I recommend reading these reports on the Buy Me A Coffee platform for optimal formatting.

You will find the content below in this order:

1. Definitions

2. Monthly

3. The Good

4. The Bad

5. CME Gaps

6. Key Levels

7. Final Thoughts

DEFINITIONS

Liquidity zones are high volume levels that offer support and resistance

Hidden bearish divergence: creating a lower high in price, with a higher high on the oscillators. This signals a possible trend continuation down.

Bearish divergence: higher high in price, lower high on the oscillators. This signals a possible trend reversal down.

Hidden bullish divergence: creating a higher low in price, with a lower low on the oscillators. This signals a possible trend continuation up.

Bullish divergence: creating a lower low in price, with a higher low on the oscillators. This signals a possible trend reversal up.

SR flip: turning old resistance into support, and vice-versa.

Fractal: recurring geometric pattern.

MONTHLY

Overview

Bitcoin will finally print its first green month after three consecutive red monthly candles. further Right now, it does still look like the possibility of this Double Top is becoming the more likely scenario given what the oscillators are saying well.

Relative Strength Index (RSI)

Bitcoin will close again in the "Neutral Zone" between 40-60.

Moving Average Convergence Divergence (MACD)

The MACD will yet again print a red histogram bar. This implies that momentum is still bearish on a macro level.

Bearish Divergence

Bitcoin has a higher high in price, with a lower high on the RSI/MACD. This is a bearish divergence, which signals a possible trend reversal down.

Note: This is a very high timeframe and it can take months for this to fully play out. Given that it is such a high timeframe, it also offers a lot more opportunity to invalidate this divergence.

Invalidation: Higher high in price and the oscillators.

Potential Hidden Bullish Divergence

Bitcoin has a higher low in price, with a lower low on the RSI/MACD. This is a hidden bullish divergence, which signals a possible trend continuation up.

Note: This is a very high timeframe and it can take months for this to fully play out. Given that it is such a high timeframe, it also offers a lot more opportunity to invalidate this divergence.

Invalidation: Lower low in price and the oscillators.

