The Federal Reserve’s FOMC meeting concludes this afternoon with the central bank’s intentions regarding the future of interest rates to be announced at 2:00 P.M. Eastern time. The market expects the central bank to hold rates steady and to once again reinforce the notion that future changes in rates will be data dependent although the central bank expects to cut rates later in the year.

Yet, there is a growing sentiment on Wall Street that the Fed won’t be able to meet its inflation target of two percent and thus it plausible to consider that starting with this announcement and Mr. Powell’s press conference the central bank will start preparing the markets for a hike in the inflation target. At least one Wall Street bank, Goldman Sachs (GS) is forecasting a new inflation target in the range of3.2-3.5%.

If the Fed raises its inflation target, it would mean that the central bank is admitting that the current rate of inflation is the best that can be hoped for without raising interest rates from current levels. In fact, it would be an event which would lead to a reset of the entire financial system.

The report follows remarks by Goldman CEO David Solomon in which he noted inflation seems more “sticky,” and “difficult to conquer” than the mainstream expectations. In addition, Solomon added that in his conversations with multinational corporation CEOs, many have told him that economic conditions have deteriorated, especially for lower tier consumers.

Is the Consumer Fraying?

As I noted in a recent post, the state of consumer finances is becoming a popular topic amongst CEOs, as homebuilder Lennar’s CEO, Bruce Gross, during the company’s recent earnings call, remarked that his company is noticing an increase in credit card defaults and other events which suggest consumer struggles are increasing.

An additional warning sign is that private home foreclosures are rising – According to Attom Data, foreclosure activity is on the rise in the U.S. Specifically, the number of filings (future foreclosures) for the month of February came in above 32,000 – rising 8% year over year but down 1% from January. This comes on the heels of a wave of actual foreclosures which seems to be slowing. Thus, while the drop in actual foreclosures is somewhat encouraging, the apparent ramping up of a new wave of filings is clearly a negative.

According to Attom the rise in activity “could signify evolving financial landscapes for homeowners, prompting adjustments in market strategies and lending practices.”

The leading foreclosure cities (completed foreclosures) are Chicago (207), Philadelphia (182), New York City (173), Pittsburgh (105), and Detroit (88).

The states with the highest foreclosure rates were South Carolina, Delaware, Florida, Ohio, and Connecticut. Specific cities with high foreclosure rates included Orlando, FL, Cleveland, OH, Riverside, CA, and Miami, FL.

The highest number of foreclosure starts in February, by state, were: Florida, California, Texas, New York, and Ohio. Cities with the highest foreclosure starts were: New York City, Houston, Los Angeles, Chicago, and Miami.

Important Chart Levels to Watch After the Fed’s Announcement

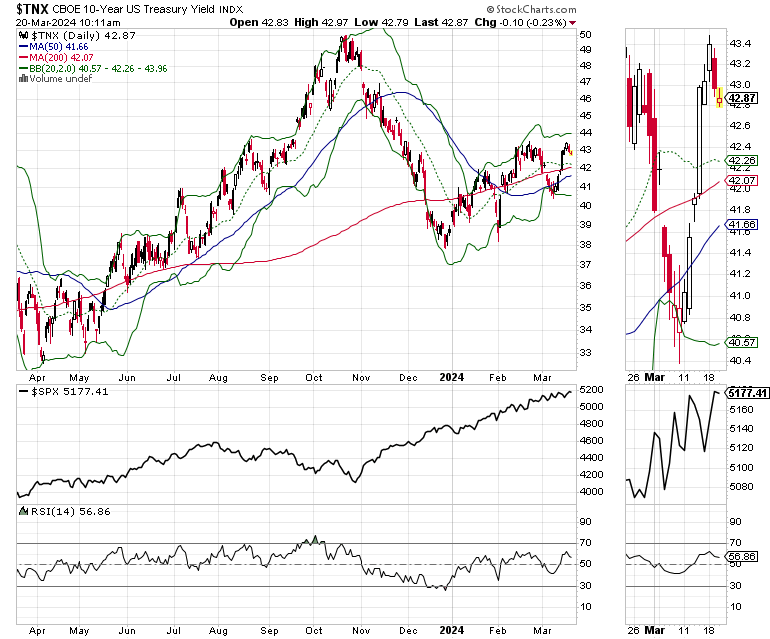

Ahead of the Fed’s announcement, the U.S. Ten Year Note yield (TNX) trading in a tight range. Of course, this could rapidly change after the FOMC’s announcement about the future of rates. Moreover, volatility in both stocks and bonds could increase if there is even a hint that the central bank is about to raise its inflation target rate above 2%.

The composite price chart, above, shows the relationship between TNX and the S&P 500 Index (SPX, middle panel). The important levels to watch after the Fed’s announcement and Chairman Powells’ press conference are:

· The TNX yield range between 4.2 and 4.4%. 4.2% corresponds to the 200-day moving average. A move below this level would be bullish. A move above 4.4% would be bearish.

· For SPX. a break below 5100 would likely lead to a test of the 5100 area. A break below that could take the index to the 5000/50-day moving average, where more meaningful consequences will likely follow.

Bottom Line

The Fed is in a tight spot. Inflation is not showing signs of moving toward the central bank’s stated 2% goal. At the same time there is anecdotal data from the housing market which suggests consumers are starting to struggle under the weight of inflation and higher interest rates.

If the central bank is keeping an eye on the consumer, the odds of a rate hike are likely to be very small.

If the Fed surprises the markets with a rate hike, which is unlikely, the markets will likely enter a bearish phase.

Important support levels to watch in the stock market are the 5000-5100 range for the S&P 500.

A rise in bond yields above 4.4% on the U.S. Ten Year note would be bearish for stocks.

Thank you for your ongoing support. I really appreciate it. If you like this post, please hit the Like (heart) button. It helps to spread the words.

If you’re an active trader, visit the Smart Money Passport.

If you like this report and want access to timely, easy to digest content which complements the Buy and Sell recommendations offered at Joe Duarte in the Money Options.com, consider becoming a member.

I also appreciate single coffees, which you can buy me here.

You’re the music. I’m just the band.