Shares of homebuilder Lennar (LEN) crashed and burned on 3/15/2024 after its earnings report despite excellent growth in many of its current metrics and well above average future tidings based on rising order flows and the tight supply of housing in the U.S.

What tripped the selling spree was a miss on revenues which was related to a decrease in a fall in average selling prices. Moreover, during the earnings call, the company’s CEO Bruce Gross noted that the company is noticing a rise in debt in its potential customer’s balance sheet and that more of its buyers are starting to miss credit card payments.

On the other hand, gross margins rose, new orders beat expectations, and the company is still expecting to close on 80,000 homes in 2024.

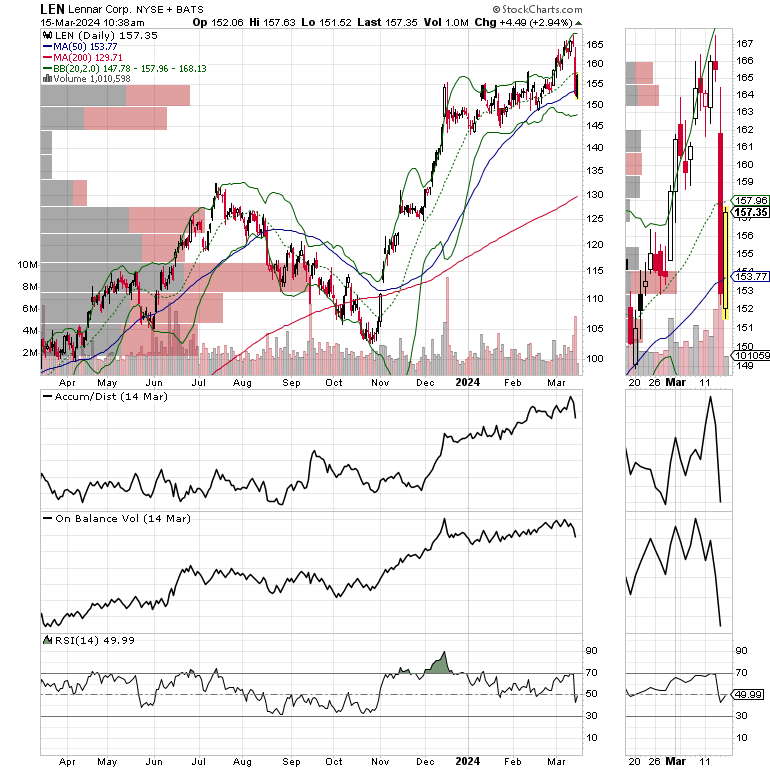

The price chart shows the stock was sold aggressively on the news. Both the ADI and OBV lines rolled over and the stock is testing the support of its 50-day moving average. A fall in ADI means short sellers are piling on while a fall in OBV means that stockholders are selling. The combination, if it persists, is a negative for the stocks.

I recommended taking profits on LEN to subscribers of Joe Duarte in the Money Options.com, ahead of the earnings, which proved to be a timely suggestion. We were stopped out of the stock with a nearly 42% gain.

It’s All About Interest Rates

As I noted in a January post, after D.R. Horton (DHI) missed its earnings, the playing field is changing. Not only is the Fed’s higher interest rate policy and its negative effect on mortgage rates hurting potential homebuyers, as Lennar’s CEO noted on its earnings call, consumers are starting to have trouble with debt payments.

