Time to talk a bit deeper about $LULU and to answer the question of whether it is a good stock to buy or not. I won't hold the suspense; at yesterday's price, I still don't think so, and that's why I didn't write this then.

There's still a lot to say about it, so I'll take time to develop my thoughts here today as to why I didn't buy yesterday and at what price I'd buy.

[The business]

Because yes, I would happily be a shareholder of the yoga pants brand. Their products are high quality and very demanded around the world; you see it very easily with the growth the company had over the past few years.

A reminder about the company if necessary.

https://twitter.com/WealthyReadings/status/1697279668380967182

No doubts in my mind, this is a high quality business to own. At the proper price. Which brings us to its growth, a pretty strong one.

Hard to deny the strength of the demand for those yoga pants and the strength of the company which sells their products with a 58% gross margin & a 16% net margin. Both higher than the industry, which sets around 45% and 12% respectively. Another proof of a well ran business.

With good management & execution. To cite a few, I'll talk about the balance sheet first, which is very important to me & my investing in the actual economic conditions. Lululemon is comfy, probably as comfy as their clients are in their products.

We do have debts, of course, because debt is a leverage that has to be used for any company. What matters is that the debt stays manageable, which to me means that it should be covered in less than 3 years by actual cash & FCF. $LULU can easily do that.

In terms of execution, we could talk about what the company calls the "Power of Three ×2", a plan launched in 2021 to double the business revenues to $12.5B by 2026 with a very specific roadmap.

https://corporate.lululemon.com/media/press-releases/2022/04-20-2022-113017957

I won't go over the exact points, but in short, they'll make it. Easily. And that demanded strong management & execution. You understood that Lululemon has everything I like. A strong brand, strong growth, good balance sheet, good execution, and a trustable management.

So why not go in?

[Sportswear market]

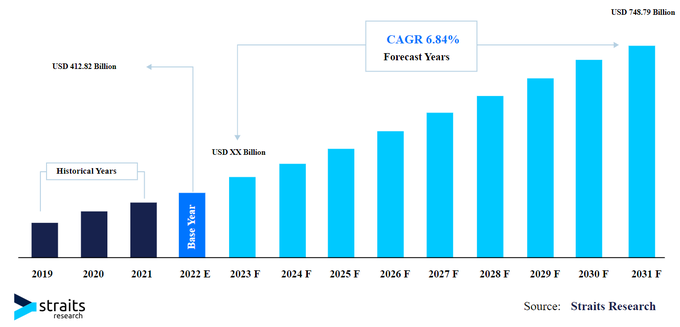

Before we go further into assumptions, I'd like to speak about the sportswear market globally, which is planned to grow to $750B by 2031 with a CAGR of 6.84%. Big market.

To go further, 35% of this market is composed of footwear, which Lululemon isn't really implied in, which leaves a market of around $490B. Keep that in mind, but now we can go further & talk about the valuation.

[Valuation]

That's where we need to take a step back after that -15% drop and still do some math because $LULU always traded with a pretty strong premium due to everything I presented earlier. A deserved premium. So the real question is, are you still paying for that premium at actual prices?

Let's look at the company's ratios first; we're with a profitable company for years and even if it's growing strongly still, ratios do make sense. Or should.

Compared to its own ratios, we could consider $LULU to be properly valued as of today, and I wouldn't really disagree with that take. Yet, ratios are still high compared to the industry as the company has always traded with that premium.

For reference from here, I'll always compare ratios to the apparel industry with an actual P/E of 30x & a P/S of 1.4x. It's pretty hard to find an industry to compare $LULU to as it's retail, apparel but also luxury & sportswear. I tried to take a mix but it always ends with the same conclusion either way.

