I recently did an interview with John Persinos, editorial director of Investing Daily.com. In the interview, John and I discuss the current market and what may lie ahead.

Topics we discuss include an update of the status of the bond market, building on the points I put forth in my recent Real Estate report, which you can find here.

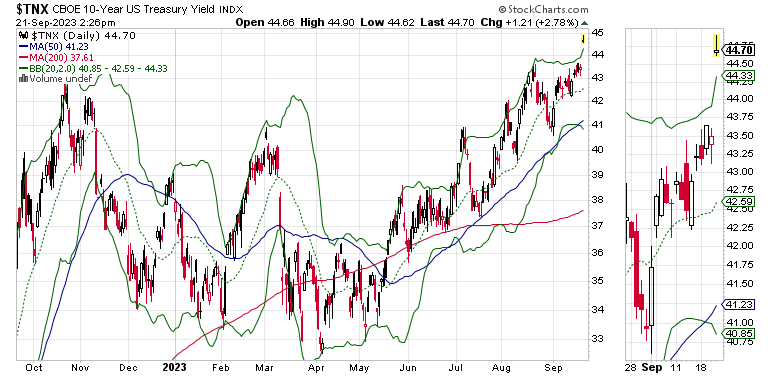

As I noted in that post, interest rates are at a meaningful inflection point. This was driven home by the U.S. Ten Year Note yield rising above 4.4% after the Federal Reserve's recent bearish pronouncements on keeping rates higher throughout 2024 than the market expected.

As you can see by the price chart above, TNX has exploded to the upside. In fact, it seems to have gone too far. If I'm right we should see a drop in TNX which would be helpful for stocks.

Here's an excerpt of the interview:

JP: Joe, you’re a renaissance man: musician, doctor, and investment expert. We’re both fans of the legendary jazz guitarist Pat Metheny, but financial advice really isn’t Metheny’s bag. So let’s turn to another source of mutual admiration: the late, great financial analyst Martin Zweig. What would Zweig say about current market conditions?

JD: Martin Zweig (RIP) is one of my heroes, so I want to be careful when I answer this question out of respect. That said, his two rules about the market were straight forward:

Don’t fight the Federal Reserve, and

Don’t fight the market’s momentum.

I can see Zweig saying that somewhere right now with a worried look on his face. And he’d be right.

The central tenet of the global economy is liquidity, and the Fed controls the money spigot. Liquidity, in the context of markets, is the amount of money that is available in the financial system to purchase assets once all other expenses are covered. In our neck of the woods, these assets are stocks. When there is enough money in the banking system after Wall Street and related entities pay their bills, liquidity is considered sufficiently adequate to buy stocks.

The stock market rally won’t be on firm ground until the Fed stops siphoning liquidity from the markets.

You can check the rest of the interview out here.

As always, thanks to everyone for their support. This page is growing steadily thanks to you. I really appreciate it.

If you like this report and want to receive it on a weekly basis, consider becoming a member.

I also appreciate single coffees, which you can buy me here.

Please hit the Like button. It helps to spread the word.

You’re the music. I’m just the band.