When spot Bitcoin ETF? It’s an extremely important question that could determine exactly how Bitcoin performs over the next few months. In this post, I’m going to answer that question. I’ll be examining exactly what goes on in the ETF market and why the current instruments are quite frankly dog sh*t. I also have a few predictions about what a spot ETF could do to the market. So, this is something that you cannot afford to miss.

Note For Professionals: If you are a crypto investor and/or trader, you have to use these 3 social media weapons well. Medium, Twitter, and Discord. To support my channer, you may Buy Me A Coffee.

Disclaimer: After getting the whole permissions, all the content converted from Coin Bureau’s “Bitcoin: Spot ETF INCOMING?! What To Watch For!” video.

ETF Overview

In order to best understand the current Bitcoin ETF landscape, we need a bit of an overview of how these are being structured if that’s something you’re fully clued up on, feel free to skip ahead.

Perhaps the most simple way that an ETF can be constructed is that the ETF provider will physically hold the asset in question. In this case, that asset is Bitcoin. They will go and buy the asset and then issue shares to the public that will give them collective exposure to the asset. The value of these shares is determined by the net asset value of the assets that are backing them. This type of fund structure is pretty popular, and most of the established ETFs in traditional finance is structured like this.

For example, the world’s largest gold ETF physically stores gold bullion and issue shares to the investing public. These funds are relatively easy to manage as it’s merely about holding the physical asset and issuing or redeeming shares in order to keep the tracking in place. However, the other type of ETF instrument available is one that tracks the price of an asset synthetically, i.e. it uses other instruments in order to get exposure to the price of the asset.

Most of the time, these instruments are derivatives like futures. The fund will enter into futures contracts such that they’re able to replicate the performance of the asset in question. In the financial markets, these instruments are normally structured to give exposure to those assets that are hard to physically hold.

For example, ETFs try to track energy or oil prices. Instead of the fund having to meet the cost of storing these items, they can invest in near-dated futures and roll them at the end of the period more on that later. But, the crucial thing to understand here is that because the fund is not buying the physical asset, their actions do not impact the spot market. Investing in paper contracts like futures does not impact the supply and demand for the underlying asset.

When it comes to Bitcoin ETFs so far, there have only been four that have been approved. These are those from ProShares, Valkyrie VanEck, and Global X Blockchain.

However, ProShares is by far the largest with almost 1 billion exposure, with Valkyrie coming in a distant second at 60 million dollars.

The most important point here is that all of the ETFs that have been approved so far are futures banked instruments. They invest in CME Bitcoin futures and use these instruments to give their investors exposure to the price of Bitcoin.

When these instruments were approved in October by the SEC, many were somewhat disappointed that they were not spot based instruments, including me. Now, don’t get me wrong, this was a massive milestone for Bitcoin, but we all knew that these ETFs themselves would not directly impact demand in the spot market. However, we were at least hopeful that the move to first approve these instruments would lead to a spot approval soon.

Unfortunately, those hopes were dashed time and time again as numerous spot applications were rejected by the SEC. Two of the most recent were the rejections of the VanEck instrument, which happened in November, as well as the WisdomTree application, which happened about a week ago. This is disappointing because apart from the fact that these instruments don’t hold any Bitcoin, they are also a pretty sub-optimal way to gain that exposure. Allow me to explain.

Why Futures ETFs Suck?

Firstly and perhaps most importantly, these instruments could suffer from something called tracking error. Essentially, this is the mismatch that you observe between the movement in the underlying futures instrument and the price of the asset that it’s trying to track.

It’s quite a common phenomenon in the commodities ETF space, where the ETF net asset value will sometimes diverge away from the price that is implied by the targeted assets. The price of an asset in the futures market is sometimes different to that of the asset in the spot market, and this then leads on to the second biggest issue that exists with futures ETFs generally, but the Bitcoin ones, more specifically something called contango bleed, sounds painful, so what the heck is it.

Firstly, you need to understand some terms. Contango is the term given to market conditions where the price of the futures instrument is above that of the spot asset.

Essentially, the futures curve is upward sloping in maturity. It’s the opposite of Backwardation, where the price of the future is below the spot. I’ve linked to this handy guide down below if you want more info.