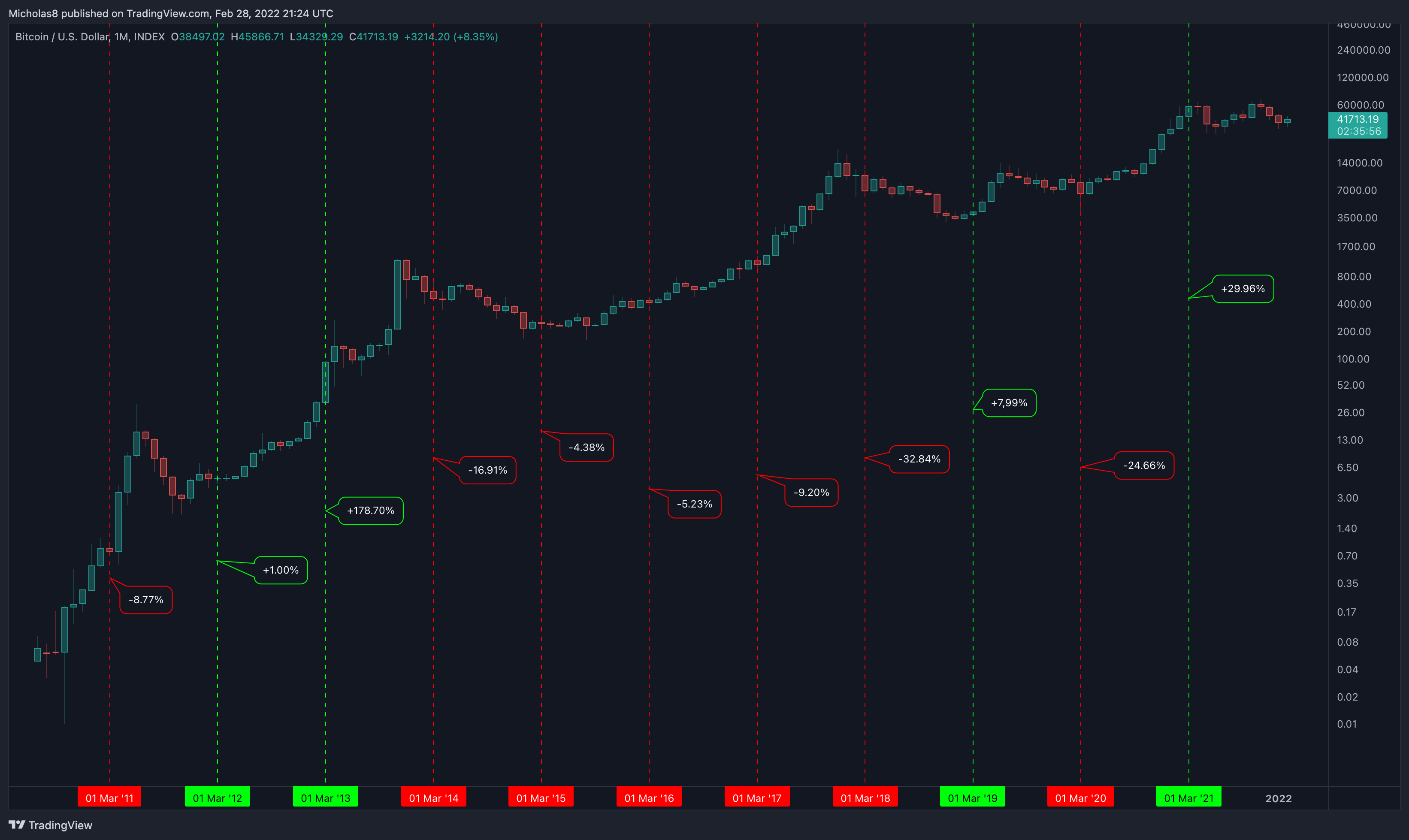

March's Historic Performance

Historically, March has been a red month for Bitcoin. But, since we did have that one +178.70% month, technically, the average performance from open to close, is a positive 15%. If we were to exclude that single data point as an 'outlier', the average performance would sit at -1.25%

If we take the average performance over the last four years, we see an average fall of -4.89%.

Let's say Bitcoin closes tonight at 42k flat. Based on these numbers, it would bring us between 39.9k-41.4k.

If we include the outlier, it would bring us to 48.3k.

Note: Past performance does not indicate future results.

THE GOOD

1D Timeframe

Divergence(s)

Hidden Bullish Divergence

Bitcoin has a higher low in price, with a lower low in the MACD. This is a hidden bullish divergence, which signals a possible trend continuation up.

Invalidation: Lower low in price and in the MACD.

Network Value to Transaction (NVT)

*This indicator describes the relationship between market cap and transfer volumes.

Bitcoin has reclaimed the NVT Signal Line as support.

Implication(s): Bullish price action typically follows after holding the NVT Signal Line as support.

Exponential Moving Average (EMA): 8 and 21

Bitcoin has risen above the 8/21-day EMAs.

Implication(s): Ideally, they serve as a level of support.

