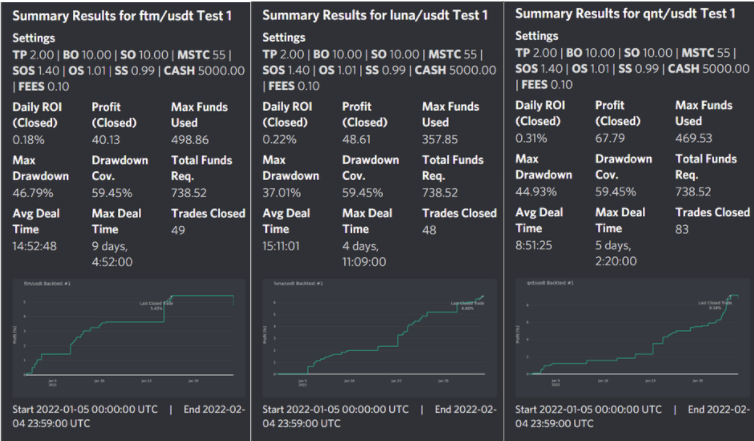

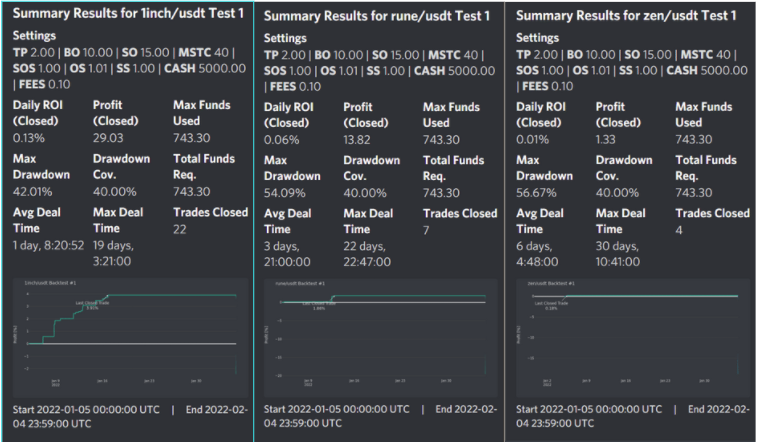

TP: 2.0%, BO: 10.0 USDT, SO: 15.0 USDT, OS: 1.01, SS: 1.0, SOS: 1.0, MSTC: 40

Barebones setting just adding safety orders every 1% but a little bit more each time if fills more safety orders. Added a bit more to Safety order at start to give it a kickstart.

Bot costs $748 with 40% coverage, and RC% of 30.46% if all safety orders filled. Very typical balanced order with nothing special.

Cant handle really bad coins, but does average on good coins.

More Safety orders to make it more passive but only 50% covered instead of 60%

TP: 2.0%, BO: 10.0 USDT, SO: 15.0 USDT, OS: 1.01, SS: 1.0, SOS: 1.0, MSTC: 50

Bot costs now $984 and at 50% drop the RC% is 42.46%

Conclusion so far, none of the settings could handle the bad coins very well. Test 1 was maybe the best one at dealing with terrible coins but not good enough. It was giving decent ROI for strong coins. I'm looking forward to Test 1 out of the tests so far. I'm also interested in test 3 just to see how well it does.

I would for now use the long tested community settings and let these develop for a longer period on paper test, or start adding any that you fancy the look off into your own paper tests/back tests and see if any you like or want to tweak.