Contango and Backwardation - The Complete Guide

Want to learn more about contango and backwardation? Read our ultimate guide to contango and backwardation to learn…

However, in the Bitcoin markets, the CME instruments have historically predominantly been in contango. Taking a look at the market at the time of the shooting, the front-month futures contract expiring at the end of December is priced at $48,720, whereas the spot price of Bitcoin right now is $48,500.

This persistent contango creates a lot of issues for ETF issuers. This is because of the way that they have to structure their ETFs to gain that exposure. Essentially, they invest in near-dated futures contracts, which are then rolled over at the end of the period into the next near-dated futures.

However, if the market is in contango, this means that they will constantly be delivering an instrument that is below the price at which you bought it. Taking a look at the price right now, if you’re buying a Bitcoin future, you will settle at a rate of $48,720, which is $134 higher than the spot.

Assuming that the price does not move between now and the expiry, you will have lost that $134 in value, about point 0.28% of your investment. This may not seem like a lot, but you have to consider the impact of compounding over the year.

If the contango is high enough, the loss you’re making could be as high as 17%. That’s according to this annualized chart over here by Charles Morris.

A separate analysis by Invesco, who had filed a spot application with the SEC, sees a monthly drag of between 0.6% and 0.8%. On an annualized basis, that works out to about 5 to 10%. On top of this, there’s also the very real risk that the demand from the funds themselves for the futures further precipitates this contango phenomenon.

As more of these funds pile into the near dated futures, that will increase the price relative to the spot and further exacerbate this pricing difference. It’s this sub-optimal structure that caused Invesco to pull its ETF application. Even after investing in a 69,000 word 75-page filing, it could not justify the cost of running these instruments.

You also had the likes of Bitwise, who pulled its SEC application for similar reasons. The costs just did not justify the benefits of doing it. Moreover, there’s just not that much demand for these futures ETF instruments. A vast majority of financial advisors in the U.S. have said that they cannot ethically suggest an instrument like these futures ETFs to their clients. This is especially the case when they can just open accounts at Coinbase and easily get that desired spot exposure.

To add to all of this, the Bitcoin CME futures market is not really fit for purpose or flexible enough. For example, in the immediate few weeks, after the ProShares ETF was approved, demand tapped out supply. The demand for future instruments overwhelmed commission merchants and was even at the risk of breaching limits.

The CME has a cap of 2,000 contracts, and in October, ProShares came very close to breaching that limit. So, perhaps this is the reason that demand for ProShares has been falling over the past few weeks. These instruments are sub-optimal expensive and not what the market wants. But why is the SEC still denying spot applications?

Why is The SEC Denying?

The official line that’s been given by the SEC over and over again is that they’re being denied because of concerns for quote “Fraud and market manipulation.”

This is something that Gary Gensler further highlighted while he was being grilled in congress by Pat Toomey. He claimed that the Bitcoin markets are unregulated and more susceptible to manipulation, whereas the futures markets are regulated and hence less susceptible.

This is counterintuitive on so many levels. Firstly, does the point that futures instruments derive their value from the price of underlying Bitcoin. In the case of the CME, 90% of the Bitcoin reference rate is made up of the spot prices on three exchanges Coinbase, Kraken, and Bitstamp.

The CME futures instruments are literally being priced based on what is going on in the spot market. If the SEC was concerned about the manipulation of spot Bitcoin, surely that would also mean that it would have the same concerns about those futures instruments. In fact, I would counter that it’s a lot easier to manipulate the CME futures market than it is the spot market.

Strategies like banging the close and other tactics are known to have been used in the futures markets. When you hold spot Bitcoin, it’s held in cold storage at a custodian. There is no funny business possible, no rolling or trading needed, no other market participants competing at different stages of the role. It’s even after when you think about the fact that spot Bitcoin ETFs already exist. Just north of the border, Canada has had a spot Bitcoin ETF for almost a year now. The purpose invest Bitcoin ETF now has close to a billion dollars in Bitcoin, and there have been no issues to speak of, no manipulation concerns, and all the Bitcoin cold stored in a custody solution over at Gemini Trust. So, the SEC’s decision making just seems so arbitrary, so silly.

This is something that many other market participants have complained about. For example, you had Grayscale, who got its lawyers to send the SEC a letter it argued that the approval process was quoted as arbitrary and capricious, something that violates the administrative procedure act.