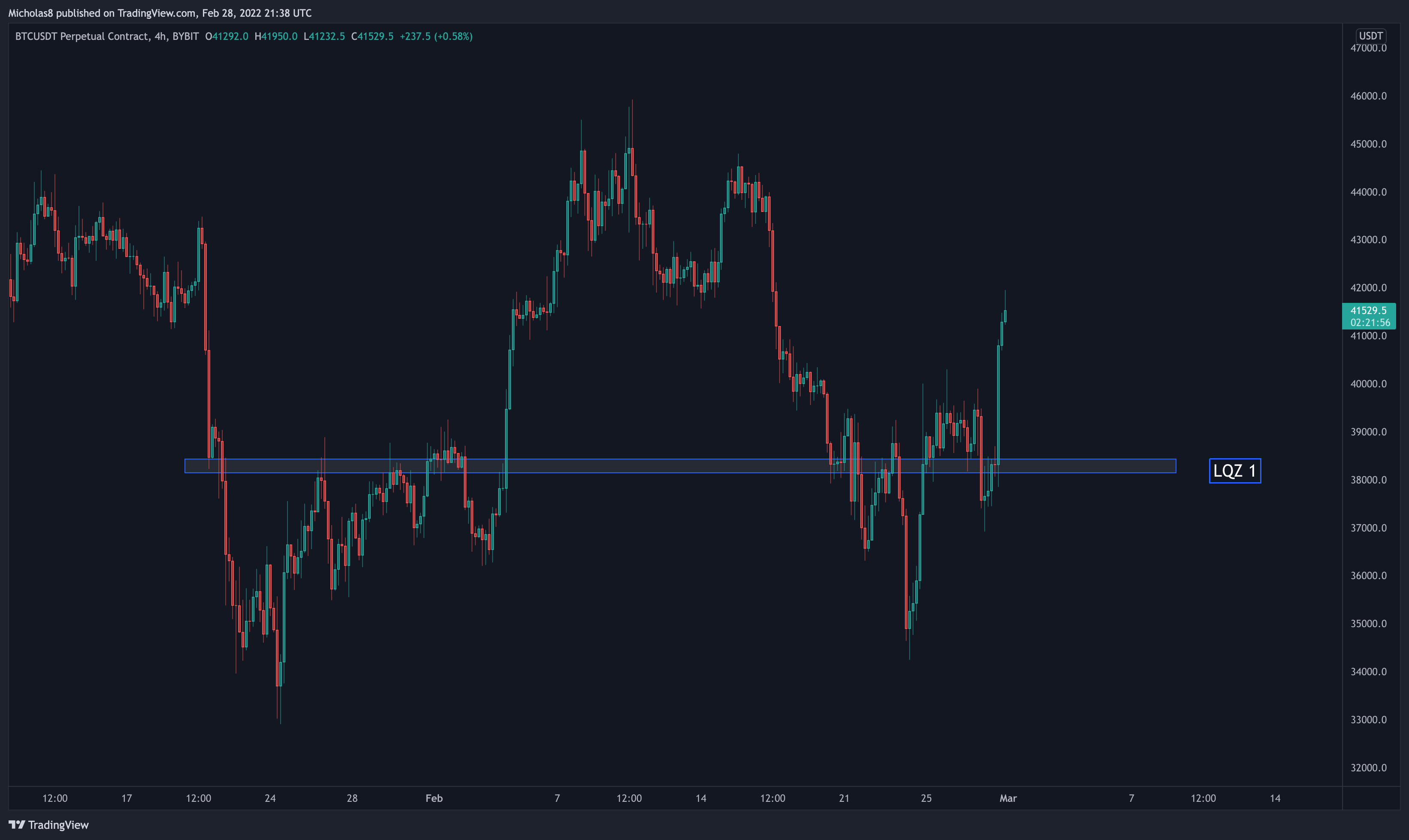

4H Timeframe

Key Liquidity Zone(s)

Zone 1: This LQZ sits at 38.1k-38.4k, which Bitcoin has reclaimed as support.

Implication(s): Ideally, it continues to serve as support.