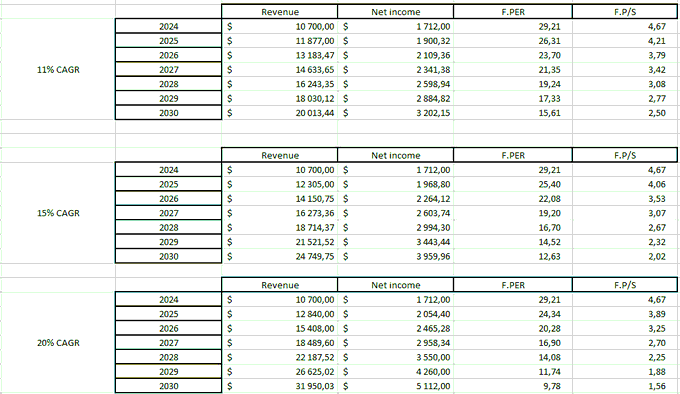

Now is the time to bring the Excel sheets & the assumptions, which are going to be the usual ones:

1. Revenue growth. $LULU grew revenues at 24.5% CAGR over the last 5 years but guided in its last quarter a 11% growth. We'll take the latter as the base case as it's probably not possible for $LULU to keep a strong double-digit growth.

2. Net revenues. No improvement over the next years for $LULU's net margin which stays flat at 16%.

3. Shares. Staying flat over the next years. No emission, no buybacks.

4. Ratios. The P/E and P/S are calculated with the actual market capitalization of $50B; I'm trying to know how many years of growth I'd be buying at the actual price.

I did put two more cases, but let's remember that 11% growth is what is guided now by $LULU, so my base case would be between this one and the 15% CAGR.

Lululemon would actually own around 3% of the global sportswear market as of today and that would grow up to 5%ish of it in 2030 assuming the 15% revenue growth CAGR. Entirely acceptable, I'd say, with the brand recognition only growing around the world and the company taking over China and Asia at large.

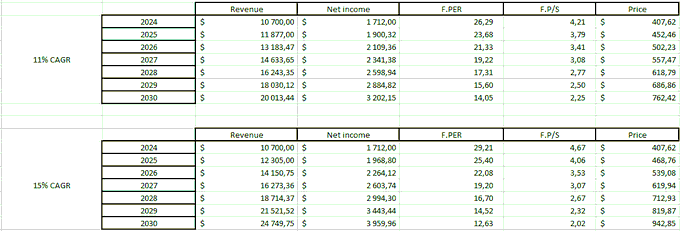

That being said, if we were to compare the company's multiples to their industry, they'd still be pretty strong with reduced growth, and you'd be paying easily two years of future growth at today's price - around $400.

I wouldn't consider this price expensive, but I wouldn't consider it a fair value and certainly not cheap, even if we were to use a 15% CAGR growth over the next 5 years.

[Target price]

Now I'd still like to put some more colors in my post as there are different cases to take into consideration here. Because what I am saying is that I wouldn't buy great companies close to their fair price... Weird.

1. Already a shareholder. If I were already a shareholder in gains, I certainly would have reinforced my position under $400 as long as it wouldn't bring my average cost above what I consider an actual cheap price.

2. Starting a position. If I were to start a position, I'd want a margin of safety, or else said, for the price to be undervalued. And that would probably mean a price with a forward P/E under the industry's & that would come lower, around $370.

3. Potential. It might look picky as we reached $387 yesterday, but we also have to take into consideration the potential of the stock. Rough calculation coming.

Buying at the low of $387 could allow you to double your money by 2030 assuming that the company keeps growing at an 11% CAGR for the next 6 years & keep guiding for this growth going further & assuming that the stock keeps trading at its P/E of 30x.

It's not a bad deal at all! But that is a CAGR of 12% for the next 6 years, which is basically what the $SPY is doing.

Using that 11% growth as a base case, the company's not cheap enough for me to buy in. Using that 15% CAGR would be, but you'd need to believe that's what Lululemon can achieve stronger results that their guidance - which they could - for the next 6 years.

[Conclusion]

That's my take on $LULU as of today. Growing an already existing position up to a $350-$380 average seems good, but buying in above $350 doesn't give enough margin of safety or enough potential based on what the company's guiding, to start a position in my opinion. Also acknowledging that $380 was probably a good price to buy, assuming a 15% CAGR.

I'd start a position if we go lower next week, but it might never happen. I'd be okay if not, though, as I do not feel comfortable paying a premium for a retail company like $LULU, even being such a growing and well-managed one.

Pretty deep dive. Hopefully one you enjoyed.