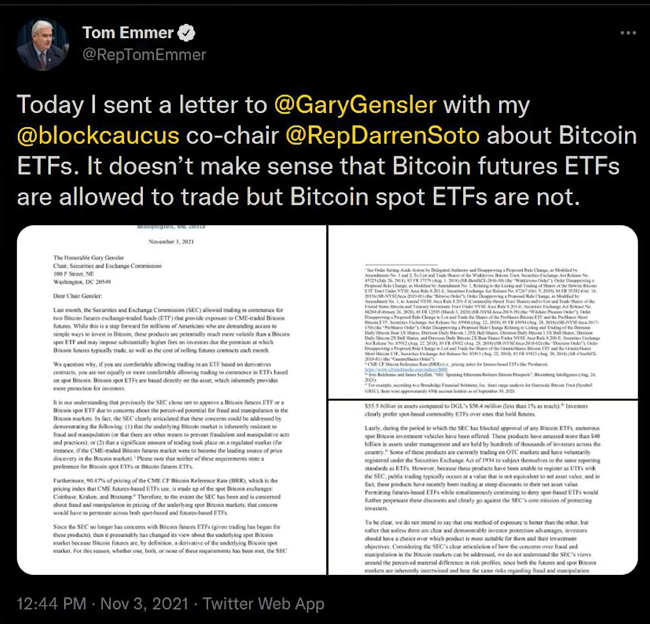

The SEC is also facing heat in congress over its seemingly arbitrary decision-making process. There are a number of lawmakers who are turning up the pressure. One of them is the aforementioned Pat Toomey. But, you also have Tom Emmer, who is a member of the blockchain caucus.

About a month ago, he sent a letter to the SEC that went over many of the same points. Quite unsurprisingly, the SEC was not quick to answer these questions. In fact, a month after they were sent, representative Emma had to chase Gary Gensler on Twitter. It’s so frustrating that there is such a lack of transparency from the agency that touts transparency. But that is neither here nor there. The main question is, “Why is the SEC so intransigent in its views with regards to the spot ETF?”

Something Else Going On?

There are a number of theories. Of course, there’s the official line, which is that it thinks that because the spot markets are unregulated, there is manipulation. It prefers an instrument that is backed by regulated assets. These are the CME futures. Technically it’s correct that these futures are regulated, but it’s pretty daft that the SEC can’t see the disconnect. But, as it stands from a regulatory standpoint, it seems to be more comfortable with any instrument that appears to be regulated, even though the asset that it’s referencing is unregulated. But what happens if there is another reason for its approach?

Something that I’ve long speculated is that the SEC is waiting until there are more custodial solutions to be able to store this Bitcoin. In fact, this is exactly what Gary mentioned in a speech that he gave at the Aspen Security Forum back in August of this year quote “The SEC is seeking comment on crypto custody arrangements by broker-dealers and relating to investment advisors .”

I know what you think. There are already hundreds of reputable custodians in the cryptocurrency space. Yes, that is indeed true. But, there, perhaps not the type of custodian that the SEC likes, perhaps the SEC is looking to line up-regulated custodians in traditional finance.

Indeed in a statement last year, the OCC stated that regulated banks and financial institutions could custody crypto provided certain conditions are met. Perhaps, Gary is waiting until there is a cryptocustodian that is favourable to some banks on Wall Street. Time will tell.

Of course, if you want to go further down the conspiracy rabbit hole, one could also say that there are many financial institutions that are benefiting from the inefficiencies in these futures ETFs. It’s well-known that hedge funds often trade on mispricing in the futures and spot markets on a number of assets. When there is a strong contango in the futures market, they often trade against the funds. They sell the futures and buy the spot in order to earn the returns that the funds are losing.

While some may say that this arbitrage condition could be closed by these actions, the problem is that the funds are obligated to continue buying. They need to gain that exposure, and the hedge funds know this. On top of this, there’s also the possibility of other forms of market manipulation around the roll periods. So, for every per cent that those funds are losing for their investors over the year, there are counterparties that are earning returns.

According to famed macro investor Raoul Pal quote “Wall Street gets richer, retail investors lose again.” Now having said all of this, I do think that we will eventually see a spot Bitcoin ETF. The momentum is clearly there, and it’s already getting quite hard for the SEC to justify its lack of action on this front, so when spotted?

When Spot ETF?