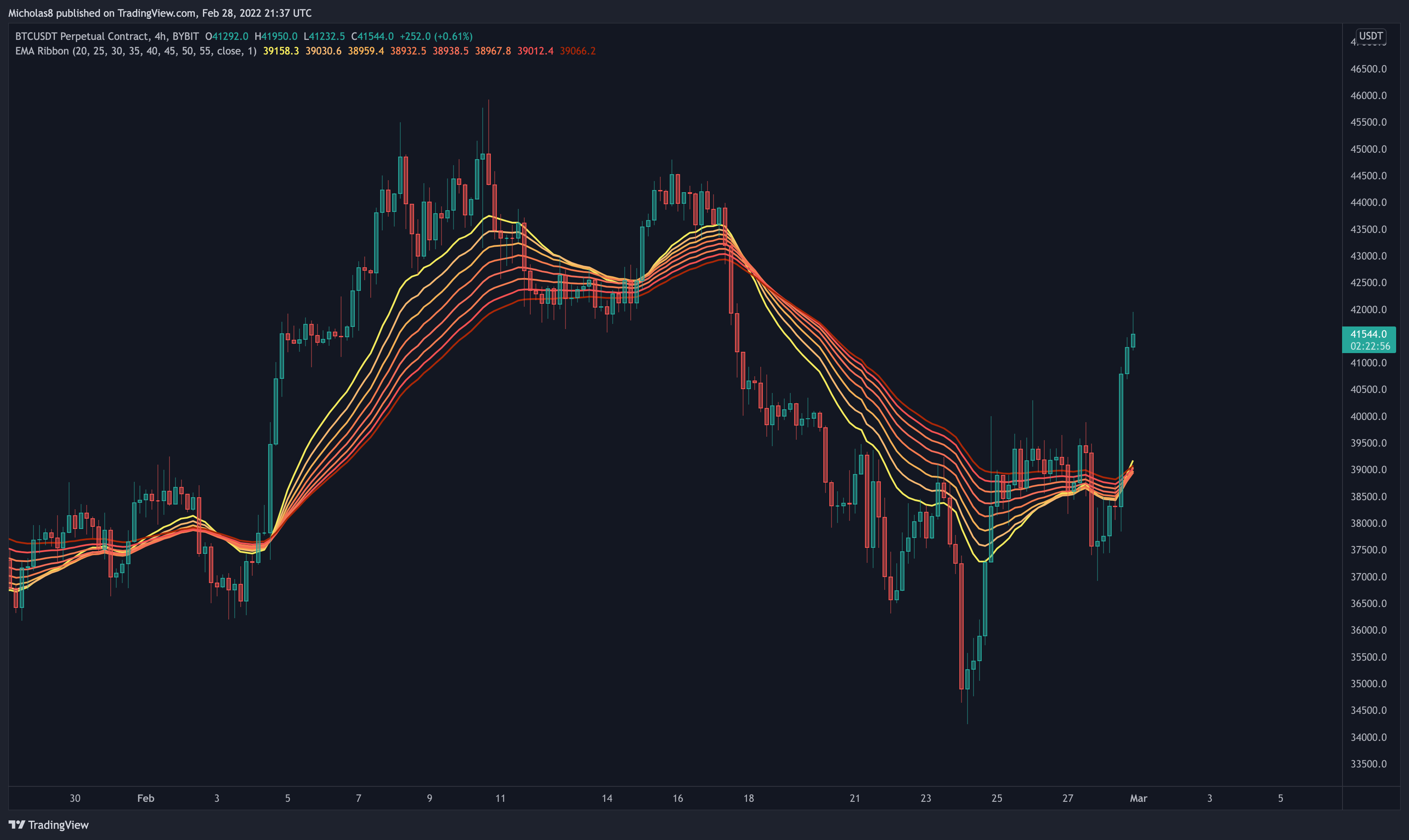

EMA Ribbon

Bitcoin has risen above the EMA ribbon on this timeframe.

Implication: Ideally, it serves as a level of support.

What is an EMA ribbon? A 'ribbon' of EMAs that together indicate bearish and bullish momentum in the market. When an asset is trading is above the ribbon, it's considered bullish. Vice-versa.