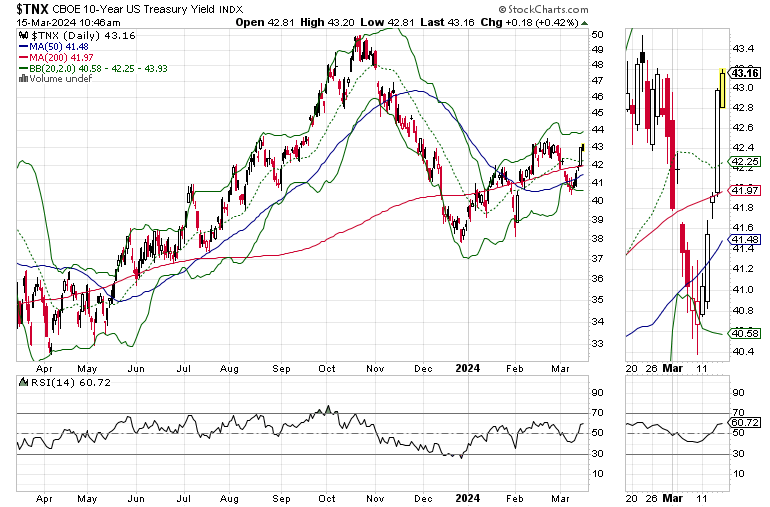

And the recent hotter than expected CPI and PPI numbers have not helped. The U.S. Ten Year Note yield (TNX) is threatening to move above the 4.3%-4.4% area. If it does, it will likely trip algo traders to sell treasuries which will push yields and mortgage rates higher.

Mortgage rates are a lagging indicator. And this week’s average rate is more related to last week’s lower TNX yields. Thus, if this rise in TNX does not reverse, by next week mortgages may once again be knocking on the door of 7%.

Oil Market Heats Up

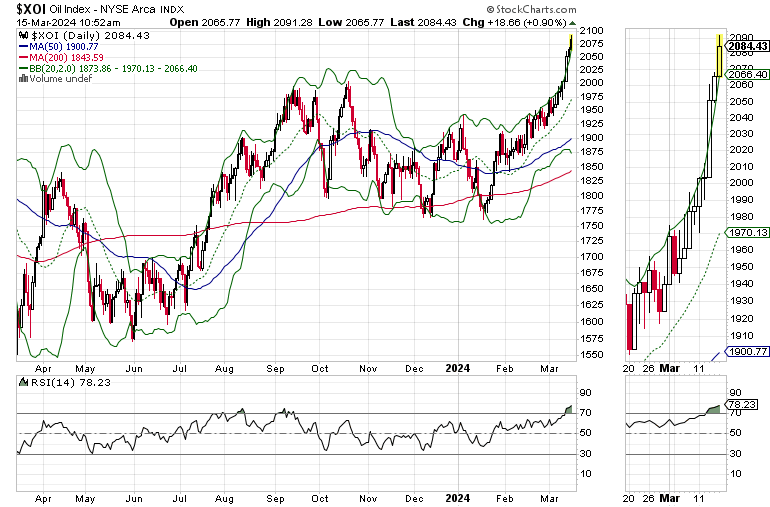

All of which brings us to the oil market where things are heating up. As the price chart for the Oil Index (XOI) shows, money is aggressively flowing into this sector of the market as the combination of tightening supplies and expectations of rising demand for the spring and summer driving season are combining to send prices higher.

Of course, if consumers are already struggling to pay their bills, as Lennar’s CEO noted, rising fuel prices are not going to be helpful.

Bottom Line

The dynamics in the housing market are changing. Homebuilders are likely to remain profitable, as supply and demand are on their side. Yet, as consumers struggle to pay their bills, Wall Street is going to have to reduce its earnings and revenue expectations.

If this doesn’t change, then what happened to DHI and LEN will likely happen more often.

Thanks to everyone for their ongoing support. I really appreciate it.

I’ve recently added a new real estate related pick with huge upside potential, have updated the homebuilders held in the Joe Duarte in the Money Options model portfolios while expanding our energy holdings. You can check them all out with a Free Two Week Trial to the Service.

If you’re an active trader, especially in the energy sector, visit the Smart Money Passport.

If you like this report and want access to timely, easy to digest content which complements the Buy and Sell recommendations offered at Joe Duarte in the Money Options.com, consider becoming a member.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.