You know the old saying

A picture is worth a thousand words

In this case I would add that

A good chart is worth a million words

Source: S&P Global

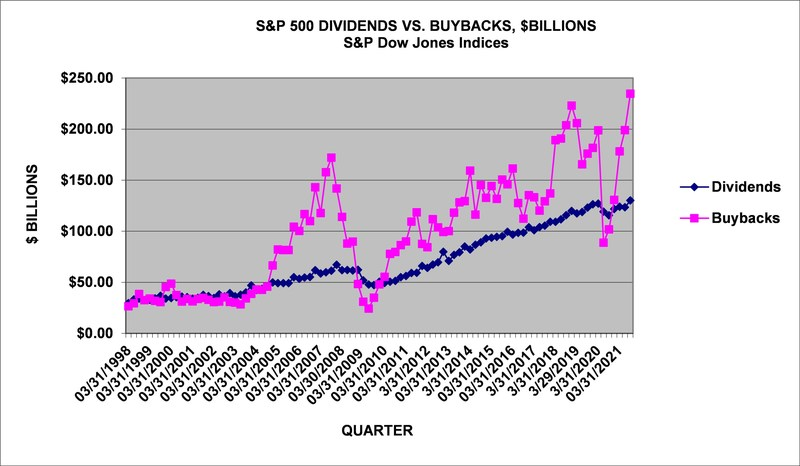

Companies seem to initiate share buybacks when share prices are high and they have a lot of free cashflow. Then they end up cancelling or drastically reducing them when share prices are low. If you are like me you would be thinking that this is crazy and it's exactly the opposite of what they should do. On the bright side, at least it's a good signal for when we as small investors should buy more.

On the other hand, companies seems to maintain or increase their dividends even in downturns.

This is one of the reasons why I prefer the relative stability and predictability of dividends. I also have the option of reinvesting them selectively.

With share buybacks I don't have this option. Also, cancelling buybacks is rarely noticed, whereas freezing / cutting dividends is almost always viewed negatively (as proof of problems with the underlying business).

In general, I believe that dividends are better then share buybacks.