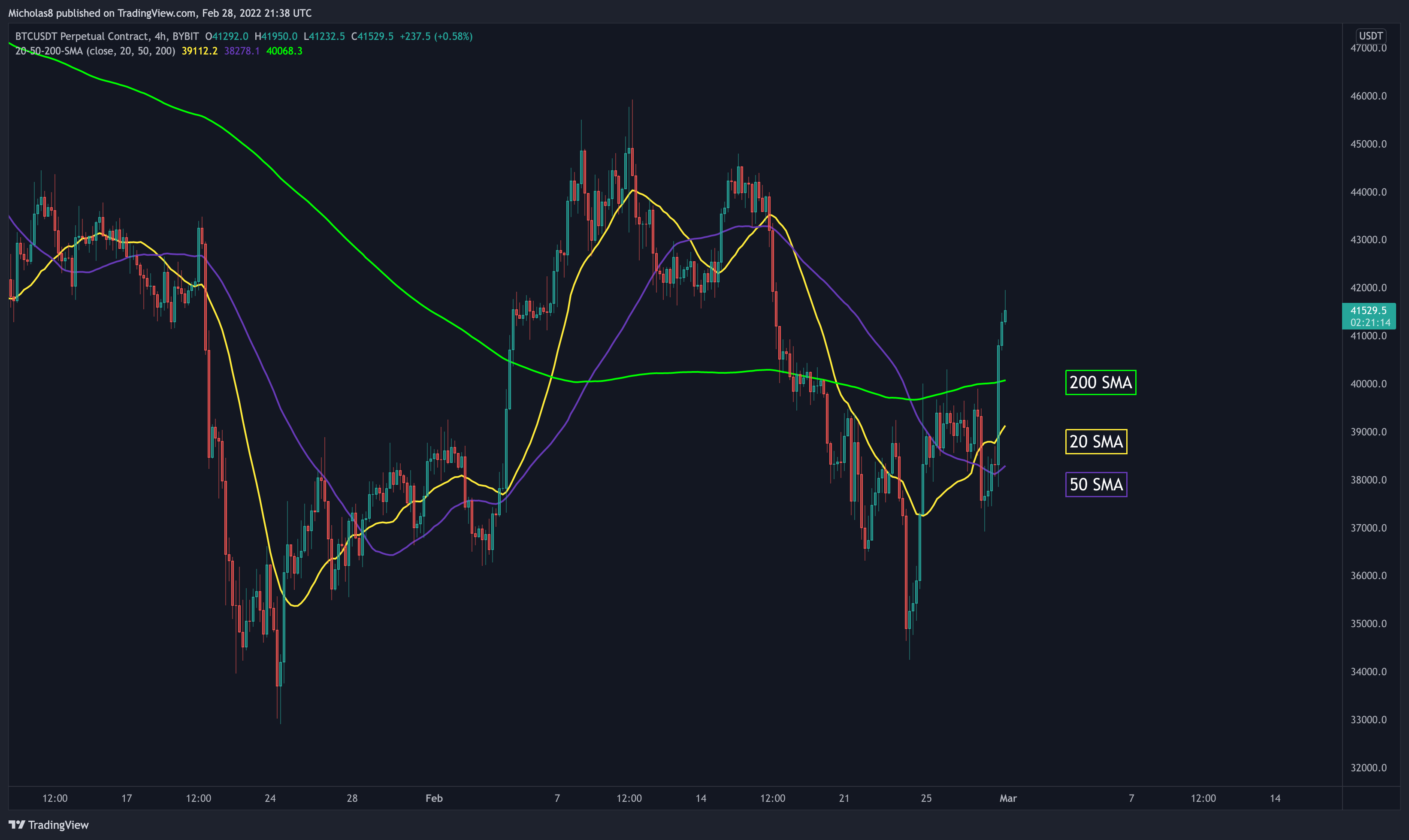

Simple Moving Averages (SMA): 20, 50 and 200

Bitcoin has risen above these SMAs.

Implication(s): Ideally, they serve as a level of support.

1H Timeframe

EMA Ribbon

Bitcoin has risen above the EMA ribbon on this timeframe.

Implication: Ideally, it serves as a level of support.

What is an EMA ribbon? A 'ribbon' of EMAs that together indicate bearish and bullish momentum in the market. When an asset is trading is above the ribbon, it's considered bullish. Vice-versa.

THE BAD

Daily Timeframe

Bearish Market Structure

Bitcoin continues to print lower highs and lower lows, thus, maintaining its bearish market structure. Until we start to see new higher highs and higher lows form, we can expect this macro trend to continue.