I happen to think that we could see one launched sometime in 2022. There are a number of things that I think could push us in that direction. Firstly when it comes to that regulated custodian point, there are already financial institutions that are lining up to fill that void. For example, in February of this year, you had the Bank of New York Mellon (BNY Mellon), who announced that it would be rolling out a crypto custody solution later in the year.

This is important because BNY Mellon is the largest custody bank in us, with over 41 trillion dollars in assets being held. Once its custody solutions for Bitcoin are fully up and running, it will allow these ETFs to use one of the most well-established trad phi custodians in the space.

In early October, U.S. Bank, the fifth-largest retail bank in America, launched its own crypto custody solution. This will use NYDIG as the sub-custodian, and it’s currently only available to fund managers.

There are also a number of other banks that are looking to potentially offer custody solutions. These include the likes of Citi Bank, JP Morgan, and yes, even Gary’s Alma Mater, Goldman Sachs.

Earlier this year, Goldman put out a request for information RFI to explore custody quote “Like JP Morgan, we have issued an RFI looking at digital custody, we are broadly exploring digital custody, and deciding what the next step is.”

Then, of course, you have further work that has been done on the regulatory side, as the FDIC has been exploring how banks could hold crypto assets.

According to the head of the agency, a team of bank regulators are trying to provide a roadmap for bank custody. So, it seems quite clear that there are moves to provide that sort of custodial landscape that could be palatable for the SEC. Beyond this, though, another reason why I think a spot ETF will land next year is because of what is taking place beyond U.S. borders. Other countries are not slowing down in their adoption of these instruments, and the more examples that exist, the more comfortable U.S. regulators will become.

It’s even worse if they see exactly how they could be missing out from this move away from the United States. For example, one of the biggest proponents behind the Bitcoin ETF push in the U.S. was fidelity digital investments. It filed an application for a spot ETF with the SEC some time back. However, just a few weeks ago, it decided to launch its ETF in Canada. The Fidelity advantage Bitcoin ETF will be a spot Bitcoin ETF, and it will be listed on the Toronto Stock Exchange.

According to Bloomberg’s senior ETF analyst quote, “This should be embarrassing for the SEC that one of America’s biggest most storied names in investing is forced to go up north to serve its clients.” I couldn’t agree more, old chap.

Of course, whether it will embarrass the SEC enough into action isn’t guaranteed. It will definitely embarrass some U.S. representatives in congress, though, especially the likes of the Blockchain Caucus.

These representatives have been pretty tenacious in their drive to get action from the SEC, and they’re getting increasingly emboldened. Let’s not forget that the crypto industry already has a pretty strong lobbying group, which showed its effectiveness in that fight over the crypto provision in the infrastructure bill.

While Gary and the SEC have been able to rebuff most of this congressional pushback up to now, it may be quite hard to do should we see a Republican-led house in 2022 something, which appears likely. Who would have thought that u.s politics would have such an impact on crypto regulations? But, here we are

Conclusion

That’s it for most of the post, but I do have a few of my final thoughts. I don’t want to be greedy and downplay the importance of the launch of these futures ETFs. They were no doubt a pivotal moment in Bitcoin’s storied history and one that I was hoping one day to see. They’ve given millions of investors the opportunity to easily buy Bitcoin in a manner they feel comfortable with. However, that does not detract from the fact that these ETFs are the second-best outcome. They’re inefficient and costly. They crimp the returns for those investing in them and benefit all the other participants feeding at the trough.

What’s even more frustrating than this is the seemingly arbitrary way the SEC is viewing the spot and futures ETF applications. It’s not entirely unexpected, though. There are always vested interests and other dynamics at play. It’s never really black, and white but things are likely to get a lot more clear next year. There will be a much wider custodial landscape there will be more pressure on the SEC. There will be more evidence from other countries that these spot instruments are safe and effective. If we do indeed see a spot ETF launch in the u.s next year, the implications could be massive.

Not only do you have the fact that these funds will have to go out and physically buy than Bitcoin, but there is likely to be a lot more demand for them than the futures-based instruments. All those financial advisors and market participants who were sceptical of the futures-based instruments will see this as their opportunity to finally jump in. Billions upon billions of retail and institutional capital could flow into these instruments, and by extension, into the Bitcoin markets as well.

Of course, I don’t need to tell you what that will do for the price. Historic, supersonic, parabolic, all the good things are ending in ick, basically. I know that’s pretty hyperbolic. There’s another.