Quality over quantity, you see the future of finance is being built right in front of our eyes, and it’s being built on the blockchain, and DeFi is the movement that transforms old financial products into trustless and transparent protocols that can run without any interference of intermediaries.

Today I want to take you through 4 top DeFi projects on Solana, but not only do they all have massive potential, but all five projects are currently trading way below the recent all-time highs. In fact, they’re all down between 56% all the way down to 94% and let me tell you one thing. I truly believe that they are future market leaders of the Solana ecosystem.

Serum (SRM)

Website: https://projectserum.com/

The Serum is a non-custodial decentralized exchange, and it’s popular for its transaction speed and low fees. So, you see, the need for speed is enormous.

Serum is the only decentralized crypto exchange, which is running fully and on-chain central limit order book, also known as CLOB, and a matching engine. The exchange also supports cross-chain acid swaps and stablecoins.

Raydium (RAY)

Website: https://raydium.io/pools/

Raydium, which is the automated market maker, and currently down 56% from its recent all-time high. So, Raydium works also as an on-chain order book that powers listen to the Cambrian explosion. That means that investors can stake their assets into Raydium liquidity pools and earn rewards in both the native rate token and the tokens that are deposited in the pool.

Like with Serum, Raydium provides on-chain liquidity to a central limit order, bookmaking the user experience, as I said, much faster, much quicker, much easier, and that is so important in order to achieve mass adoption.

I have to say I was a little slow in the beginning right very much. You know Ethereum fan once I finally got over to Solana. I mean, it’s a blessing in the sky. Even I am reborn. I’ve become a righteous man when it comes to Solana.

Saber (SBR)

Website: https://saber.so/

I kind of tend to think this is my favourite of today, Saber, which is the stable hub, and that is currently down 93% from its recent all-time high.

Saber works in a similar way to Curve Finance. We’re going to look at that, and compare them a little bit later here in this video, so Curve Finance on Ethereum that it functions as a stablecoin exchange. However, Saber on Solana and with cross-chain capabilities.

You see, stable current liquidity is vital to DeFi because stablecoins deserve so many functions in the ecosystem. A huge amount of stablecoin liquidity is needed to make sure that somebody is trading a million dollars worth of USDC. For example, doesn’t end up paying $20,000 worth of slippage fees.

Saber hey bring this vital liquidity to Solana, and they help facilitate the transfer of assets between Solana and other dApp platforms. So, the famous market makers, I hope you know, who they are right people who help any kind of exchange to run by providing funds. They can deposit crypto into a safe Saber liquidity pool in order to earn yield from transaction fees.

It can pick up some token-based incentives and benefit from automated device strategies, which saves a lot of time does manually chasing the best yield across different pools is almost impossible. But, you’ve got lots of time you could try, kitty tried didn’t get anywhere.

Mango Markets (MNGO)

Website: https://mango.markets/

Mango Markets, which is the place for DeFi derivatives on the Solana blockchain. This lending, borrowing, and trading platform are promising the lowest fees in the entire Solana ecosystem. Let me just remind you salaam is already cheap, so being the cheapest in the Solana ecosystem, they must be really cheap. Let’s hope they’re quick too. I think so.

Mango they’re benefiting from Serum’s fully on-chain perpetual features order book and spot margin. On Mango, every asset is cross-collateralized and used as collateral to open leverage positions.

The goal of Mango is to have the usability and liquidity available on centralized exchanges and pair it with the permissionless feature of DeFi. Traders using Mango can earn interest on their open interests, deposits, and collaterals.

Comparing SOLANA & ETHEREUM Coins

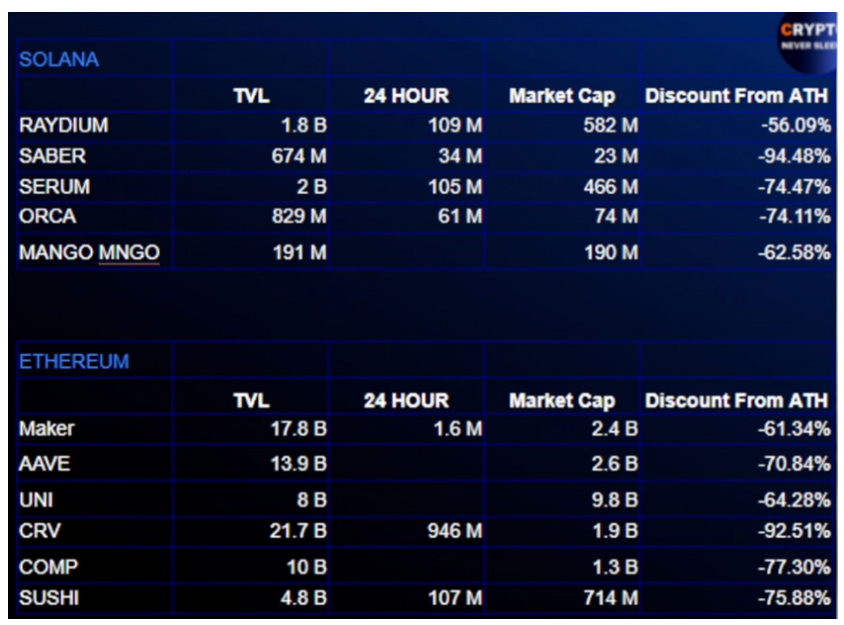

Before we end, I just wanted to share this slide with you here because I wanted to take some, you know, some of the biggest DEXs on Ethereum, and show you the market cap, and compare them with the biggest Exeter that we were just talking about on Solana.

I mean, just look at it, you know maker has a total volume logged in of 17 billion, and then we got AAVE 13 billion, UNI with 8, 21 billion to Curve (CRV), Compound (COMP) 10 billion, and Sushi with 4.8 billion.

The funny thing is you can obviously see that the big boys from Ethereum are also very cheap if you want to compare it to the reason all-time highs. But, look at the I mean currently right Solana is also in the top 5, and look at the small amount of the TVL, which means the total volume locked in the look on Raydium it’s 1.8 billion.

We come to my favourite if you can go down to the second line, Saber. Sabre has a 674 million total value locked in, but look at that they got a market cap of only 23 million. 23 million, so just look at the big brother Raydium with 1.8 billion has a market cap of 482. Barry wants to do it. You could do a small calculation, you could say four times, but really it’s only three times more, and if you would see a three times increase in Saber, it would still only be at seven, you know not a hundred.

Lots of potentials, and then if you move down, and we look at the Ethereum big boys, look at the market cap of Maker 2.4 billion, AAVE 2.6 only 9.8. I mean, I think it looks like Solana got lots of room to grow and listen to this. If that wasn’t enough if you don’t think you can make that, why don’t you just go and stake it? Because on Raydium, you can stake Serum and Raydium in one pool, and you can receive 60% APR.