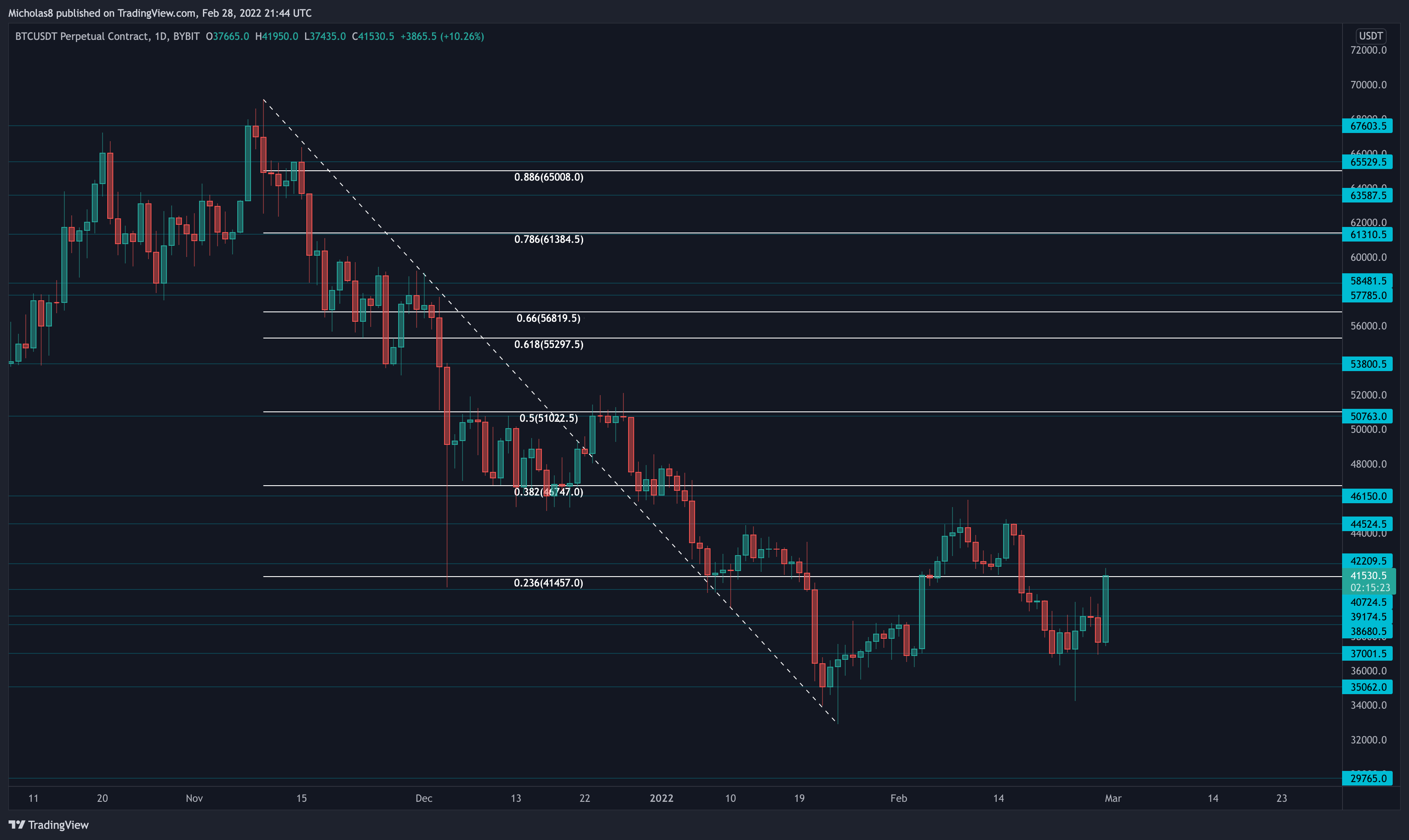

Logarithmic Curve

Bitcoin has failed to breakthrough and hold the 0.236 Fibonacci Level as support.

Once Bitcoin fell below the median line, it became bearish. We can treat this curve as we do with ranges – the upper half = bullish, the bottom half = bearish.

Key Liquidity Zone (LQZ)

Zone 1: Bitcoin has lost the LQZ sitting at 42.2k - 43k.

Implication(s): We may see this serve as a level of resistance moving forward.

Directional Movement Index (DMI)

*This is another momentum indicator.

Generally speaking, when the blue line (bullish) crosses below the orange line (bearish), it signals a potential shift in momentum to the bears. Given that the orange line still trends above the blue line, Bitcoin's momentum remains negative.

Implication(s): As we have seen a bearish cross between these two signal lines, momentum is now with the bears on a macro level.

EMA Ribbon

Bitcoin has lost the EMA ribbon as support in this timeframe.

Implication: Momentum is now with the bears on a macro level.

What is an EMA ribbon? A 'ribbon' of EMAs that together indicate bearish and bullish momentum in the market. When an asset is trading is above the ribbon, it's considered bullish. Vice-versa.

Simple Moving Average (SMA): 20, 50, 100 and 200

Bitcoin continues to trade below the 100/200-day SMAs, and is finding resistance from the 20/50-day SMAs.

Implication(s): They may serve as levels of resistance moving forward.

Exponential Moving Average (EMA): 50 and 200

Bitcoin continues to trade below the 50/200-day EMAs.

Implication(s): They may serve as levels of resistance moving forward.

4H Timeframe

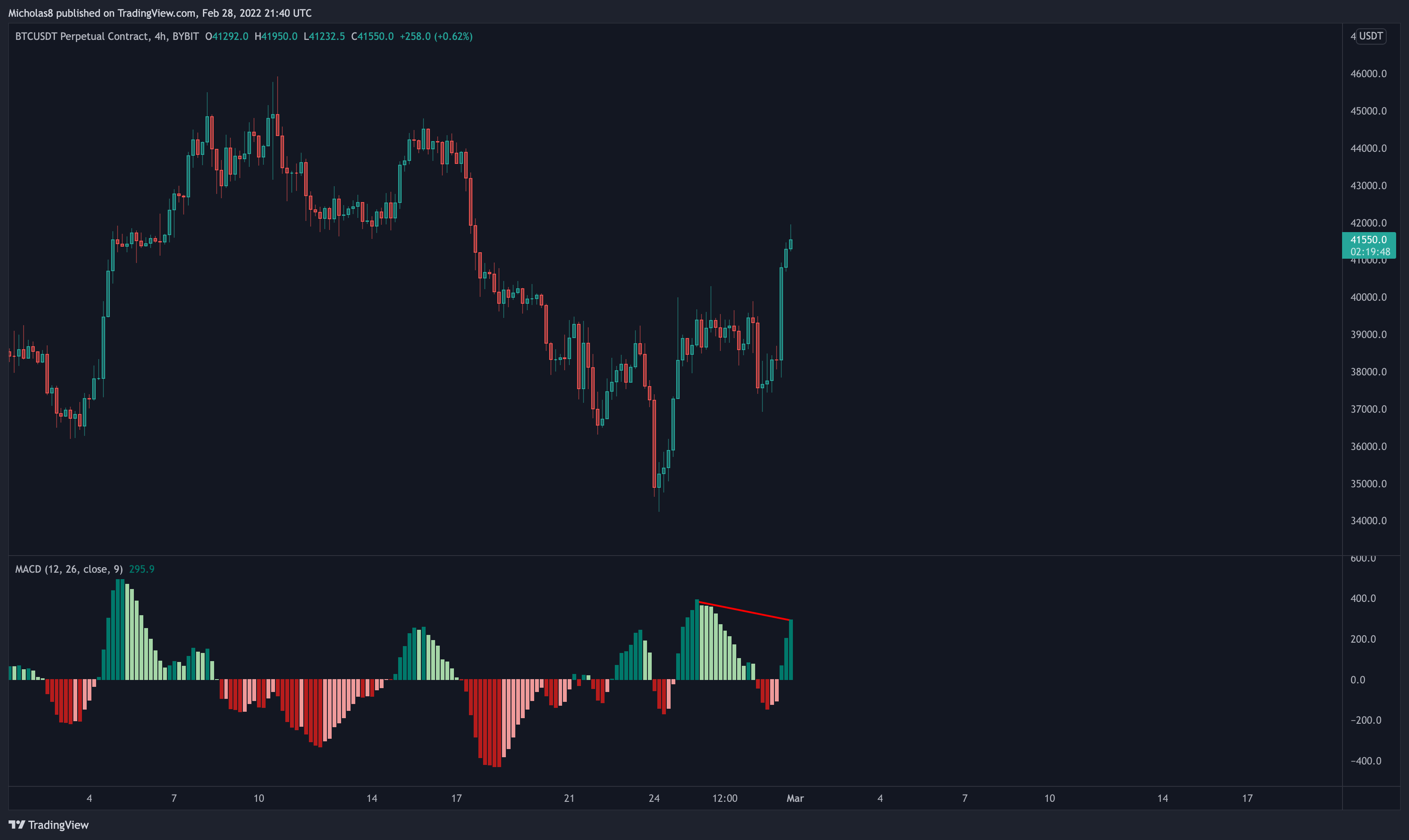

Divergence(s)

Bearish Divergence

Bitcoin has a higher high in price, with a lower high in the MACD. This is a bearish divergence, which signals a possible trend reversal down.

Invalidation: Higher high in price and in the MACD.

Hidden Bearish Divergence

Bitcoin has a lower high in price, with a higher high in the RSI. This is a hidden bearish divergence, which signals a possible trend continuation down.

Invalidation: Higher high in price with a higher high in the RSI.

1H Timeframe

Divergence(s)

Bearish Divergence

Bitcoin has a higher high in price, with a lower high in the MACD. This is a bearish divergence, which signals a possible trend reversal down.

Invalidation: Higher high in price and in the MACD.

CME GAPS

GAP: 32,480 – This gap has nearly been completely filled!

GAP: 39,935 – Filled!

GAP: 53,675 – As mentioned when the gap first formed, this is a "breakaway gap". These are gaps that form when there's a dramatic shift in market structure. Typically these gaps take much longer to fill than the normal gaps. This is comparable to the gap at 32,480.

Key Levels

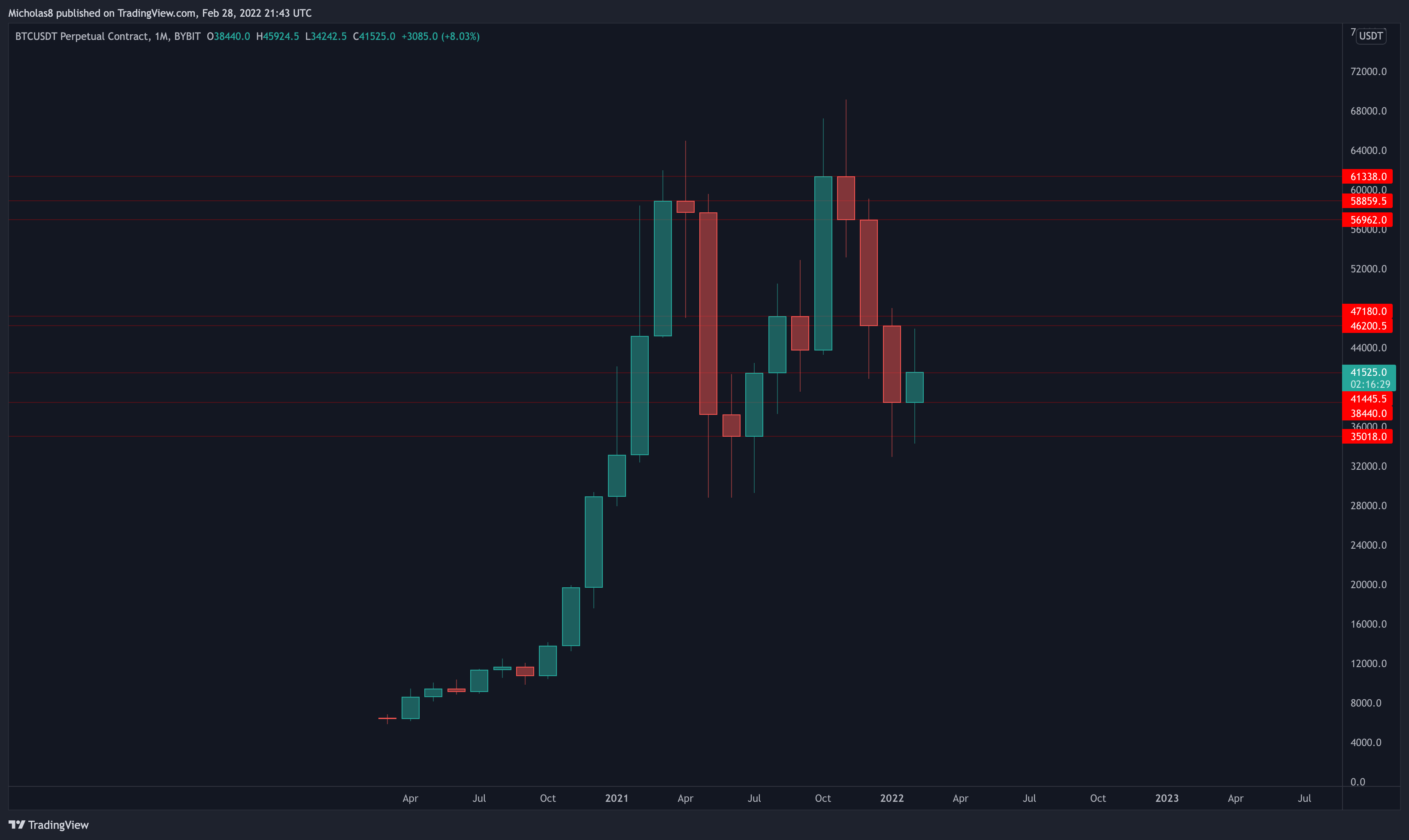

Monthly Timeframe

35018

38440

41445

46200

47180

56965

58860

61340

Daily Timeframe

29765

35060

37000

38680

39175

40725

42210

44525

46150

50765

51800

53800

57785

58480

61310

63590

65530

67600

Fibonacci Levels

4H Timeframe

32905

33960

35490

36200

36630

37550

39250

40350

40830

41555

42745

43495

44450

45280

45925

46730

48555

50490

52120

Fibonacci levels

1-hour Timeframe

34240

35850

36315

37165

37920

38600

38900

39440

40010

40430

40925

42835

43265

44375

44800

Fibonacci levels

FINAL THOUGHTS

RECAP FROM FRIDAY NIGHT

Bitcoin continues to see volume-supported upside.

If we continue to see upside PA, these are the two Golden Pockets that I have my eye on here – from where I will be looking to potentially enter short positions/TP from my longs. And if we do continue up, I will also be looking for potential long entries on the LTFs to ride the wave up.

All in all, Bitcoin still does remain in a bearish position on a macro level for a multitude of reasons. However, there is a lot of strength with this move, and we may be in store for continued upside PA this week.

_

TONIGHT

The Good

1D/1W Hidden Bullish Divergence

CME Gaps at 39,935 and 53,665

Bullish NVT

_

The Bad

Lost the 1H/4H/1D/1W EMA Ribbons

Lost the Bull Market Support Band

Lost the 20/50/100/200-week SMAs

1H/4H/1D Hidden Bearish Divergence

1W/1M Bearish Divergence

Bearish Market Structure (1D timeframe)

Trading below the 8/21/50/200-day EMAs

Trading below the 20/50/200 4H SMAs

Trading below the Daily LQZ 1

Resistance from the Bitcoin Logarithmic Curve Median Line

20/50-day SMA Death Cross

20/100-day SMA Death Cross

50/100-day SMA Death Cross

20/200-day SMA Death Cross

50/200-day EMA Death Cross

50/200-day SMA Death Cross

100/200-day SMA Death Cross

_

TONIGHT

As discussed earlier today, we were looking for resistance at the white Golden Pocket, and currently, that's what we're seeing.

We are starting to form bearish divergences on the MTFs/LTFs, which implies that we're likely to see either bullish consolidation and create a new sideways range, or a move to the downside.

If we do see that move to the downside, these are the Golden Pockets that we can keep an eye out for.

All in all, Bitcoin still does remain in a bearish position on a macro level for a multitude of reasons. But on a medium-term level, we may be in store for some more upside and/or bullish consolidation at the highs.

Thank you for your continued support, and I hope you have a great start to your week!

Cheers!